A monumental week in currency markets as US Bond yields soared weighing on Emerging Markets sentiment. After an effervescent week in equity markets, they retraced on Friday after the energy sector swooned burdened by the prospect that OPEC will not cap supply. Also, precious metals have plummeted as the safe – haven appeal diminishes amid higher expectations for a FED hike.

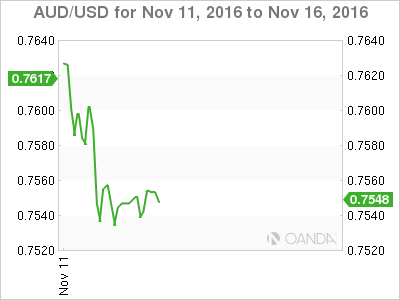

While industrial metals have benefited from both the prospects of increased infrastructure builds in both the US and China, much of the latest move has been driven by Speculative money as mainlanders are caught up in the recent commodity frenzy which caught the eye of China regulators. The Aussie was slammed when copper futures came crashing lower on Friday after Chinese regulators placed new limits on retail copper positions. IN concert, Rebar prices fell below 3000 after trading to a high of 3200, further dampening sentiment. Fears that the current market froth is based on a flimsy house of cards sent the market toppling

While there is little domestic cause for the recent Aussie swoon, the mounting pressure in local EM space along with China’s underpriced financial risk should continue to exert local pressure as the US dollar remains King.

Also , the Australian dollar remains pressures on the backdrop of broader US strength but more so associated with the sharp rise in US yields putting a strain on APAC emerging markets and by proxy the Aussie dollar.

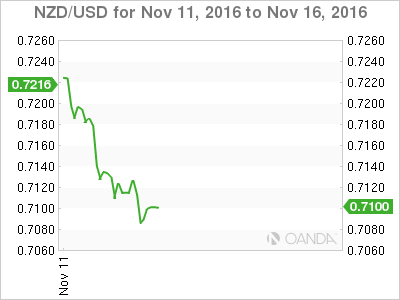

The NZD earthquake will likely dwarf any domestic economic news until the completion of the damage assessment; Currency market reaction was initially muted, as traders remained focused on the G-10 and EM macro developments. But the Earth Quake will certainly provide considerable headwinds for any near term reversals of current market view.

APAC

Anticipating a busy day in APAC as the market digests the fallout from yesterday’s New Zealand Earth Quake and the release of China monthly key activity metrics of October. As per the latest Bloomberg Surveys, the market expects to see a small bounce in IP growth (to 6.2% from 6.1% in September), Fixed asset investment (FAI (8.2%) and retail sales steady (10.7%)

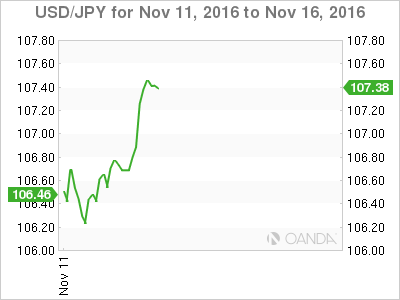

Japanese Yen

USD/JPY continues to look higher given expectations that US yields will continue rising, and risk continues to froth. Market continue to focus on US fiscal spend which is being received well by investors who continue to express their optimism. IN early trade the S&P 500 futures are looking to recoup Friday’s energy sector swoon. The USD remains King.

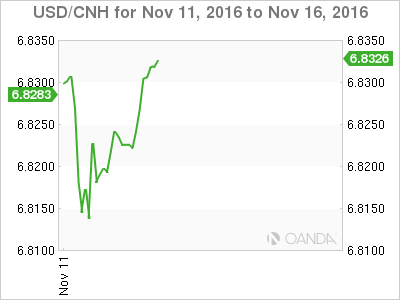

Chinese Yuan

It’s expected the President Elect policies will convert to higher US rates wich in not helpful to the Yuan. Notwithstanding the mounting pressure from capital outflow, indeed, the market must surely be underpriced for the tumultuous emerging market dump, and we may only be on the cusp of fundamental repricing of China market risk.

EM Asia

Are we in the midst of “Trump Slump” or a “Trump Dump” therein lies the question for the recent APAC taper tantrum. Local currency markets are reacting negatively on the backdrop of investors seeking currency hedges versus the stronger USD prospects. Much of the action is expressed through illiquid NDF markets in both IDR and MYR which caused the regional central banks to take intervention actions.

Bank Negara was quick to the call instructing onshore banks to refrain from speculative FX activities which are being perceived as a form of capital control measures. Given the fragile state of the central bank reserves, the direct intervention was unlikely. ON shore is trading 4.2950-3050 this morning, and we will need to see the onshore developments which should help with sentiment.

Indonesia Central Bank where USD reserves as better positioned opted for direct currency intervention to temporarily stem the tide. But with asset rotation along with a mad dash for currency hedges for those willing to stick it out, one should expect the USD/IDR to remain firm on dips

Keep in mind, depth of market in regional currencies is fragile this morning and will likely amplify currency moves.

Overall I expect EM bonds to remain under pressure with low yielders and those currencies sensitive to Fixed Income differential more at risk. We’re witnessing an immense turnaround from secular stagnation of US reinflation, which will continue to weigh on APAC capital markets.