My PLUS (AKA 'Slope GOLD') post for subscribers last week may have been the timeliest of the year. Emerging markets have been absolutely falling to pieces and after yesterday’s meaningless bounce-back rally, things are the proper color again: Red.

I’m getting a very late start this morning, so here are a few ETF charts I think merit observation. First is the oil and gas explorers, which are on the cusp of an important breakdown. This morning’s crude oil inventory impacted the sector.

XOP

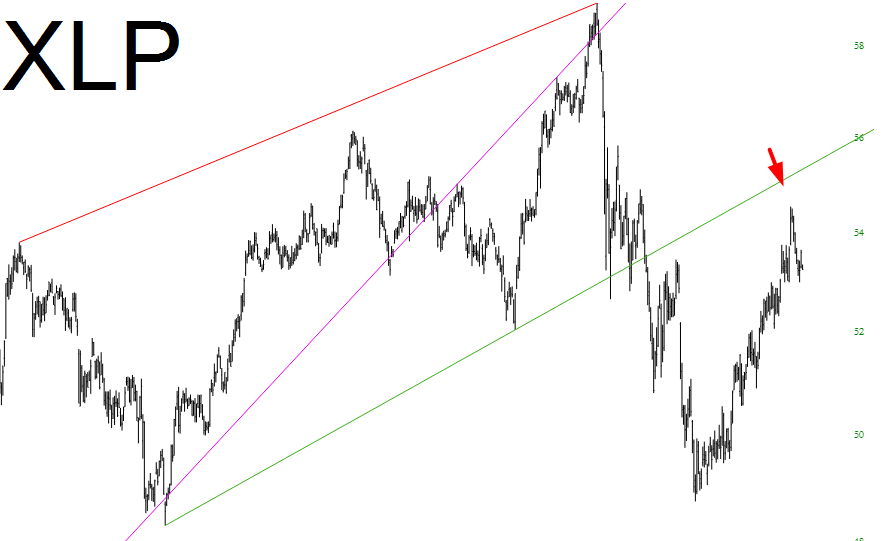

Consumer staples, which I pointed out as it approached its broken trendline, also looks poised for more pronounced weakness.

XLP

The difference between last week and this week is vast, thanks for the gap-down which took place because of the Turkey turmoil. My dread and horror about a new potential breakdown has been replaced with elation at the failed bullish breakout and the ravaging it could do to our doe-eyed, ever-optimistic bullish friends.

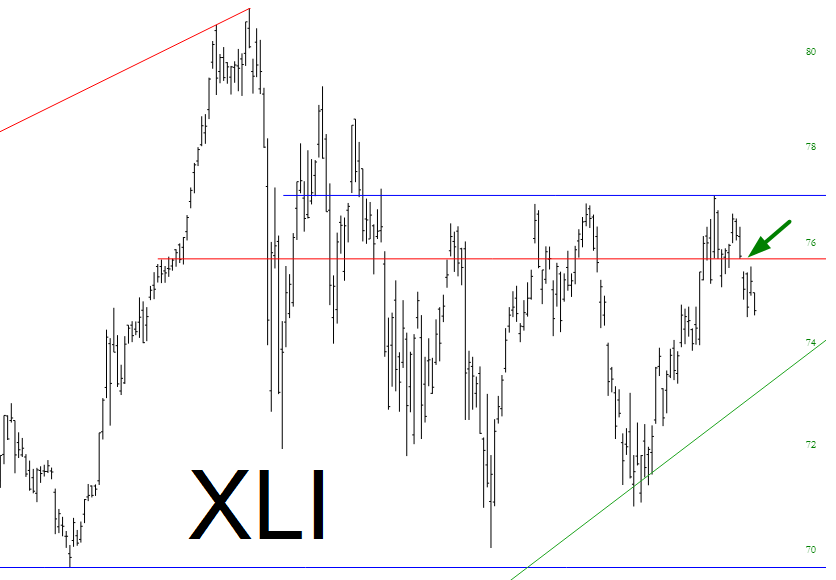

XLI

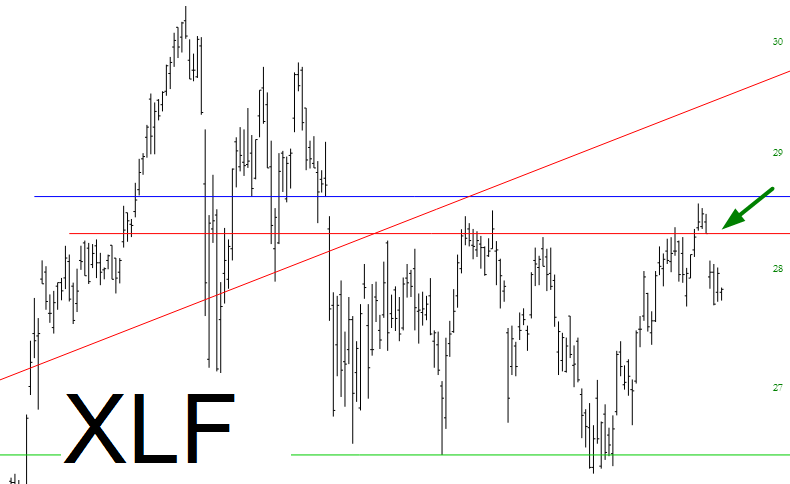

The financials play a key part in this scenario as well. They, too, sport a very important price gap which I believe could mark a psychological sea-change.

