EM equities are down 16% over the rolling quarter and 22% over the rolling year

Source: Short Side of Long

iShares MSCI Emerging Markets (NYSE:EEM) is now in the crash mode. Since the index peaked in late April of this year at 1070 points, it has lost over 20%. When we observe the chart above, the index is now down over 16% over the 3 month rolling time frame, which is 1.5 standard deviations oversold level. Furthermore, the index has lost over 22% on the 12 month rolling basis (not yet oversold in the long term).

Short Side of Long Portfolio has been recommending short positions on the MSCI EM stocks since the inception and has done very well holding those bearish bets over the last couple of months. While we believe that the price could decline further still, the index is rapidly becoming more and more attractive via valuations.

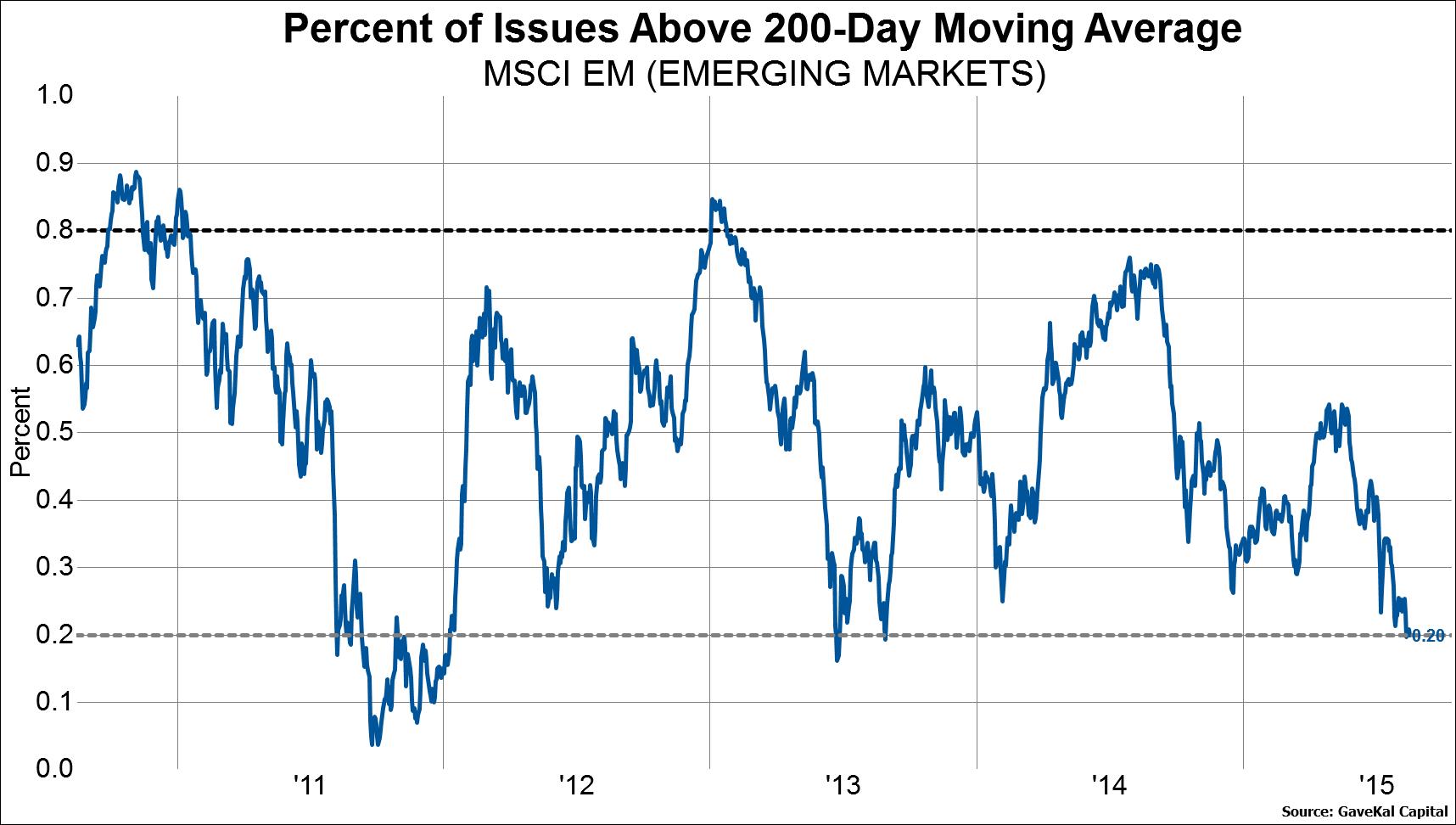

Technically, all indicators including breadth measures are now very much oversold as well. Recently, GaveKal Research showed only 20% of MSCI EM stocks trading above their respective 200 day MAs and over 70% of the MSCI EM stocks down 20% or more from the recent highs. Technically, we are looking for further deterioration with 10% of stocks above the 200 MA and 90% of stocks in a bear market (down 20% or more).

There are only 20% of stocks in MSCI EM Index trading above their 200 day MAs

Source: GaveKal Capital