As regular readers would already know, I am not too bullish on US equities due to their high valuations, huge bull market gains from March 2009 lows and over-owned status when it comes to consensus fund manager weighting. However, that doesn’t mean I dislike all equities, all over the world. The obvious preference I hold links to cheap Emerging Markets.

I’ve recently started buying some Chinese shares and will continue to add to them when the time is right. I also bought a very small position in Russian equities way back in early March during the Crimea panic, and with the MSCI Emerging Markets index breaking to new lows (only in USD terms) I plan to add to my existing holdings. My plan is to slowly continue to add and build positions in this sector.

Chart 1: Emerging markets total return is consolidating below resistance

This is completely opposite situation to what the majority of the global fund managers are doing. While my strategy is to build long term positions for the future, we see in the recent November edition of the Merrill Lynch Fund Manager Survey that global fund managers remain underweight Emerging Markets, by more then one standard deviation from the mean. Furthermore, 13 out of the last 18 months, managers have been underweight these equities. I wonder if in hindsight we will look back at this period as a major bottom, before an upside breakout?

Technically, Emerging Market equities have been underperforming Developed Market counterparts since May 2011, when the US dollar bull market started. The overall equity iShares MSCI Emerging Markets ETF (ARCA:EEM) total return, which tracks the MSCI Emerging Market Index, has been consolidating under a major resistance zone dating back to the peak in 2007. We are slowly but surely coming to a pressure cooker climax, where a break in either direction will occur.

Chart 2: Emerging market equities are very cheap relative to US equities

I favour an upside breakout, but obviously this is just my opinion. I hold this view due to attractive valuation, both in actual and relative terms. Many times, as I discuss price patterns and future direction of asset classes, I receive emails regarding fundamentals or valuations. I do not have time to write large and in-depth articles that cover these matters, so you have to do your own research.

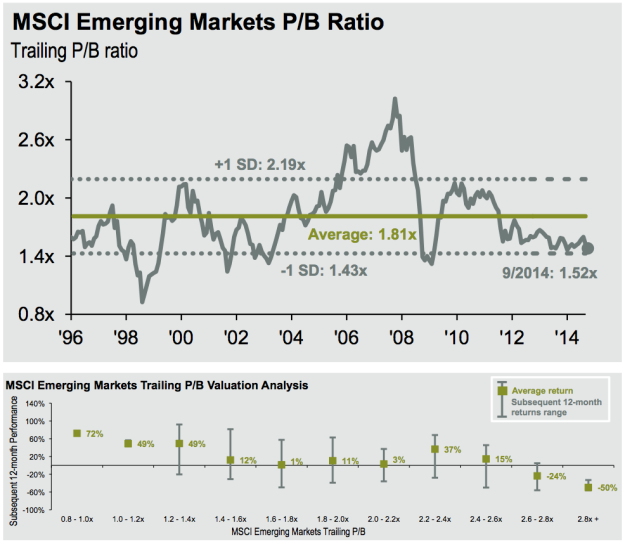

However, I will touch upon this here, today. As of September 2014, GEM equities traded at 1.5 times price to book value, which is historically 1 standard deviation below the mean. Since 1995, the index has returned 15% on average, in the subsequent 12 months. More importantly, the GEM index was positive 89% of the time in all of these instances.

Therefore, buying Emerging Market equities at current valuations or even lower (if we get there), gives an investor a chance of gaining a positive double digit return 9 out of 10 times over the next year. I like these kind of odds from the valuation perspective. But, nevertheless I will pay close attention to the technical formation in Chart 1, and respect the tape as it attempts to break up or down.