XLF

Just to echo my XOP chart above, here is oil itself, by way of USO. We are resting right at the trendline. A surprise from the inventory report (which will probably be out already by the time you are reading this) could do the trick.

USO

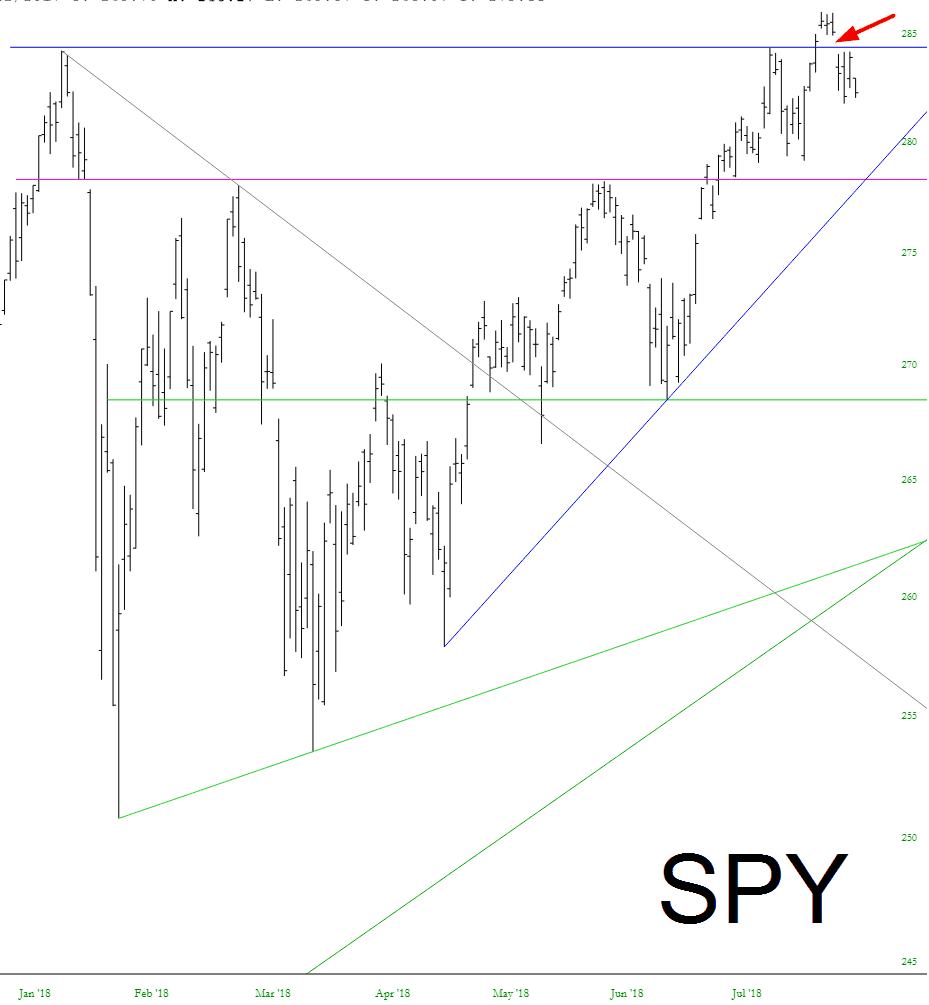

OK, these gaps are getting old to you maybe, but I can’t overemphasize their importance. WORRY has taken the place of ANTICIPATION for the bulls.

SPY

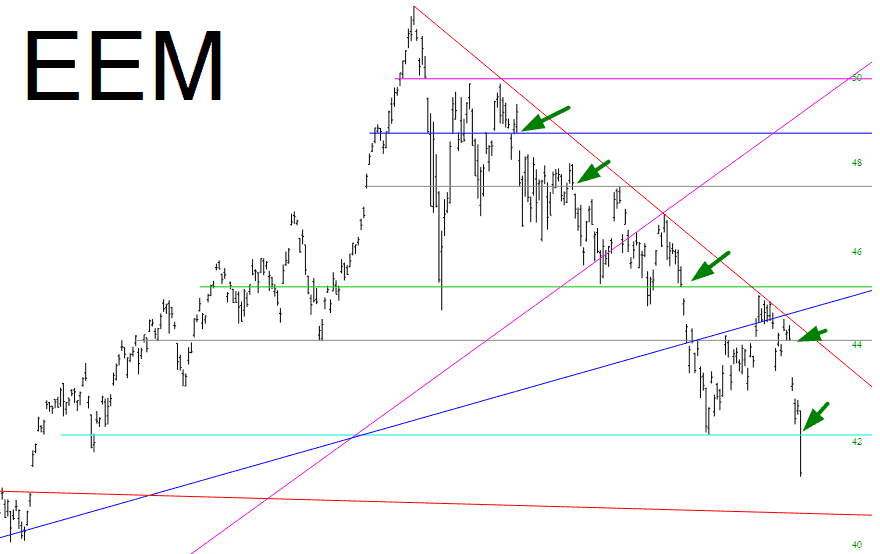

And, finally, my best friend EEM, the emerging markets, which have spent the entirety of 2018 breaking down, and breaking down, and breaking down some more. Even I am surprised at how diseased this entire sector has become.

EEM