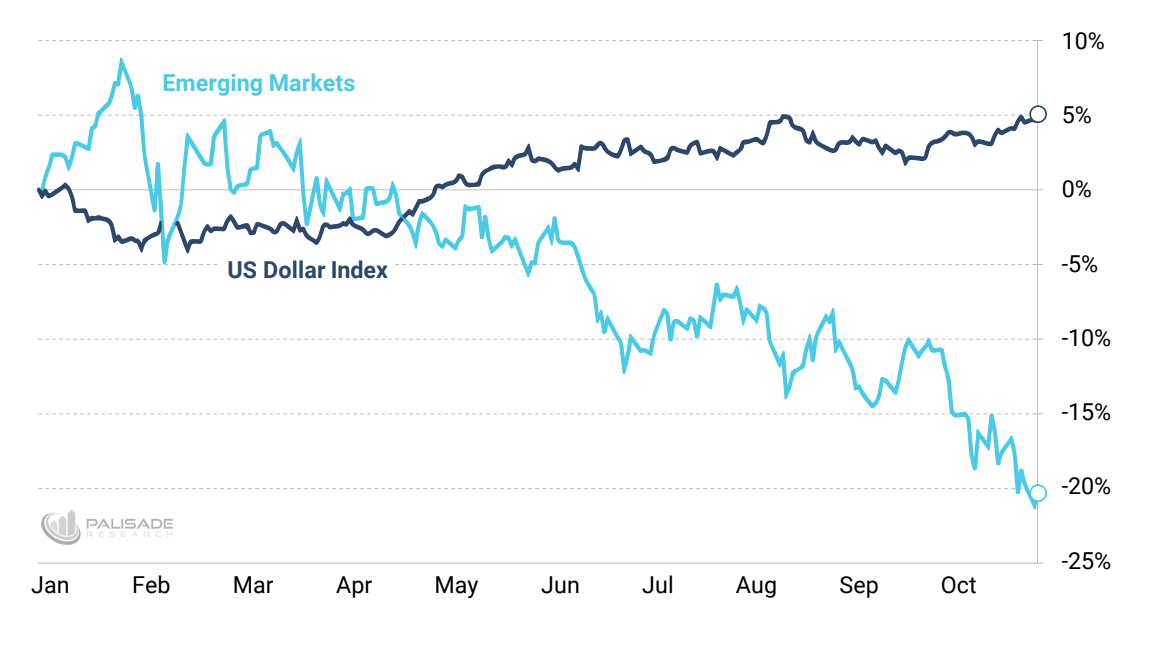

The U.S. dollar continues being the single most important factor for the Emerging Markets. And as the dollar keeps getting stronger – it will continue crippling them.

“But isn’t a strong dollar supposed to be better for Emerging Markets by making their exports cheaper?”

Yes – and no. True, a stronger dollar does make foreign currencies cheaper – which can boost their exports.

But the problem today is that Emerging Markets are bogged down with massive amounts of dollar-denominated debts. And the weaker their currencies are – the harder it is to repay those debts.

