“A new week, a new yearly high for the US dollar index” is a phrase that traders are growing accustomed to of late; indeed, it would have been a valid statement 10 of the last 14 weeks. While the Federal Reserve is far from outright hawkish, it appears likely that the US central bank will be the first major central bank to raise interest rates next year, and the resulting dollar strength has spilled over into emerging market FX as well. For this week, we wanted to look at three EM central bank decision and analyze how they could impact the currencies in question:

USD/PLN: Tough Decision Amidst Falling Inflation Data

Poland’s Monetary Policy Council (MPC) will conclude its regular meeting on Wednesday, and traders generally expect that the central bank will cut interest rates by 25bps to 1.75% to combat weak inflation (year-over-year CPI inflation has been negative over the last three months). In addition, the central bank will reveal its latest forecasts for growth and inflation with the decision, giving traders insight into the projected future path of monetary policy.

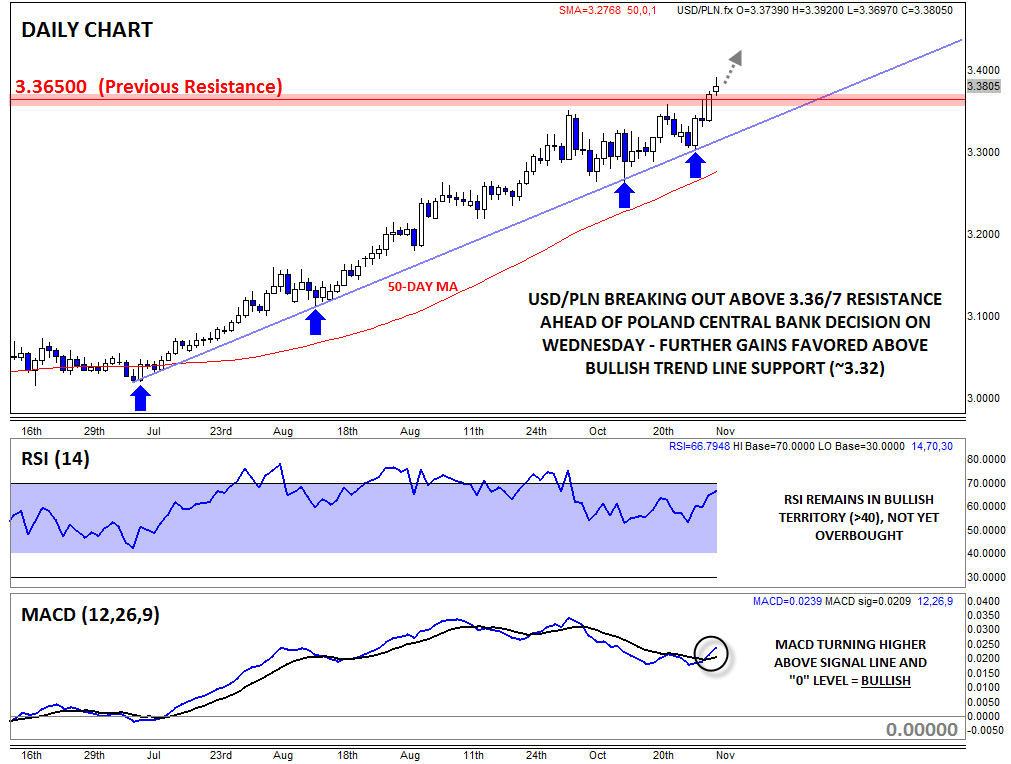

If Poland’s MPC cuts as expected, USD/PLN may extend its gains further this week. The pair is already at its highest level since mid-2012, and with the recent break above key resistance in the 3.36/7 area, rates may rise further toward 3.50 in time. Meanwhile, the RSI indicator remains in bullish territory and the MACD has turned higher back above its signal line again. As long as rates stay above previous resistance at 3.36/7 and the bullish trend line at 3.32, more strength is likely.

USDMXN: No Tricks or Treats from the Central Bank of Mexico

The Central Bank of Mexico (Banxico) left interest rates unchanged at 3.0% on Friday as widely expected, and issued a neutral policy statement with the decision. The central bank suggested that economy accelerated in the third quarter of the year, after a disappointing 1.7% growth in the first half of the year, and hinted that inflation should moderate toward its 3% target heading into next year.

