This is the third of a 10-part blog series where I will go through each of the charts from the 10 Charts to Watch in 2019. The purpose is to add some extra comments and context around the charts, as well as to explain some of the finer details of the indicators.

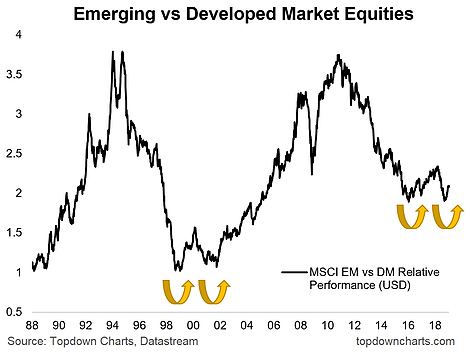

This time we look again at EM vs DM: specifically the relative performance of emerging market equities (MSCI Emerging Markets Index) and developed market equities (MSCI World Index). Basically a familiar pattern is appearing, which leads me to believe (based on several other key charts and indicators) that we are at a major market turning point with these two.

Among the factors driving a potential multi-year EM vs DM relative performance turning point are: valuations (across a range of valuation metrics emerging market equities look cheap in absolute and relative terms), sentiment (in the short term we've seen contrarian bullish signals in our indicators), technicals (the above chart on a longer term basis, and improving market breadth shorter-term), and economics (short-term starting to see some stabilization in EM macro, and longer term the rise of EM is an important if forgotten theme which supports this rotation).

There are certainly risks to this view, for example if the US dollar undergoes another round of strength that will put a spanner in the works short-term. China is another key one— i.e. basically if they do a policy mistake and the economy/financial markets spiral out of their control. A global recession (not my base case) would also cause issues for EM equity absolute returns.

The reality is there rarely is, if ever, a situation where a compelling investment case is without risk, and indeed the other big risk is simply that I could be too early with this call. But following my process and ever-growing indicator set, I can at least say based on the current evidence that the weight of probabilities here is clear, and to a certain extent the chart speaks for itself.

So for investors considering their EM allocations, be sure to consider this chart!