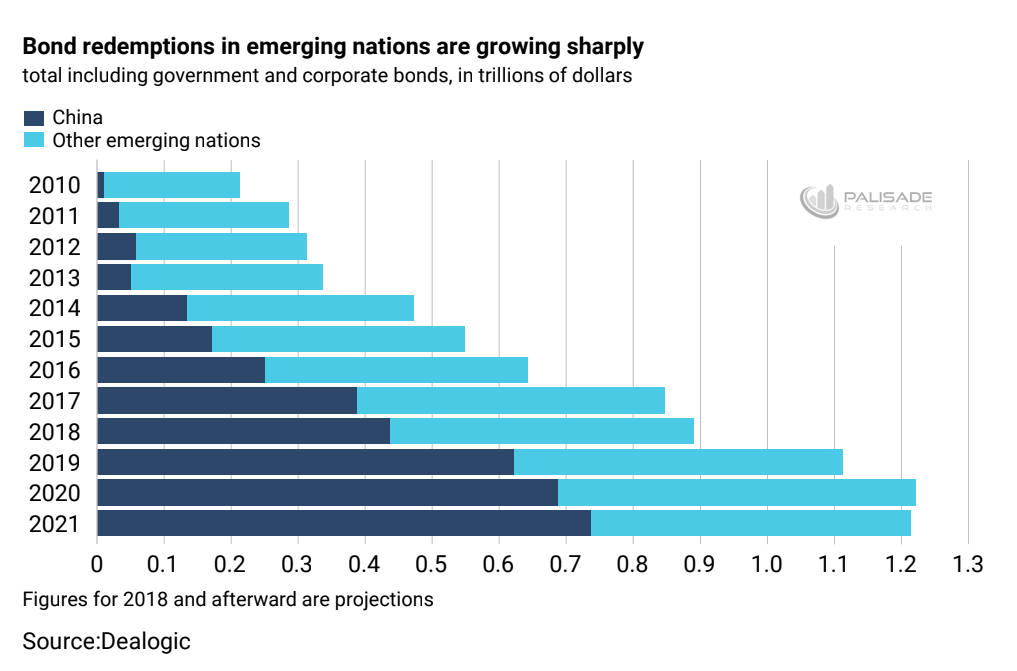

That’s very important to keep in mind – especially as trillions of dollar-denominated bonds mature over the next few years.

Let’s take a closer look. . .

Since 2009 – Emerging Market governments and corporations have gorged on cheap dollar debt.

How?

Because when the Federal Reserve cut interest rates to zero and launched three rounds of money printing (via Quantitative Easing) in an attempt to save the global financial system post-2008 – two critical things ended up happening.

First – U.S. investors were starved for yield. Meaning they couldn’t make enough interest from government bonds to meet their future obligations. So they started lending abroad to foreign countries that offered higher rates of interest (although much riskier).

And even though some of these borrowers didn’t deserve such favorable rates (like Turkey and Argentina and Greece) – lenders still gave them what they wanted.

And Second – the Emerging Market governments and corporations saw this as an opportunity to get cheaper dollar financing. They could now get dollar loans at lower rates of interest than what was available locally.

Here’s an example of a ‘free money’ tactic Emerging Markets would do with their cheaper U.S. debt. Many cash rich foreign companies would borrow debt denominated in dollars so that they could get the lower U.S. interest rates. Convert it into their own domestic currency. And then they would lend it out at higher local rates through domestic bank deposits or money market accounts.

So – all was well as these two groups (lenders and borrowers) fed off each other.

Starved investors got that extra one or two percentage points of fixed income. And eager foreign debtors were able to binge on cheaper debt.

What could go wrong?

