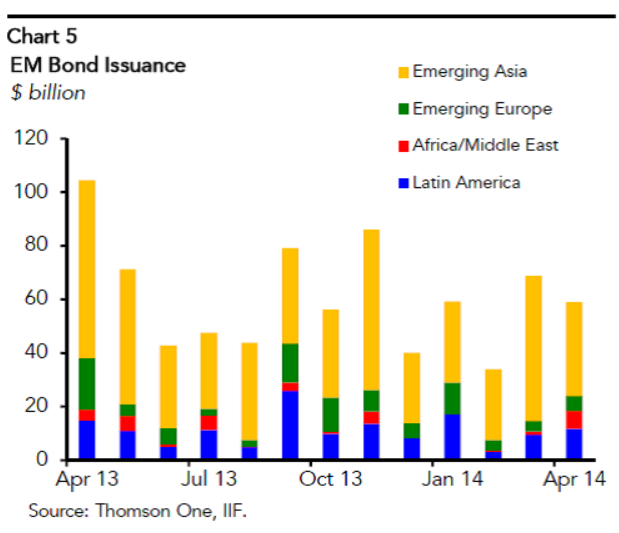

Sovereigns and corporates are taking advantage of the still accommodative global monetary conditions to secure funding. This Great Graphic, tweeted by Emerging Equity, from IIF data shows emerging market economies bond issuance over the past year.

It is remarkable that the bulk of the bond issuance over the past year from emerging markets comes from Asia. We suspect the bulk of this is from the private sector.

In discussions about potential bubbles, emerging market corporates are increasingly cited as a risk. Past crises have been proceeded by an accumulation of foreign currency debt.

The IMF recently warned that the bond market rally in Europe may be getting ahead of itself and is especially vulnerable as US rates begin to rise. That cautionary note seems applicable to the emerging markets too, even if some countries have built substantial reserves. Traditionally, investors and economists looked at reserves relative to imports. After the 1997-98 Asian financial crisis, reserves were also in the context of short-term debt obligations. Now it seems many observers and policy makers are including a third metric: the amount of hot money that has entered the country.