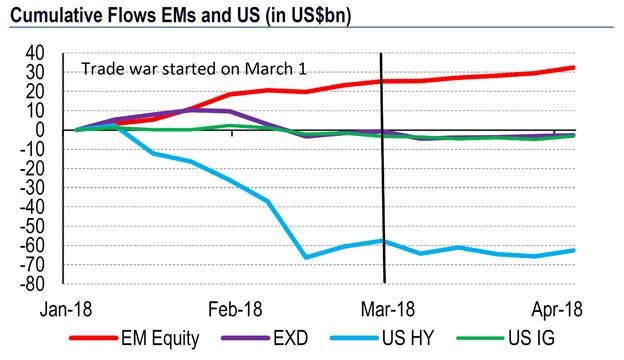

If an impending trade war is about to create havoc for emerging markets, someone forgot to tell investors. Emerging-market equity inflows have continued apace since the specter of a trade war emerged at the beginning of March. (Dollar-denominated emerging-market debt moved to modest outflows, moving similarly to U.S. investment-grade corporate debt.)

EXD = dollar-denominated emerging-market debt

HY = High yield

EM = emerging markets

IG = Investment grade

Source: Bank of America Merrill Lynch (NYSE:BAC) Research

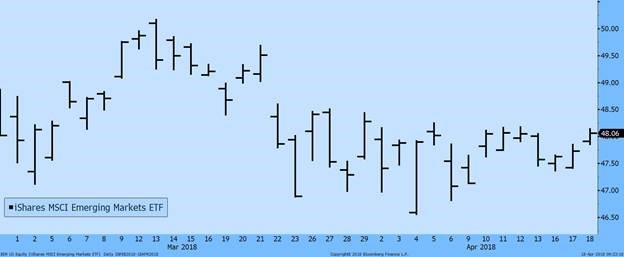

The largest U.S.-traded emerging-market ETF(EEM) has behaved well, remaining in a trading range as trade-war anxieties have ebbed and flowed and as the ongoing sideways correction in global markets has continued.

In short, EM investors are behaving largely as if they share our view of the likely nature and trajectory of current trade negotiations:

• Current verbal positioning on both sides does not represent a “final offer,” but is simply the opening phase of longer formal negotiations;

• Chinese President Xi Jinping’s conciliatory remarks at an Asian economic forum on April 11 show at least that he is intent on calm -- and may suggest that China will wait for a more pliant White House before openly resuming some of their more egregious trade behavior;

• In the lead-up to fall mid-term elections in the U.S., President Donald Trump likely believes that his base will respond positively to his rhetoric on trade. However, that base is also more fundamentally concerned with robust economic growth and with jobs -- so the President is unlikely to plan or take actions that would cause real economic damage;

• Though not currently on the front burner of mainstream media, North Korea remains a point of concern, and perhaps a point of pride for the U.S. President in his ambition to create a lasting solution where his predecessors failed -- and China’s cooperation remains key for any such solution;

• Steel and aluminum tariff announcements are more intended to put pressure on current NAFTA negotiations, ahead of July’s Mexican elections that may put a left-leaning president in power in Mexico, than they are aimed at China.

Investment implications: We continue to believe that several emerging markets could perform strongly for the duration of the current global expansion, particularly Asian manufacturing exporters. We currently favor Vietnam, Thailand, and India; within China, we favor social media and internet tech leaders.

Market Summary

The U.S. Market and Economy

Earnings season has begun for U.S. companies, and corporate profits are at least as good as expected in the first four days of earnings season. We anticipate that the strong start will carry through for the remainder of the season. Banks, financial services, insurers, credit card issuers, stock brokers, and some tech and healthcare companies are among the early reporters. So far, healthcare companies and most techs have had very good news, and banks have been generally positive, in line with expectations.

We expect strong earnings to continue throughout 2018. The earnings will be driven by a combination of strong global economic growth, strong U.S. growth, and lower taxes. Major U.S. companies’ financial reports will continue throughout April and May. A second positive is that beginning in May, many companies will resume their stock buybacks after earnings are reported. The combination of these events will be a positive for stocks for the next couple of months.

During the May-to-September period there will be a large number of industry conferences at which analysts can visit with the managements of the companies that make presentations. This communication by company managements with institutional portfolio managers and analysts will drive further information flow. Information about future business plans, new projects to expand facilities, build new plants, buy new equipment or otherwise expand operations.

The third market driver is that in our opinion, many companies have plans to make purchases of new plant and equipment and enter into new markets. This will increase competition within the U.S. and with trading partners around the world.

Asia and Emerging Markets

China is in the midst of cutting back on the speculative lending which has led to excessive speculation on investment products. This has caused a tightening of money available for lending in China, and caused some financial services operators to declare bankruptcy. This is a normal restriction of excess speculation and should not have a negative long-term effect on China, which continues to grow at 6.8% according to official statistics (but probably closer to 5% in reality).

We believe that a few countries in Asia are attractive: Vietnam, India, and Thailand lead our list. Within China, we would only get involved in social media or internet companies. We are not bullish on every country in the region.

Europe

Our view on Europe has become somewhat more positive. Political risks are diminishing, as the world is now starting to respond to aggressive Russian behavior.

Banking risks in Europe and the oncoming end of QE are the two risks that we see. Clearly, Britain is the place to look for opportunity as it becomes obvious that they will not be hurt by Brexit and probably their growth will be benefitted by a removal of European bureaucratic restrictions. We will write more on Europe in coming weeks.

Gold

Cyclically, gold is near a correction level, but fundamentally it looks as if it could head to $1,380–$1,400 within a few months. Longer term we believe that gold could approach $1,500.

Cryptos

Cryptocurrencies have enjoyed a modest rally since April 12. According to some reports, Americans will owe as much as $25 billion in cryptocurrency capital gains on last year’s trading. There seems to have been selling pressure leading up to tax day as positions were liquidated -- and over the past week, though Bitcoin has enjoyed a modest rally, some alt coins have rallied much more strongly.