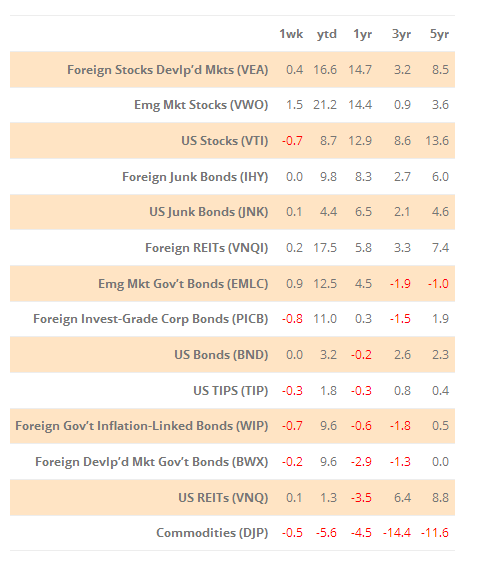

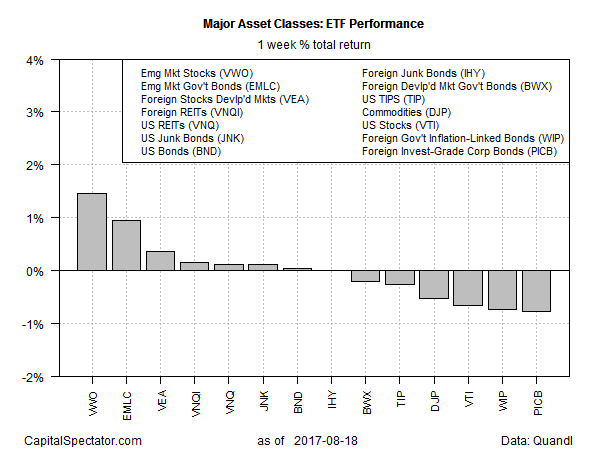

Equities and fixed-income securities in emerging markets took the lead last week, posting the biggest gains among the major asset classes, based on a set of exchange-traded products. Meanwhile, US stocks fell for a second week, the first back-to-back weekly losses in three months, based on Vanguard Total Stock Market (NYSE:VTI).

Last week’s top performer: Vanguard FTSE Emerging Markets (NYSE:VWO), which rose 1.5%. Bonds in emerging markets were the second-best performer, posting a 1.0% gain. Last week’s increase lifted VanEck Vectors JP Morgan Emerging Market Local Currency Bd (NYSE:EMLC) to its highest close in a year-and-a-half.

The biggest loser last week: foreign corporate bonds. PowerShares International Corporate Bond (NYSE:PICB) slumped 0.8%, marking the ETF’s first weekly loss in more than a month.

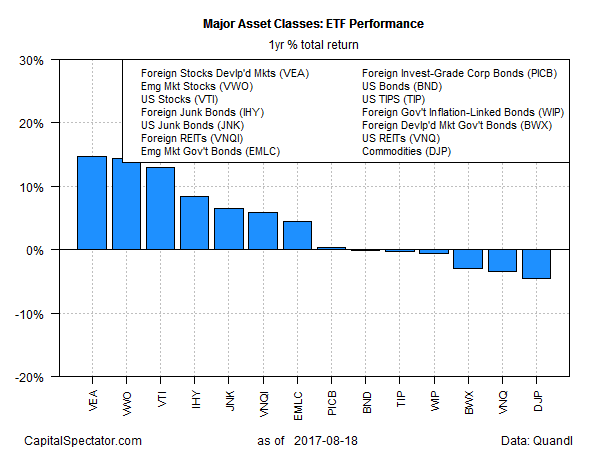

In the one-year column, foreign equities in developed markets continue to hold the lead. Vanguard FTSE Developed Markets (NYSE:VEA) is ahead by 14.7% for the trailing 12-month change, just slightly ahead of the number-two performer: Vanguard FTSE Emerging Markets (VWO).

Broadly defined commodities remain in last place for the one-year return among the major asset classes. iPath Bloomberg Commodity Index Total Return (NYSE:DJP) is off 4.5% as of last week’s close vs. the year-earlier price.

Total Returns (%) Ranked by 1-year Performance