The iShares MSCI Emerging Markets (NYSE:EEM) has punched above one level of major resistance (38.00), but it's facing even stronger major resistance (price and trendline convergence) around the 39.00 - 40.00 level, as shown on the following Daily chart.

The RSI indicator has made a new swing high on a higher swing high in price, but has yet to do so on the MACD and PMO indicators. Volumes have also been steadily dropping, on average, since July 2016. So we're seeing some mixed messages on this timeframe.

A hold above the 38.00 level is crucial now, as a drop and hold below could see price drop, once again, to the 50 or 200 day moving averages, or lower.

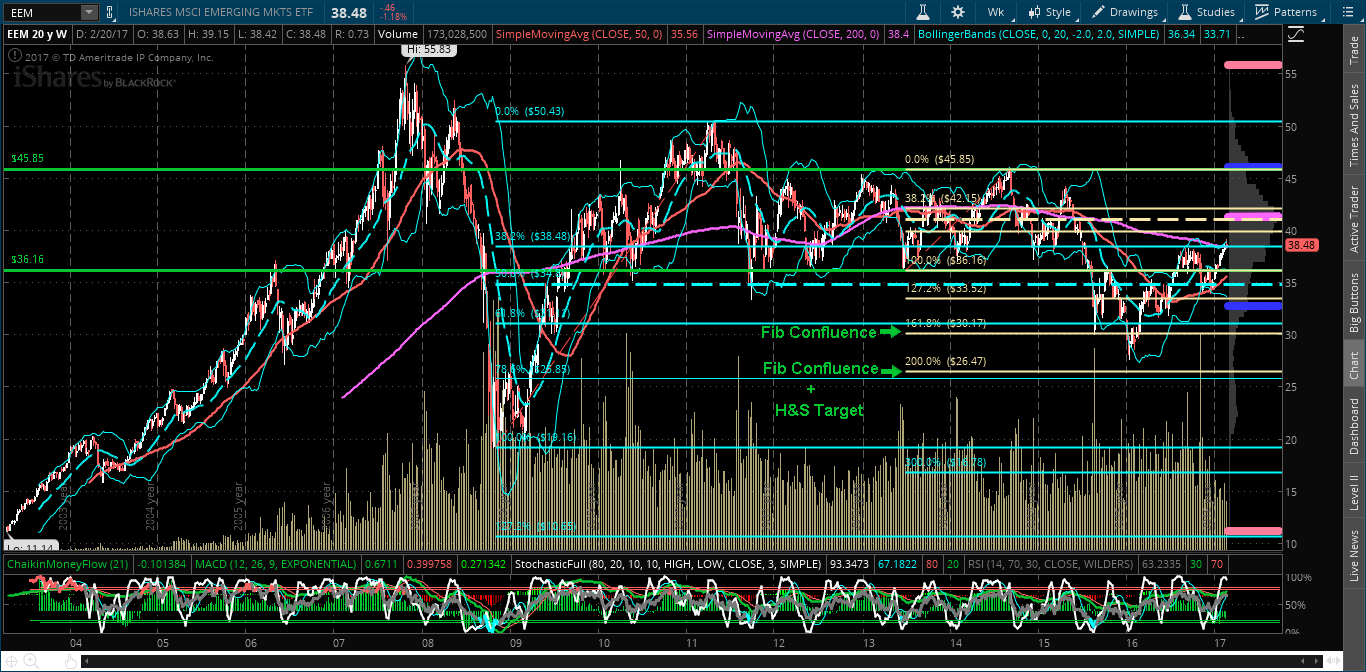

Price on the Weekly chart below is resting right on a long-term 40% Fibonacci retracement level (from 2008) and the 200 week moving average (both around the 38.40 level).

So, it's doubly important that EEM hold the 38.00 level, lest we see some major weakness creep in.