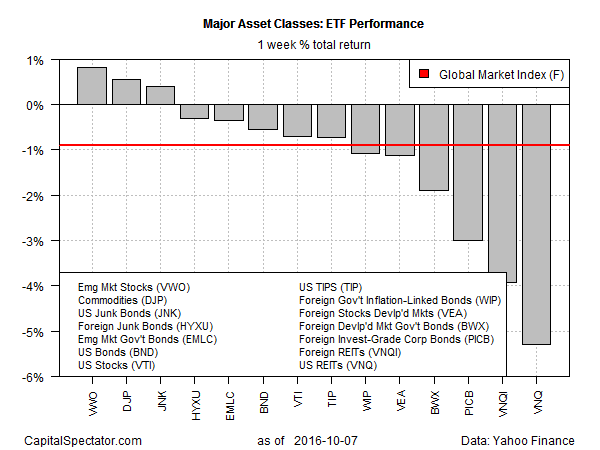

The major asset classes dispensed a wide range of performances last week, based on a set of proxy ETFs. Although losses dominated the five trading days through Oct. 7, a handful of markets bucked the trend, led by equities in emerging markets. But the week was overshadowed by the red ink brigade, with US real estate investment trusts (REITs) suffering the biggest setback.

At the top of the list for the winners: Vanguard FTSE Emerging Markets (NYSE:VWO), which ticked higher by 0.8%. Meanwhile, last week’s biggest loser, Vanguard REIT (NYSE:VNQ), shed more than 5% in total return terms.

The negative bias in last week’s trading weighed on an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights. GMI.F lost 0.9% in the five trading days through Friday.

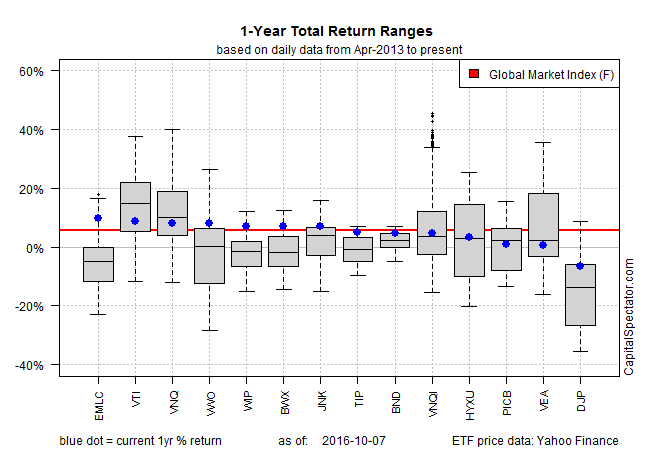

The correction in REITs, which has been unfolding for much of the past two months, has knocked the asset class off its perch for the trailing one-year column. No longer leading the field, VNQ has slipped to third place in the one-year (252 trading days) column for the major asset classes. The current leader: VanEck Vectors JP Morgan EM Local Currency Bd (NYSE:EMLC), which is ahead by 11.4% for the year through Oct. 7.

The sole case of red ink for one-year performances: broadly defined commodities. The iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) is off by 6.3% for the 12 months through last week’s close.

Meantime, GMI.F continues to hold on to a moderate gain for the one-year comparison. The benchmark is ahead by 5.8% for the year through Oct. 7.