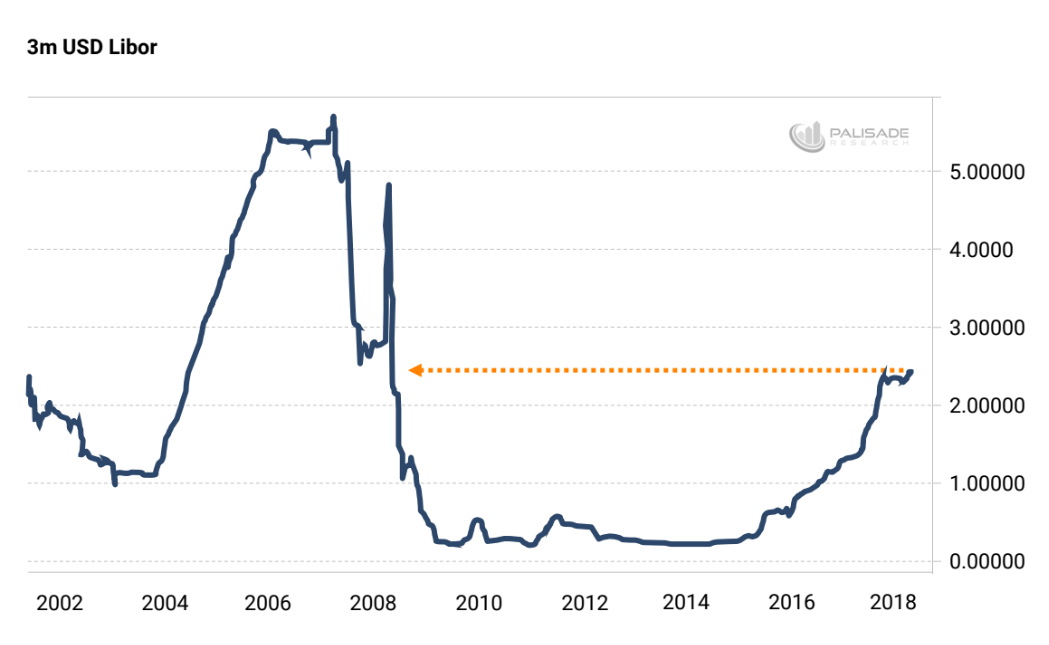

Well in December 2015, the Federal Reserve started tightening. Making U.S. interest rates rise for the first time in seven years.

The first few hikes (each only being 0.25%) weren’t enough to cause investors to abandon their higher rate securities abroad. But since the beginning of 2018, the Fed’s overnight rate hit 2% (now at 2.5%). That’s a whole different game.

Now U.S. investors can get higher yielding bonds domestically – and best of all, it’s basically ‘risk free’. So as investors bailed out of their Emerging Market bonds, equities, and currencies – everything collapsed just as fast as it all went up years before.

But here’s the real problem going forward that virtually no one in the mainstream’s talking about . These Emerging Market governments and corporations have massive amounts of dollar-denominated debts maturing over the next three years – nearly $3.25 trillion (90% being corporate bonds).

And more than half from China alone. Giving some context here: the Chinese government and corporations owe roughly $1.75 trillion – nearly 55% of the total – of bonds maturing through 2020. And they won’t be able to roll it over (refinance) cheaper as rates worldwide rise – led by the Fed’s tightening.

In fact – like I wrote earlier this month – we’ve already seen a record year for onshore bond defaults on China (click here).

See – when bonds mature – the debtors generally borrow new debt to cover the maturing debt (basically refinancing). But since Emerging Markets don’t have such deep pocket investors with dollars or reserves on hand – they have to ‘float’ (meaning funding due in the short term) dollar-denominated debts.

Unfortunately – as I showed last week (read here) – the rate hikes by the Fed have caused the short-term dollar funding to rise dramatically. Back to levels not seen since 2008.

(Source: Zerohedge)

Not to mention – the dollar continues strengthening. Meaning it takes more local currency to repay that same dollar due via exchange rates.

Thus the era of poor credit worthy, risky, foreign economies and corporations getting cheap dollar funding is over.

Now the questions remain: will places like Brazil – which owes $140 billion in bonds coming due over the next three years – be able to get short term funding to make good on their debts?

What about Mexico – owing $90 billion in maturing bonds by 2021? How about Russia – owing $133 billion.

Putting things simply – countries and corporations that relied on low rates are toast.

Thanks to the Fed’s post-2008 ZIRP (zero interest rate policy) – many institutions got better debt deals than what they truly deserved.

And we saw what happened to those over-indebted, riskier Emerging Markets last time U.S. rates rose in a meaningful way – the late 1990’s.

And today there’s even more debt outstanding.

So – in summary – here’s what to look out for. . .

Over indebted Emerging Market governments and corporations will have to get their hands on huge amounts of dollars over the next few years.

But with interest rates rising. And the dollar getting stronger – the expensive cost to roll over all this debt poses a new risk for Emerging Markets. Especially the countries and firms with poor credit ratings

And with the global dollar shortage worsening – expect some big market crashes as bond defaults and debt restructures make headlines. . .