- Increasing trade risks are not altering the case for emerging market stocks

- Structural reforms support the outlook for emerging markets

- India’s reform driven, self-sustaining growth is a case in point

- Risks include a sharp rise in the dollar, accelerating trade tensions

In a time of escalating trade risks and rising U.S. interest rates, traders could be forgiven for struggling to figure out where to invest next. But Richard Turnbull, global chief investment strategist at BlackRock, the world's largest money manager, says that there is a strong case to be made for investing in emerging market stocks, trade war risks or not.

BlackRock’s preferred markets in the emerging world? India in particular, as the sub-continent's brightening economy boosts earnings expectations and offers a cushion against potential trade-related shocks, Turnbull wrote in the firm’s global weekly commentary on Monday.

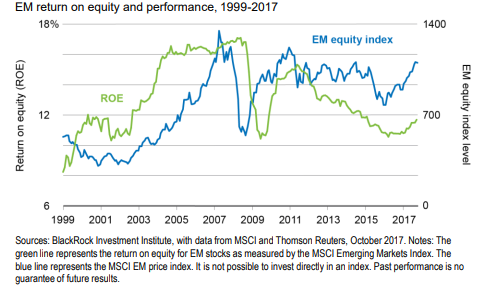

Emerging market stocks outperformed in 2017 after five years of declining profitability and sagging earnings growth, boosted by stronger global expansion and by significant reforms in a few major countries, notably in India and emerging market powerhouse China.

More EM Gains in 2018

BlackRock believes there's more room for gains in emerging markets in 2018 and says India is a good example of what's on offer. The International Monetary Fund (IMF) sees India as the fastest-growing major economy in the world in 2018 and 2019, the top ranking it briefly lost to China in 2017.

The Indian government has implemented structural reforms to tackle chronically low productivity and the bureaucratic barriers hampering the private sector. Financial sector reform is also encouraging, Turnbull says. A government-led capital injection into banks has helped to repair bank balance sheets. The clean-up of bad loans and banking sector recapitalization is clearing the path for private sector investments and a long-awaited capex recovery.

Company margins have been challenged as the government has undertaken these reforms, but are slowly showing signs of improvement amid lower expenses and inflation. Earnings growth picked up to more than 10% in 2017, according to Thomson Reuters data, and analysts are expecting this to increase 21% in 2018 according to Turnbull, the highest of any major market.

What are the Risks?

Risks to the outlook include tense trade relations, but India’s relatively low dependence on global trade makes it BlackRock’s favored pick in the emerging world. Another risk is a sharp rise in the U.S. dollar, but BlackRock has said that it sees the dollar appreciating only gradually and expects it to have limited impact on most emerging markets.

The majority have stronger current accounts and reserves than during the ‘taper tantrum’ of 2013, which sent emerging market assets into a tailspin.