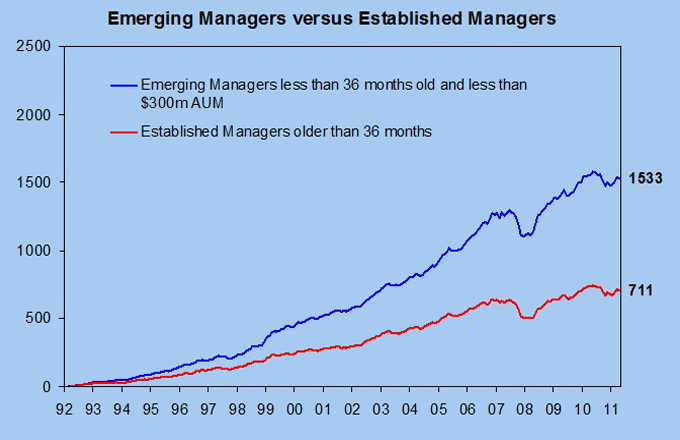

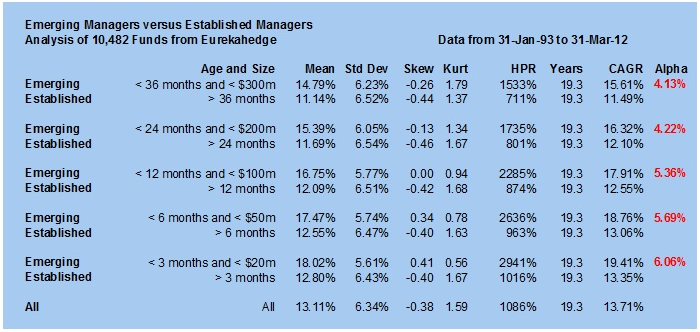

Emerging Hedge Funds, defined here as those funds with less than 36 months of history and whose AUM 36 month ), typically larger, brethren. This geometric rate of excess return compounds out to just under +100% cumulative over the 19.25 year period to end March 2012. It represents an arithmetic excess return, or alpha if you will, of +4.13% per annum.

These findings, based on an update of some research conducted in 2008, broadly agree with those of other studies by amongst others PerTrac, HFR and Phillipe Jorion and are based on the Eurekahedge database.

One of the immediate questions such studies raise is what about the question of Survivorship bias ? In response I would say only that the database used includes both dead and alive funds and that whatever bias there is affects both Emerging and Established Managers. Nonetheless it is no doubt a factor. One of the better pieces of research on the possible extent of survivor bias is An Examination of Hedge Fund Survivorship Bias and Attrition Before and During the Global Financial Crisis published in the March 2011 edition of The Journal of Alternative Investments. In it the authors find that the average annual returns of the living (surviving) funds are 1.82% (mean) to 2.78% (median) higher than those for the combined living and dead fund average returns. In, addition they find the bias for Small funds to be slightly higher at 2.15% (mean) to 2.86% (median) per annum. They also find a negative bias or underestimation of Large Fund returns of -0.06% to -0.30% p.a. Taking the worst case scenario therefore of Small bias plus Large underestimation bias gives a Total Bias of 2.46% (mean) to 2.93% (median). If one subtracts that from the gross alpha of +4.13% you are still left with bias free excess returns of +1.20% to +1.67% for small Emerging funds and +1.35% to +2.31% for all Emerging funds. This last number is almost exactly the same as that found by Jorion.

Those numbers compound out to lower, but still impressive, outperformance of +25.9% to +37.7% for small funds and +29.5% to +55.1% for all funds over the 19.25 year period.

To be sure Emerging Managers do have periods of relative underperformance typically following market peaks and crisis periods, eg in 1997-98, 2002-04 and 2009-10. This probably reflects a decline in issuance of new funds immediately following such periods and this is a topic worthy of further investigation.

Some interesting highlights from the study include the following snippets:

At launch the average Hedge Fund had $26m in AUM. Current average AUM as at 31-Mar-2012 is $234m

It takes the average hedge fund 16 months to grow its AUM to over $100m after which those funds that manage to do so ( 21.2%) have an average of $131m in AUM.

Only 7.8% of the 10,482 funds in the sample grew their assets to $500m or more. It took around 40 months for them to do so.

Only 3.7% of the 10,482 funds in the sample grew their assets to $1bn or more. It took them an average of 55 months to do so after which their average AUM was $1.4bn

After 84 months ( 7 years ) the average annual arithmetic return of a fund falls to the long run average of +8.52% p.a. irrespective of when the fund was launched.

Large funds, as proxied by the Top 100 Funds by AUM, underperform Emerging Managers by 200 – 400bp p.a

Despite these findings, by myself and others, The latest asset flows data from HFR

(see: HFR, Inc. releases HFR Global Hedge Fund Industry Report for Q1 2012 ) indicates that only the larger funds are attracting new AUM.

Average fund size is now around $234m which should generate revenue of $8-10m (assuming 2:20 and +10% p.a. returns). But performances have been far lower than +10% over the past few years leaving most funds with revenues of less than half of that. Moreover, fully 50% of all funds of funds remain below their high water marks and are also not allocating except for the top 50 or so by AUM.

The consolidation currently underway in the Funds of Hedge Funds business (see: this weeks Economist ”Funds of hedge funds Going, going, gone ?“ ) may also pose the equivalent of a TBTF problem for those mega FoF with AUM > 10bn or so. Since less than 4% of all funds have more than $1bn in AUM these large Funds of Funds are restricted to a universe of only around 400 or so of the same funds unless they are willing to hold more than 10% of an individual underlying hedge funds AUM or hold hundreds of smaller funds.

Based on the historic data it seems that Institutional investors are prepared to forgo returns that are at least 20 – 40% higher (100 – 200bp p.a.) from Emerging Managers in exchange for the assumed peace of mind and reduced business risk that larger funds provide.

If smaller emerging hedge funds truly pose the equivalent of the ‘Small Cap’ effect in equities, as the research suggests, this is likely to prove costly to those who fail to consider them.

*Peter Urbani is the former Chief Investment Officer ( CIO ) of Infiniti Capital, a now defunct Hong Kong based Fund of Funds group. He is an experienced portfolio manager, alternative investment and risk management expert. The presentation upon which this article is based can be downloaded here.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Emerging Managers Delivered Twice the Returns of Established Managers

Published 06/22/2012, 03:02 AM

Updated 07/09/2023, 06:31 AM

Emerging Managers Delivered Twice the Returns of Established Managers

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.