If it was not for Barrick’s (ABX) and Newmont’s (NEM) Nevada mines they would probably be bankrupt by now. The infrastructure, stability and experienced local labor force in Nevada makes it just too appealing for investors than other places in the World like South America and West Africa where there are too many geopolitical risks.

There is no doubt we have been in one of the toughest mining bear markets in modern history. Any one can pick stocks in a rising bull market. It is the analysts and fund managers who can predict the winners that are outperforming in a bear market and the coming turnaround that should be followed.

For a long time, I told you to watch Comstock Mining (LODE) as it was coming into production and could gain market share from the big gold mining giants such as Barrick and Newmont who made stupid moves with high cost projects in risky jurisdictions.

On the other hand, Comstock has over delivered on its promises, while the big boys have disappointed their shareholders with billions of dollars of write-downs. The uptrend of Comstock versus the majors such as Barrick is apparent over the past two years by studying the chart above. Comstock may be on the verge of a breakout versus its peers.

Major institutions have been buying most notably Century Management, US Global Investors and Solus Asset Management as they can see the improving balance sheet and as Comstock enters profitability and free cash flow. The turning from red ink to black ink could possibly occur over the next two quarters.

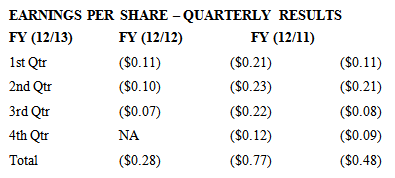

Since I started following Comstock in my premium service, the Earning Per Share losses have decreased from $(-.22) to $(-.07). If the price of gold moves higher I expect Comstock to turn profitable in the 4th Quarter. If gold continues to correct shareholders may have to wait until the first or second quarter to enter the black as the margins will be tighter.

Comstock Mining (LODE) was just approved for a modification which will help the company expand their heap leach pads and reach their production goals of 40,000 ounces of gold annually. The company should increase the rate of production, which should drive down average costs. The company also recently announced that for the three months ending September 30th, they shipped a record amount of gold and silver and are on track to deliver 20,000 ounces of gold for 2013.

This is a significant achievement during one of the worst bear markets in gold mining history in 2012 and 2013. The major miners are dealing with high cost production above the spot price. Comstock Mining (LODE) has moved from a mine explorer into a low cost gold and silver producer in a supportive and friendly mining jurisdiction.

Comstock is reducing its losses and on track to earn a profit. For months I have tried to shine light on this emerging gold producer which should be a model to other developing junior gold miners during this bear market.

They knew the key was sustainability and that if they could generate cash then it will allow them to continue scaling up and increasing production. The geologic potential of this deposit is huge as management and the geologists believe they are only scratching the surface.

Comstock should be in a position to generate free cash flow to expand resource growth in 2014. That is when I think it could really make waves in the mining community as many do not understand how big an operation this could eventually become.

This production increase to 40k ounces per year for Comstock may be just the beginning as they could expand exponentially over the next 2-4 years as the price of gold and silver continue their secular upward trends. With the addition of the Dayton Mine the company could move up to producing 150k ounces at some of the lowest costs in the industry. Amazingly, the price is still near lows, but may not be for too long as they begin to move from the red to the black or operating with a loss to positive earnings per share.

Disclosure: Jeb Handwerger Owns Comstock Mining Shares and the company

Below you may find the video.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Emerging Gold Producer Outperforming Barrick, Newmont Minining

Published 11/19/2013, 01:21 AM

Emerging Gold Producer Outperforming Barrick, Newmont Minining

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.