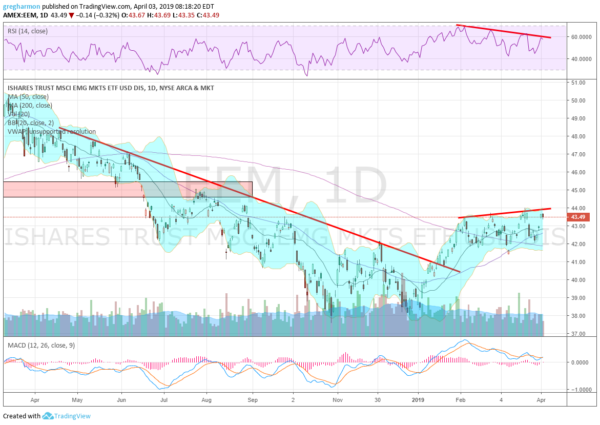

The Emerging Markets ETF had a rough 2018. After a strong January, it fell the rest of the year, giving up over 25% of its value in the process. 2019 has been a different story so far though. Just over a quarter of the way through the year, it is up about 13%. Will the party continue in 2019?

There are some strong positives in place for Emerging Markets. First, they broke the long downtrend resistance in January and kept going. Next, they confirmed a double bottom by rising over the December bounce high. They have been consolidating in a bull flag over the past 2 months, which suggests a Measured move to about 48 on a break to the upside.

During the consolidation, the momentum indicators have also reset from overbought conditions. The MACD is back near the zero line and has plenty of room to move back higher now. The RSI is bouncing off of the lower end of the bullish zone. But the one concern is that the bounces have been making lower highs since the start of February. This divergence is not a show of strength. Emerging Markets may break out higher but taking a cautious stance until they do seems prudent for now.

Disclaimer:

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.