About a month has gone by since the last earnings report for Emergent Biosolutions, Inc. (EBS). Shares have added about 6% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Emergent Q2 Earnings Miss Estimates, Revenues Rise Y/Y

Emergent reported earnings of $0.13 per share in the second quarter of 2017, which missed the Zacks Consensus Estimate of $0.26. Earnings however increased from the year-ago loss of $0.01.

Revenues in the reported quarter rallied 10% from the year-ago period to $100.8 million, primarily on the back of higher product sales and contract manufacturing revenues.

However, revenues missed the Zacks Consensus Estimate of $106 million.

Quarter in Detail

Total product sales surged 32% to $63.6 million from the year-ago period, mainly owing to the timing of BioThrax (Anthrax Vaccine Adsorbed) deliveries to the SNS.

Contracts, grants and collaboration revenues plunged 36% year over year to $21 million, primarily due to the timing of the ongoing development activities leading to a reduction of development funding under ongoing programs as well as expansion of the Bayview manufacturing site.

Contract manufacturing revenues were $16.2 million, soared significantly by 59% compared with the year-ago figure. The increase was primarily driven by the favorable timing of fill/finish services as well as certain bulk manufacturing services performed for Aptevo.

Research and development expenses were $25.8 million, down 8% from the year-ago quarter. This downside is attributable to cost-reduction related to development services performed during the period.

Selling, general and administrative expenses decreased 11% to $31.9 million owing to favorable timing of professional services to support the Emergent’s strategic growth initiatives.

2017 Outlook

Emergent continues to expect revenues in the range of $500–$530 million in 2017, including BioThrax sales of $265–$280 million.

The company projects revenue in the range of $115-$130 million for the third-quarter of 2017.

How Have Estimates Been Moving Since Then?

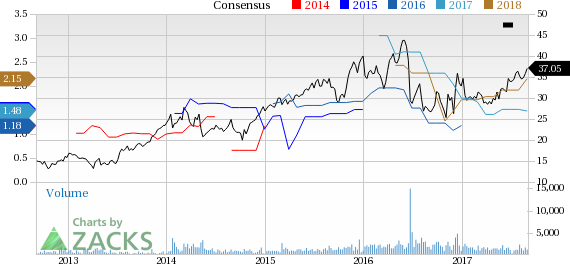

Following the release, investors have witnessed a downward trend in fresh estimates. There have been two revisions lower for the current quarter. In the past month, the consensus estimate has shifted down by 18.5% due to these changes.

VGM Scores

At this time, the stock has a nice Growth Score of B, though it is lagging a bit on the momentum front with a D. However, the stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable for value and growth investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Emergent Biosolutions, Inc. (EBS): Free Stock Analysis Report

Original post

Zacks Investment Research