“Davidson” submits:

The market volatility of the past couple of weeks is a common feature of market activity when Hedge Funds make changes in their perceptions of future returns in various asset classes. Often what we see is a temporary fall in the SP500.

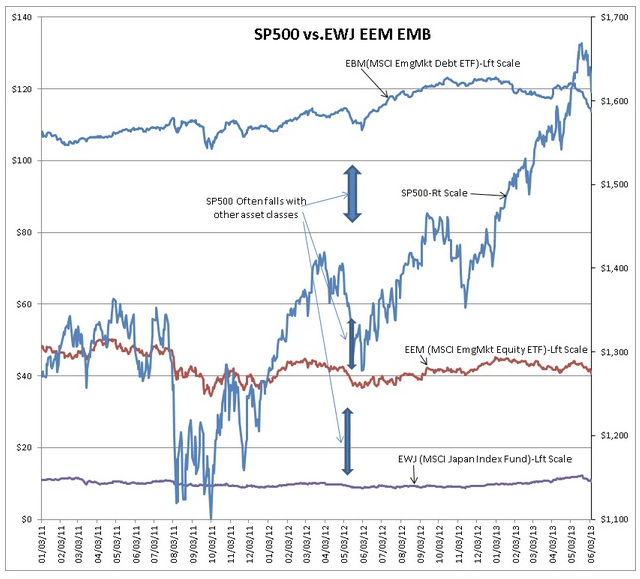

In the current environment we are seeing the SP500 sell off with the sell off in the EEM (MSCI Emerging Market ETF), EMB (MSCI Emerging Market Bond ETF) and EWJ ( MSCI Japan Index Fund)-see the chart below. This deserves some explanation.

When Hedge Funds invest, the managers tend to be diversified across a wide group of asset classes attempting to take advantage of price movements in multiple asset classes. What often occurs in the less liquid asset classes is that too many funds in a single asset class creates the situation where they find themselves trapped and unable to sell efficiently when they all want to sell at the same time. What they do to meet the inevitable margin calls which occur each afternoon (2:30PM in the US markets) is to sell the more liquid investments which often proves to be US stocks, i.e. the SP500 (SPY) . The effect is that investors witness smaller, less liquid asset classes causing a fall in the LgCap more liquid issues for no apparent reason. This is something I have witnessed since Hedge Funds evolved in 1995 to have considerable impact on short term market volatility.

It is also my observation which is supported by observations of well known value managers over many years that economic growth trends have the largest long term impact on securities prices. I call your attention to the chart above. This chart covers only the period of early 2011 thru today’s pricing. The information I had available indicated that we exit Emerging Markets with large gains in early 2011 but remain invested in several other asset classes including the SP500. If economic trends are rising, so do the associated equity asset classes.

The SP500 has risen from $1,272 from the beginning of the chart to $1,610 when this data was collected or a 26.5% gain while the EMB had a 6.5% return, the EEM lost ~15.5% and the EWJ had a gain of 3%. Hedge Funds noting this are adjusting portfolios as they are leaving behind the anti-US$ bet which favored commodities and the Emerging Markets which produced them. The economic data which supported our decisions in the past continues to indicate that the SP500 and Intl LgCap equities are the better asset classes to hold in portfolios.

It is my opinion that the recent sell off in the SP500 as others sell their Emerging Market positions is simply the effect of Hedge Funds adjusting their portfolios and selling what they need to meet daily margin calls. This is something which longer term investors should ignore and trust the economic data which has served us so well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Emerging Markets And The S&P 500

Published 06/07/2013, 04:00 AM

Updated 07/09/2023, 06:31 AM

Emerging Markets And The S&P 500

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.