While Emed Mining Public Ltd, (EMED) continues to make good progress on the permitting related to restarting the world-class Rio Tinto copper project in Spain, it will continue under new management. Effective 19 September, Harry Anagnostaras-Adams resigned as MD and CEO and Rod Halliday has been appointed interim CEO. The company states it is in the final stages of permitting, which will allow the project’s restart, initially at the Cerro Colorado open pit around the end of 2013, with commissioning expected around H115. Following the initial start-up, EMED aims to expand the open pit and restart the higher-grade underground mines on the property.

AAU and Administrative Standing pending

A 30-day public comment period on the Environmental Plan for the Rio Tinto project began on 14 September 2013, having been updated for the changes to the tailings management facility that was agreed in May 2013. This is required for granting of the Administrative Standing for EMED’s mineral rights over the world-class Rio Tinto mining district. The Andalucian government has publicly reaffirmed the feasibility of issuing the two principal permits required to start pre-production work around the end of 2013. The approval of the Environmental Plan followed by granting of the Administrative Standing will trigger the initial work at the Cerro Colorado open pit.

Completion of loan note subscription

On 15 July 2013, EMED announced the completion of a £9.6m (€11.1m) financing for convertible secured loan notes issued to existing customers Yanggu Xiangguang Copper (XGC) and Red Kite. The notes bear 9% interest for the first 12 months and 11% thereafter and could be converted into equity at 9p/share. The funds will be used to continue final permitting and for general working capital. Further funding will be required as the company moves from final permitting to restarting activities.

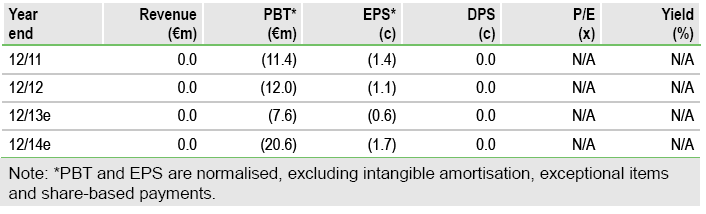

Valuation: Base case valuation remains at US$209m

Assuming EMED achieves commissioning H115, we maintain our SOTP valuation at US$209m or 11p/share, with the potential expansion to 12Mt/year (US$303m or 16p/share) or 15Mt/year (US$397m or 22p/share) as published in our 23 May 2013 note. Our valuation is based on a long-term Cu price of US$2.96/lb, which remains unchanged. We have updated our financial model based on EMED’s 2013 interim results and the completion of the £9.6m loan note subscription.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EMED Mining: Base Case Valuation Remains At $209 Million

Published 09/24/2013, 01:13 AM

Updated 07/09/2023, 06:31 AM

EMED Mining: Base Case Valuation Remains At $209 Million

Restart to occur under new management

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.