Forex News and Events:

As the greenback remains broadly in demand, the carry unwind weighs heavy on EM assets and currencies. The lira recorded the largest drop versus USD since the week began; more weakness is eyed ahead of the first round of presidential elections due on August 10th. Today, traders’ focus shifts to the BoE and ECB policy decisions. Both central banks are expected to keep the status quo, the ECB President monthly press conference (at 12:30) should trigger some price action in the EUR markets. The bets are negatively skewed as EUR/USD approaches the critical 1.3296 (Nov 2013 low).

BoE and ECB decision day

The BoE and the ECB will give policy verdict today and are expected to keep their respective rates unchanged. The ECB President Draghi will give his monthly press conference at 12:30 GMT. Given the further softness in Euro-zone inflation (0.4% y/y in July), Mario Draghi is expected to sound sufficiently dovish to keep the EUR bias on the downside. We expect to hear further information regarding the implementation of policy easing tools (ABS purchases prospects, TLTROs). The dovish ECB already being priced, EUR/USD hit a nine month low (1.3333) yesterday. The key technical support remains at 1.3296 (Nov 2013 low). If EUR/USD manages to limit losses at 1.3296/1.3333 zone, corrective bids should lift the pair marginally higher. Solid offers are seen at 1.3475 / 1.3500 (21-dma / optionality). A break below the support zone will shift the focus to 1.3105 (September 2013 low).

In UK, the BoE decision should have little impact on the currency markets. While GBP/USD trades in the bearish consolidation zone (below January-July uptrend channel), the technical indicators hint of lighter selling pressures. The UK releases the June construction output and trade data on August 8th, the optimistic expectations should help GBP/USD holding ground above Aug 1/4th double bottom (1.6814) and pull the pair towards its daily cloud cover (1.6935/1.7000). The UK recovery should start moving the dove-hawk balance in the heart of the MPC regarding the timing of the first BoE rate hike, the focus is likely to remain on the progress in exports, foreign investments and the wage growth. Yet we will not have detailed information before the minutes release, thus today’s BoE meeting should remain a non-event.

Solid resistance ahead of the 50-dma (0.79814) pulled EUR/GBP back towards the June-July downtrend channel. Technically, the positive momentum slows since Monday’s bearish harami formation. We expect the upside correction to resume should the 21-dma (0.83536) is broken on the downside.

Carry unwind hits TRY, RUB and ZAR

The reversal in international capital flows continue weighing on the EM currencies; Turkish lira, Russian ruble and South African rand are among the most hit since the week began. The Turkish lira has been the biggest EM looser against USD with 1.42% drop through the past three sessions. As the Fed normalization bets gain traction, the outflows from the EM can only intensify. As previously mentioned, the most UST-sensitive currencies (BRL, INR, IDR, TRY, ZAR and RUB) require particular attention.

As the Turkish 2-year yields rally above 9%, the 2-10 year spread flattens for the first time since May confirming the rising short-term tensions in Turkish markets. We expect further losses in lira walking into the first round of presidential elections in Turkey (Aug 10th). Traders should keep in mind the high event risk in addition to materializing carry risk.

In Russia, USD/RUB extends gains to 36.2928 for the first time since March; trend and momentum indicators are comfortably bullish. The critical resistance is eyed at 36.9029 (all time high). The South African Rand tests June-to-date trading band top, a break above the range top (10.8626, June 18th high) should open the way towards 11.00/40 year highs.

Today's Key Issues (time in GMT):

2014-08-07T11:00:00 GBP Bank of England Bank Rate, exp 0.50%, last 0.50%2014-08-07T11:00:00 GBP BOE Asset Purchase Target, exp 375B, last 375B

2014-08-07T11:45:00 EUR ECB Main Refinancing Rate, exp 0.15%, last 0.15%

2014-08-07T11:45:00 EUR ECB Marginal Lending Facility, exp 0.40%, last 0.40%

2014-08-07T11:45:00 EUR ECB Deposit Facility Rate, exp -0.10%, last -0.10%

2014-08-07T12:30:00 CAD Jun Building Permits MoM, exp -1.90%, last 13.80%

2014-08-07T12:30:00 USD Aug 2nd Initial Jobless Claims, exp 304K, last 302K

2014-08-07T12:30:00 USD Jul 26th Continuing Claims, exp 2512K, last 2539K

2014-08-07T14:00:00 CAD Jul Ivey Purchasing Managers Index SA, exp 53, last 46.9

2014-08-07T19:00:00 USD Jun Consumer Credit, exp $18.650B, last $19.602B

The Risk Today:

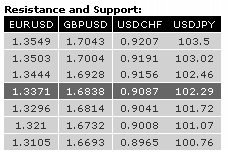

EURUSD EUR/USD made a bullish intraday reversal yesterday (hammer). Coupled with the proximity of the key support at 1.3296, the odds of a short-term rebound are increasing. Resistances stand at 1.3444 and 1.3503 (05/06/2014 low). An hourly can now be found at 1.3333 (06/08/2014 low). In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. The downside risk is given by 1.3210 (second leg lower after the rebound from 1.3503 to 1.3700). A strong support stands at 1.3296 (07/11/2013 low). A key resistance lies at 1.3549 (21/07/2014 high).

GBPUSD GBP/USD has thus far failed to break the hourly resistance at 1.6893 (see also the declining trendline), suggesting persistent selling pressures. Another resistance can be found at 1.6928 (intraday high). An hourly support lies at 1.6814. In the longer term, the break of the major resistance at 1.7043 (05/08/2009 high) calls for further strength. Resistances can be found at 1.7332 (see the 50% retracement of the 2008 decline) and 1.7447 (11/09/2008 low). A key support stands at 1.6693 (29/05/2014 low). We have updated the stop-loss of our long strategy.

USDJPY USD/JPY has broken the support at 102.36 (18/06/2014 high), suggesting further sideways move within the broad horizontal range between 100.76 and 103.02. An hourly support lies at 101.72 (see also the 61.8% retracement), whereas an hourly resistance can be found at 102.46 (05/08/2014 low). A long-term bullish bias is favoured as long as the key support 99.57 (19/11/2013 low) holds. However, a break to the upside out of the current consolidation phase between 100.76 (04/02/2014 low) and 103.02 is needed to resume the underlying bullish trend. Another resistance can be found at 104.13 (04/04/2014 high), while a major resistance stands at 110.66 (15/08/2008 high).

USDCHF USD/CHF has thus far failed to decisively break the hourly resistance at 0.9107. However, the short-term bullish momentum remains positive as long as the support at 0.9041 (01/08/2014 low) holds. Another support can be found at 0.9008. From a longer term perspective, the recent technical improvements call for the end of the large corrective phase that started in July 2012. The long-term upside potential implied by the double-bottom formation is 0.9207. Furthermore, the break of the resistance at 0.9037 calls for a second leg higher (echoing the one started on 8 May) with an upside potential at 0.9191. As a result, a test of the strong resistance at 0.9156 (21/01/2014 high) is expected.