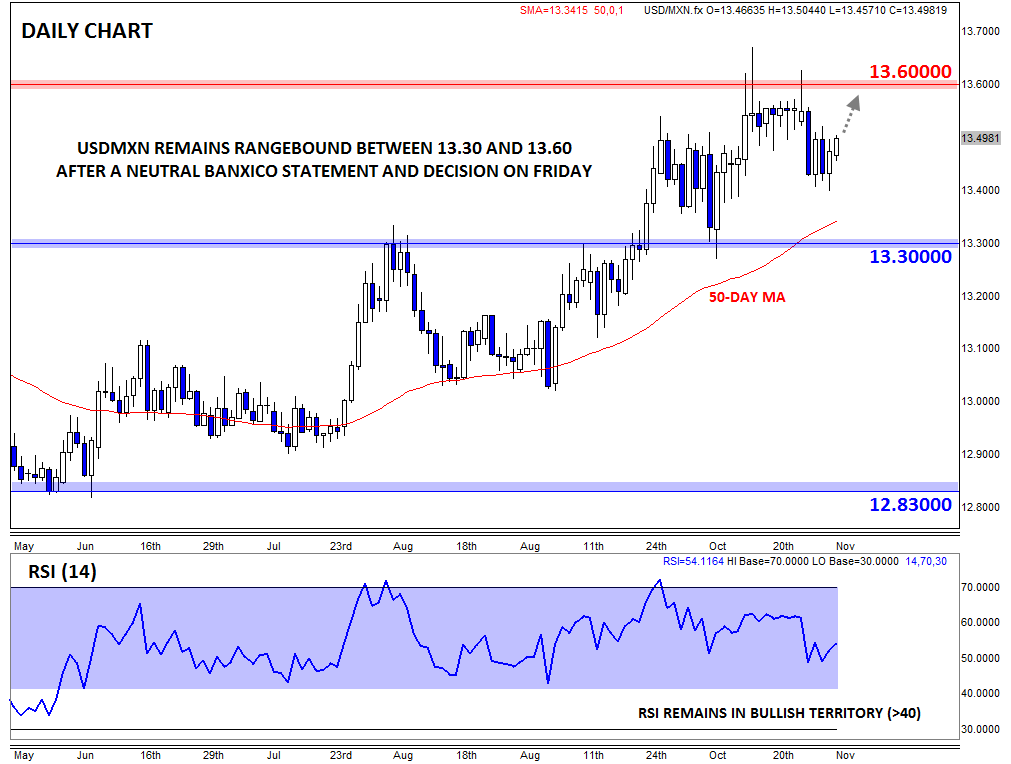

Because the decision was widely expected, there was little reaction in USD/MXN. The pair remains within its recent consolidation range from 13.30 to 13.60, where rates have been consolidating for over six weeks now. While the price action has not been particularly compelling of late, the peso’s relative resilience against the otherwise strong dollar bodes well for MXN bulls. Nonethless, the longer-term bias in USD/MXN remains to the topside for now, as the RSI is still in bullish territory (>40) and the rising 50-day MA is catching up with price.

USDRUB: CBR Unable to Stem the Ruble’s Bleeding

In an attempt to stem the unrelenting weakness in its currency, the Central Bank of Russia (CBR) hiked its policy rate by a larger-than-expected 150bps to 9.50% on Friday. The CBR cited rising inflation expectations as a result of the recent import ban on food and the collapsing ruble as the catalysts for the move. Though this action makes the ruble more attractive for traders from a longer-term perspective, it hints of panic among Russian policymakers, and traders have already driven the ruble back to its pre-CBR lows.

In the short term, there is still the distinct risk that the CBR could intervene more directly into the market to support the ruble, but from a purely technical basis, USDRUB’s outlook remains constructive. The pair remains above both of its recent bullish trend lines, and the secondary indicators continue to point toward further gains, with the RSI oscillating in and out of overbought territory and the MACD trending higher above its signal line and the “0” level. With USDRUB already at an all-time high, ruble bulls may be in for more pain in the short term.