Emerging market currencies suffered a substantial sell-off yesterday as market participants were less prone to load on more risk. The sell-off in the Brazilian real was also strengthen by the weak industrial output. Industrial production missed widely consensus as it contracted 5.2%y/y in August (versus -4.8% expected) after shrinking 6.4% in the previous month. The Brazilian real slid 1.47% against the US dollar yesterday and returned at around 3.2580. The Colombian pesos was also under pressure on Tuesday as it slid 1.52% versus the US dollar amid broad risk-off sentiment.

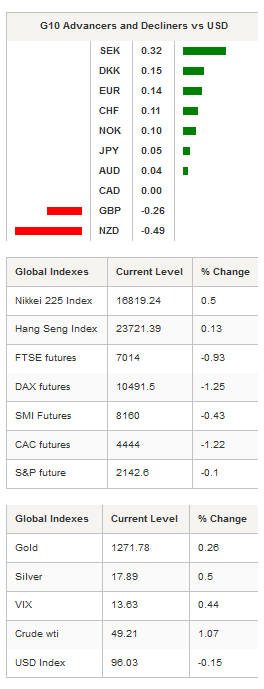

Precious metals recovered somewhat this morning after slumping massively. The yellow metal fell 3.30% from $1,310.50 to $1,267.10 amid speculation central banks are about to tighten their respective monetary policy conditions. Silver took also a big hit as it slid almost 6% to 17.80 before getting some ground back and returning at around $18. This morning, palladium and platinum were up 0.10% and 0.65% respectively.

The New Zealand dollar was the worst performer amongst the G10 complex as it fell 0.49% against the greenback, down to $0.7176, the lowest level since August. NZD/USD clearly broke the 0.7222 support to the downside and is now heading towards the following one that stands at around 0.7165. The recent debasement of the Kiwi is mainly due to the fact that market participants have been starting to price in another rate cut from the RBNZ, forcing yields chaser to look for another ways to generate return. If the later support is broken, the following support lies at 0.7088 (low from August 8th), then the road is wide open towards $0.70.

The pound sterling traded sideways during the Asian session before suffering a mini sell-off in early European session. GBP slid another 0.30% against the dollar, down to 1.2691, as the uncertainty surrounding the Brexit story climbed another notch. We are having a hard time to turn bullish on the sterling as we have no visibility on the outlook. However, we also have the feeling that the pound is being over sold as investors are lost in the dark without any historical benchmark of such a situation.

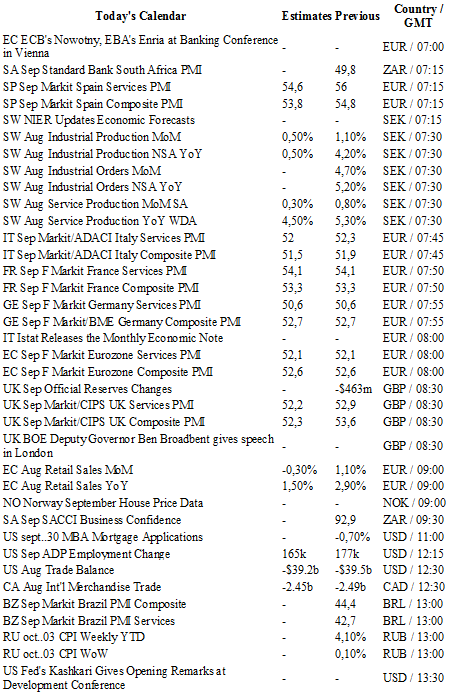

Today traders will be watching Services and Composite PMIs from Spain, the Euro zone, France, Germany, the UK, Brazil and the US; ADP employment change, MBA mortgage application, trade balance, factory orders, durable goods orders and crude oil inventories from the US.

Currency Tech

EURUSD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1218

S 1: 1.1046

S 2: 1.0913

GBPUSD

R 2: 1.3445

R 1: 1.3121

CURRENT: 1.2709

S 1: 1.2000

S 2: 1.0520

USDJPY

R 2: 107.90

R 1: 104.32

CURRENT: 102.83

S 1: 99.02

S 2: 96.57

USDCHF

R 2: 0.9956

R 1: 0.9885

CURRENT: 0.9776

S 1: 0.9522

S 2: 0.9444