This article was originally published at TopDown Charts.

-

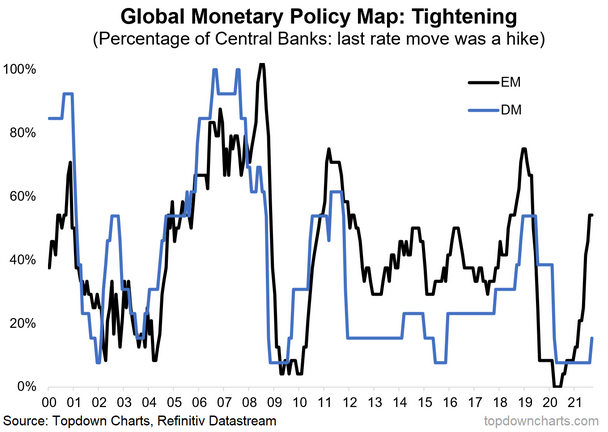

The majority of EM central banks are steadily hiking policy rates and developed markets are not far behind.

-

We see near-term risks but maintain a medium and longer-term bullish outlook for emerging markets

-

Could EM, further along in a tightening cycle, be a harbinger for DM?

Norway made headlines last week as the first developed market economy to hike interest rates. It sets off a lift-off cycle that we assert will bring about potential headwinds. Meanwhile, emerging markets are well into their own tightening cycle. The easy money policy of the last 18 months is fast becoming a thing of the past.

The featured chart below from our latest Weekly Macro Themes report really puts things into perspective on this matter.

Norway Marks First Developed Market Central Bank Rate Hike

Still Easy DM Policy

The percentage of developed market central banks lifting rates remains low. And there are other policies such as bond buying programs that are still quite dovish. Take a look at EM in the above chart, however. Inflation realities are biting into policymakers’ ability to facilitate economic growth—more than half of EM central banks are increasing benchmark rates. (Interestingly, Turkey chose to cut this month, but don’t expect that to spark a dovish trend.)

WMT Overview

Last week’s report dived deep into affected areas such as the US Treasury market (which broke down in price as the 10-year yield rose sharply— making what looks like a major break), the US dollar outlook (which remains confined to its recent range), and an in-depth review of where emerging markets stand after a whirlwind Q3. We also reviewed the emerging opportunities in the UK stock market.

EM Risks

Focusing on EM, we have the space on “risk-watch” for the short-term but we also see a medium and longer-term bullish case, as outlined below.

Bearish Technicals

Looking at price-action, the MSCI Emerging Markets (local) Index continues below its 200dma while the percentage of EM nations above their 50dma is at the lowest level since late 2020—and dropping fast. Tighter monetary policy is having its impact despite strong commodity prices, normally a boon for the group.

EMFX Near the Lows

Moreover, EMFX has not bounced despite the slew of rate increases. The equal-weight EMFX Index is testing support once again. Breadth among EM currencies is soft as just a third of the components are above their respective 200dma. Global traders must watch EMFX closely as a breakdown will no doubt draw a risk-off environment.

Near-Term Economic Challenges, but COVID Improving

One bright spot is the retreat in COVID-19 cases across EM, particularly in EM ex-Asia. This trend, assuming it continues, will help those economies re-open more fully. Unfortunately, the surge in cases earlier this year took its economic toll and pressured corporate earnings. The EM Economic Surprise Index has dropped into negative territory while the EM Earnings Revision Ratio has trended lower through much of 2021. There could be more pain here before things rebound.

The Bullish Take Looking Further Out

The bull case is seen in fund flows and sentiment. Flows are on the rebound after a Q2 reset. Recall that EM stocks were the hot trade in the first several weeks of the year, but the group then plunged on a relative basis. Optimism was simply too high in early Q1. Rolling quarterly fund flows were negative for a moment, but are now back on the rise despite the MSCI EM Index hovering near its lows. Meanwhile, the Sentix AC Sentiment Survey has also ticked up after dropping to a 1-year low a few weeks ago. These inflections support a medium-term bullish view.

Finally, EM valuations have turned more attractive on an absolute and relative basis in 2021, making for a longer-term bullish thesis.

Bottom Line: Current volatility in EM comes after a policy rate hike cycle that has been ongoing for much of this year. Meanwhile, DM is just beginning its hawkish turn. Investors must monitor these important monetary policy moves and pause to consider its likely implications.