It is well documented that picking individual stocks is a losing proposition. So I do not put much stock in investment recommendations, even my own. As noted in an earlier piece, 670 of the largest financial houses manage $32.2 trillion. Let’s say that on average, they collect a 2% fee and half of that goes into research = $322 billion of research trying to find the undervalued investment. That is a lot of research money. They use it to investigate all aspects every industry and to employ computer-driven programs to buy or sell when prices get out of whack. There is no way that any individual investors can compete with them. New information? They will get it before me.

However, Peter Lynch, the very successful former manager of Fidelity’s Magellan Fund said you have an edge if you invest in what you know. Well, I know countries since I have worked in more than 40 of them. So my investment “sector” is nations, not high-cap, growth, etc. Many investment advisors make recommendations year after year without looking back. It is easier that way. However, I believe looking back can be instructive, especially after what has happened in the last six years.

So here goes.

I. Just After US Bank Collapse That Caused Largest and Longest Depression Since 1929

In late 2008 – early 2009, the US banks collapsed. And asset holders lost $50 trillion globally. Most of those losses occurred in the West. In emerging market countries, the losses were smaller large proportionately because only the wealthy own equities investments and most people pay cash for real estate. The bottom line: the “wealth effect” was far smaller. No question that export demand from the West fell, but emerging nations by definition were “emerging”. And that meant growing demand from growing middle classes. Projected growth numbers reflected this: emerging market countries were projected to recover far more rapidly than Western nations.

And I had another reason to buy emerging market stocks: I thought the dollar would lose value. In panic times, people rush to safety: that means they invest in their own currencies and US dollars. I figured that when the panic subsided, the dollar would weaken. So from 2009 on, I recommended emerging market investments and for a while, they did well.

II. The Euro Banks Collapse

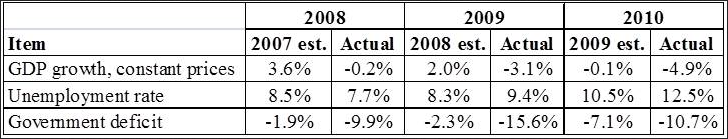

Nobody I know predicted the euro-zone collapse. But then, few knew that European bank regulators viewed Greek debt as safe as cash and would allow it to count the same as cash as reserves. Table 1 provides IMF estimates for Greece in designated years against what actually happened. Note that only one year prior, the IMF had no idea just how bad things would get.

Table 1

Source: IMF World Economic Outlooks

And right after Greece, problems emerge in Spain, Portugal, and Italy. With panic emerging again, I lose my bet against the dollar. And the guild comes off the rose on emerging market investments: investors start thinking that with the European bank collapse, the Western demand for emerging market products would cut significantly into their growth. The result has been that after reaching a high of 58 in April 2011, the iShares MSCI Emerging Markets ETF (EEM) is now trading at 42. In contrast, the S&P 500 has moved from 1330 in April 2011 to over 1600 today.

For me, the European collapse was very worrying, and with the “gild off the lily” in emerging markets, I looked for safe investments. With the Federal Reserve’s quantitative easing policy in place, there were no government debt instruments with high returns, so I turned to emerging market debt and US real estate.

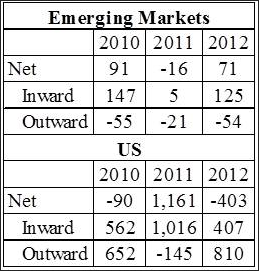

Lessons Learned 1. While emerging market prospects have dimmed somewhat, the real reason for their market selloff has been Westerners pulling out. Keep in mind that while the majority of a country’s equities are held by its citizens, it is the buyers and sellers who determine prices. And Westerners are the primary buyers and sellers on emerging market stock exchanges. Table 2 shows equity flows to and from emerging markets and the US. Flows into and out of the US dwarf emerging market totals.

In short, US enthusiasms have a lot to do with emerging market stock prices.

Table 2

Source: Institute of International Finance and US Treasury

2. Western demand for emerging market exports remains important. Sure, most developing countries have growing middle classes. But they still need significant Western demand for their products to keep their growth rates high.

