The ratio of investment in S&P 500 to that in the Emerging Markets has many meanings and measures for investors and traders. A run lower, in favor of Emerging Markets, is often cited as a risk on measure. That can mean frothiness in the broad world markets at the top of a cycle or the sign of a global turn around if it is not the top. I really do not need to have a narrative associated with price action to explain it, but understand the needs of others in that regard. To me the price action itself is enough. And what the price action in this pair is saying is interesting. Take a look.

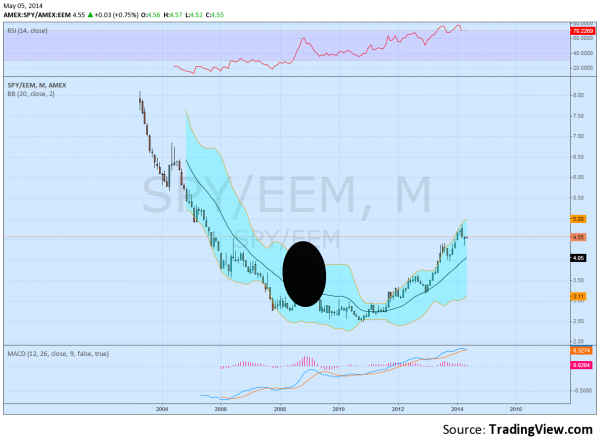

The daily chart above shows the last year’s price action. The ratio rose up to 4.40 and established that as resistance 2 months, retesting it 3 times, before pulling back. The pullback came right back to that resistance and had a shallower pullback, establishing a Cup-and-Handle pattern. At that point it broke the resistance to the upside and reaching a bit past the pattern target. The pullback from that high then retested the extension of the breakout level and is moving higher again. Now in a bull flag with a Measured move higher to a ratio of about 4.80 on a break higher. The momentum indicators are also positive, with the RSI at the mid line after rising, and the MAD moving higher. Translation: The movement of money from Emerging markets into the S&P 500 looks to continue after the recent pullback. That was a lot of complex technical analysis. But you can get the same perspective with a lot less of the noise by looking at the monthly chart of the ratio below. Plain and simple, with the time around the financial crisis blacked out, there has been nothing but a smooth flowing transition from Emerging Markets in to the S&P 500 that is continuing. How far will it go? Nobody knows, but don’t try to tell me that it is overbought so it is not worth pursuing. It remained oversold for more than 5 years.

Are you going to continue to just sit and watch this happen?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.