Shares in emerging markets rallied for the first time in three weeks, posting the best weekly performance for the major asset classes through Friday’s close (Feb. 7), based on a set of ETFs.

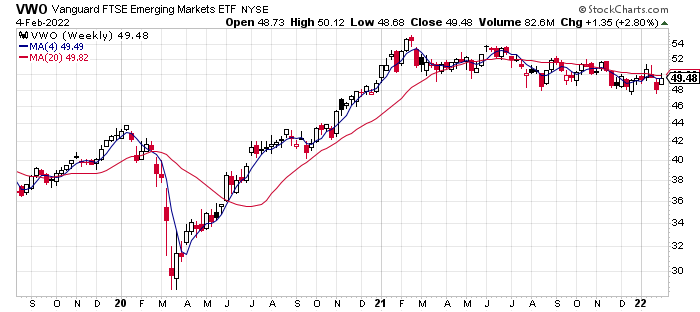

Vanguard FTSE Emerging Markets (NYSE:VWO) rose 2.8% last week. Despite the jump, the trend for the fund still looks mildly bearish. As the weekly chart of VWO prices below shows, the ETF has been slowly but persistently drifting lower for much of the past 12 months.

In relative terms emerging markets have outperformed their counterparts in the developed world ex-US so far in 2022. While VWO is flat year to date, the performance compares favorably with a 3.4% loss this year for Vanguard FTSE Developed Markets (VEA).

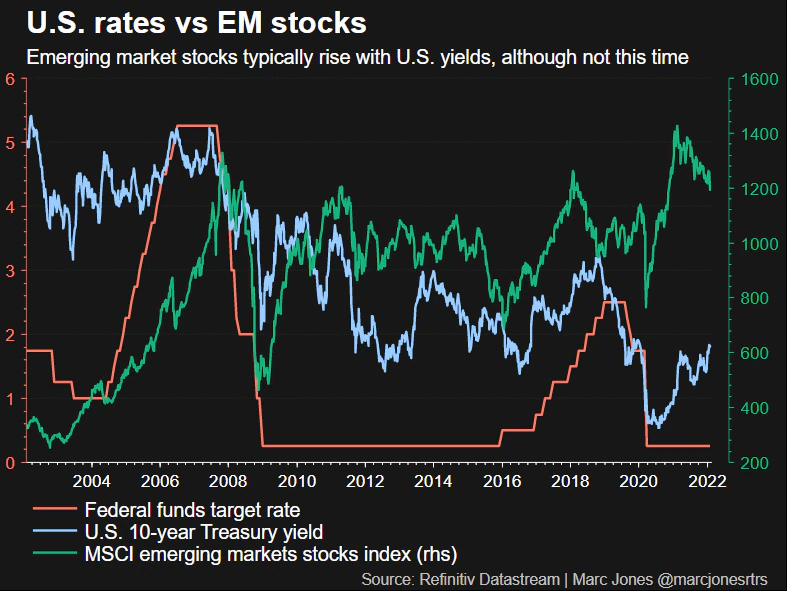

Outperformance of emerging markets over developed markets is typical in the early part of a period of interest-rate hikes by Federal Reserve, according to Morgan Stanley analysis. Markets are pricing in a high probability that the Fed will start raising rates at next month’s policy meeting, based futures data. Reuters reports:

Morgan Stanley (NYSE:MS) analysts have not yet made the call to “buy EM,” but the history of these markets in the preliminary stage of Fed tightenings “suggests that the time to get more bullish on EM may be approaching.” The massive outperformance from Latin American stocks in January could be a harbinger of more EM gains.

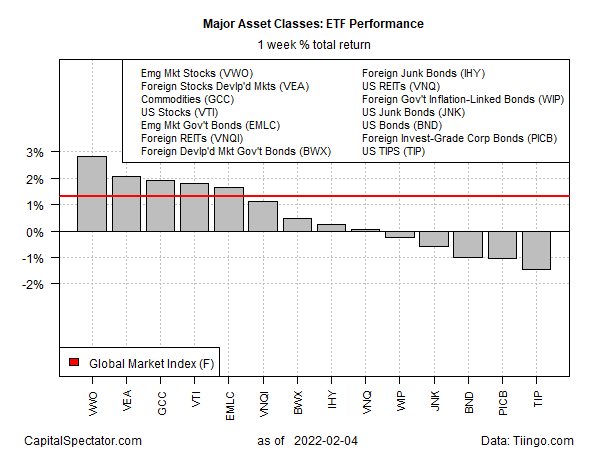

Overall, it was a mixed run of performances last week for the major asset classes. The losers were confined to fixed-income markets. The biggest setback for our ETF opportunity set: inflation-indexed Treasuries via iShares TIPS Bond ETF (NYSE:TIP), which fell 1.3%.

The overall trend for assets was up last week, based on the Global Market Index (GMI.F). This unmanaged benchmark, which is maintained by CapitalSpectator.com and holds all the major asset classes (except cash) in market-value weights via ETF proxies, rose 1.3% last week–the first weekly gain in the past five.

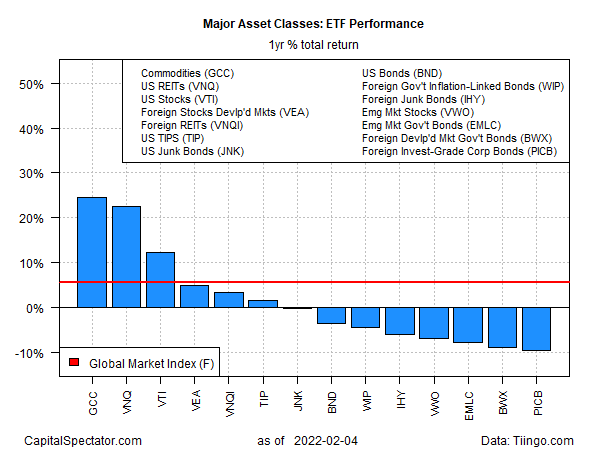

The weakest performer for the major asset classes over the past year: foreign corporate bonds via Invesco International Corporate Bond ETF (NYSE:PICB), which is down 9.1%.

GMI.F’s one-year change: a 5.4% gain.

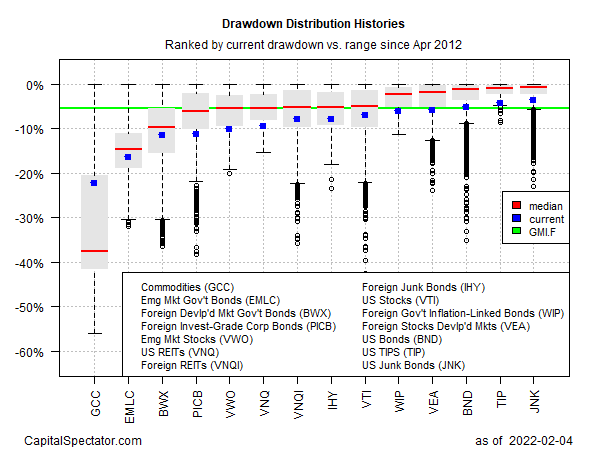

Monitoring markets through a drawdown lens shows that most of the major asset classes are currently posting peak-to-trough declines below GMI.F’s slide, which suggests a broad-based weakness persists around the world.