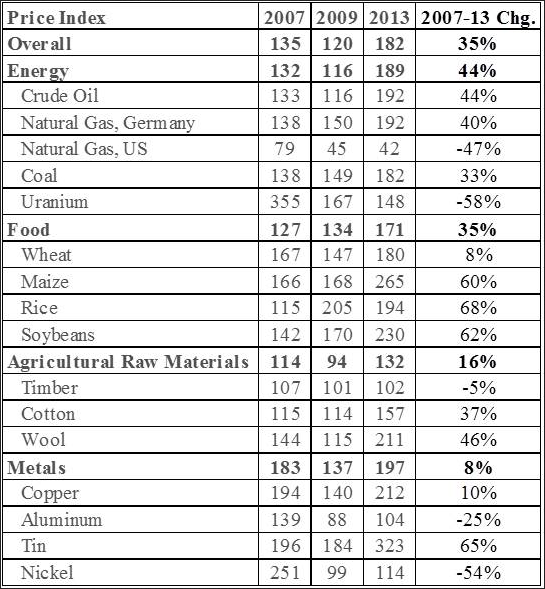

3. Commodity prices are important to a number of emerging market countries. And while they have fallen in recent years, they will come back. Table 3 provides data on how commodity prices have recovered from their collapse in the global depression. Most have more than recovered where they were in 2007. This augurs well for emerging market countries. Only timber, nuclear and natural gas prices are lower due to the slow real estate recovery, the Fukushima nuclear disaster and US natural gas discoveries, respectively. This augurs well for the emerging market commodity exporters.

Table 3

Source: IMF World Economic Outlook

4. When investing overseas, keep in mind that exchange rates matter. How does this work? Suppose that you buy a stock on the Shanghai stock exchange. You can’t use your currency to buy foreign stocks trading on foreign exchanges. You first have to convert your currency into the foreign currency to buy the stock. When you sell, the reverse applies: you get foreign currency proceeds that you have to convert back into your currency. If the foreign currency increases in value while you are holding the foreign stock, your local currency proceeds will be higher when you sell. And as Table 4 indicates, exchange rate changes can be significant. If you invested in Japan equities in 2007, your dollar proceeds would be 29% higher when you sold in 2013 just because the Japanese yen strengthened relative to the dollar by 29%.

Table 4

Source: OANDA

To determine whether this holds as well when you invest via mutual funds and ETFs, I called Harbor Funds and i-Shares. Harbor Funds indicated “they are very aware of exchange rate risk but do not hedge.” This is true of most mutual funds but there are some that hedge – I know Longleaf Partners used hedge against exchange rate fluctuations. i-Shares indicated the exchange rate fluctuations/risk are definitely included in their ETF prices.

Looking Ahead

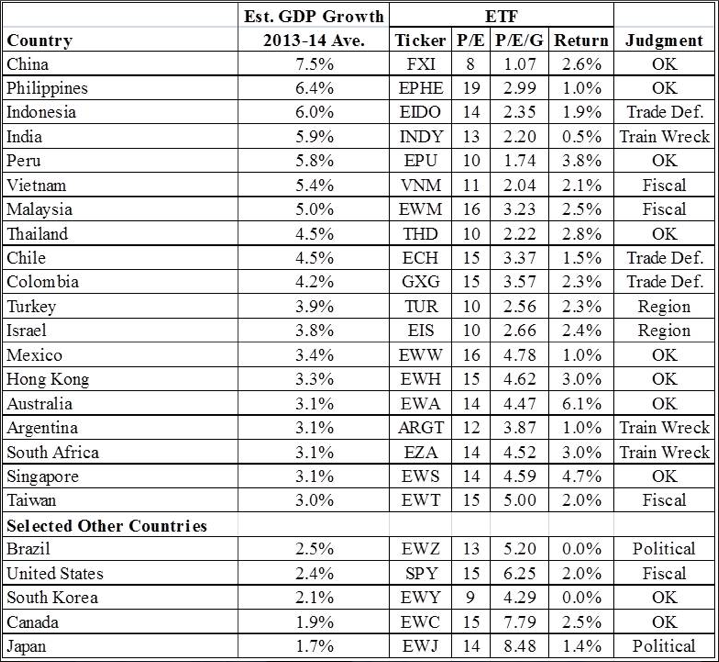

Table 5 includes countries with ETFs that have the highest projected growth rates in the 2013-14 period along with selected other countries. The projected growth rates are the consensus forecasts of 20+ banks and other financial firms assembled by FocusEconomics. The table also includes a representative ETF for each country along with its current price-earnings ratio. A statistic favored by Peter Lynch, the P/E ratio divided by its growth rate, is also included. I offer a cursory judgment on each country in the final column. “OK” means worth looking more closely; “Trade Def.” means the country is running a worrying current account deficit; “Train Wreck” means stay away; “Fiscal” means the country has a worrying government deficit; “Region” means Middle East, stay away; and “Political” means government is uncertain.

Table 5

Source: FocusEconomics and Yahoo Finance

Table 5 should be seen as a starting point for anyone interested in emerging market investments.

Conclusions

Emerging markets are currently out of favor. And because of the dominance of Western investors, they will not perform well again until Western investors return. In the next couple of years, Western investors will return.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Emerging Markets Revisited

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.