The precipitous decline in global economic fundamentals has not been without casualties, as evidenced by the deteriorating outlook for many emerging economies. While many of these still blooming economies benefited broadly from zero interest-rate policies, the pace of foreign direct investment outflows is showing that savvy investors are shifting from yield to quality. The impact of weak commodity prices is also contributing in a major way to the distress, confirmed by the situation unfolding in Brazil. Moreover, the economic outlook is bleeding into the political climate with the large protests engulfing the nation serving as testimony to this notion. Citizens are currently seeking to unseat and impeach President Dilma Rousseff on allegations of corruption and misrepresenting economic data. The Brazilian real has been on a path of collapse since expectations of an end to United States QE measures surfaced approximately one year ago, followed closely by the reaction in the US dollar. USD/BRL has risen by 13% since the beginning of July, highlighting further the uproar in emerging markets.

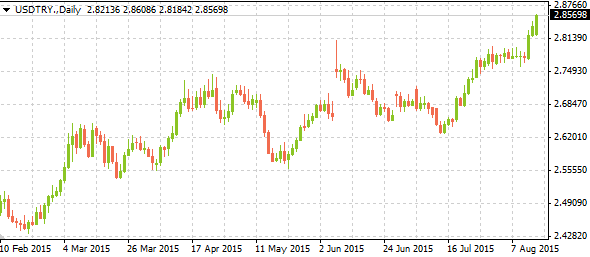

Aside from the economic situation heightening the political fragility in South America, a similar unfolding of events is transpiring in Turkey. The Turkish lira has had a miserable year, with USD/TRY hitting a new record high today. The lira has lost 23% year-to-date versus the dollar as economic and political crises become further entwined. Confidence in the government is waning, especially after the last election’s fragmentation of the vote resulting in the difficulty present to forming a coalition. Although the nation has attracted over $4 billion in new foreign capital in 2015, the number belies the recent exodus of dollars from the economy, which has forced the currency demonstrably lower. The weak political backdrop and worsening economic conditions are testament to the power of the dollar in setting the tone for the global economy. Tomorrow’s Turkish interest-rate decision is not forecast to see the Central Bank of the Republic of Turkey cut rates further, despite expectations that the benchmark will fall to 7.25% in the fourth quarter. However, it could be the beginning of a more dramatic slide as the country’s precarious economic and political situations skid out of control.