KEY POINTS

- The divergence in EM and DM equities in 2013 was the first year since 1998

- That divergence has ended in 2014, and there has also been a great intra-EM divergence in returns

- Our equity model has delivered very good results this quarter in identifying equity outperformers, and moderate success in identifying the underperformers

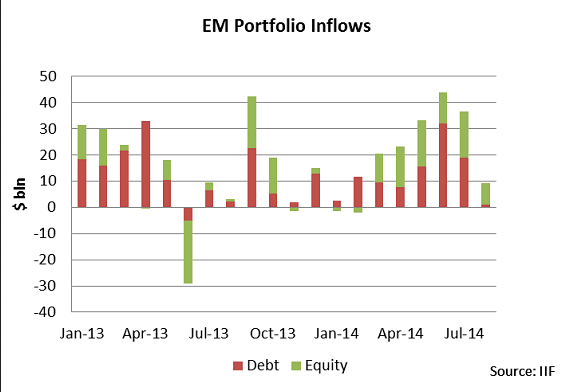

- Measures of capital flows suggest inflows into EM are continuing, albeit slowing a bit

- We think EM will continue to deliver solid returns, and remain cautiously optimistic

INTRODUCTION

EM assets have held up well since bottoming in January-February. Markets have digested ongoing tensions in Russia/Ukraine, heightened political risk in the Middle East, and an Argentine devaluation and default over the course of this year. Yet EM equities, bonds, and FX are for the most part firmer now than when 2014 began. Of course, there has been greater divergence amongst EM countries, with poor fundamentals weighing on several countries. This trend should continue into year-end.

EM and DM equities diverged in 2013, as MSCI EM (-5.1%) and MSCI DM (+23.7%) moved in opposite directions for the first year since 1998. This divergence ended in 2014, with MSCI EM up 8.1% YTD and MSCI DM up 5.3% YTD. Indeed, the trend for EM to typically outperform DM seems to be back in play after some DM outperformance earlier this year. We note that MSCI indices measure dollar returns, taking into account both equity and FX movements for dollar-based investors.

Within EM, we note that there has also been greater divergence of returns, continuing the trend that began in 2012 after two straight years of highly correlated EM returns. The standard deviation of MSCI country returns within EM was near 20 percentage points in both 2012 and 2013, the highest since 2009. However, this falls well short of the average standard deviation near 31 percentage points from 1996-2011. We think this trend of greater divergence will continue in both 2014 and 2015, as the standard deviation of returns has moved higher during the course of this year.

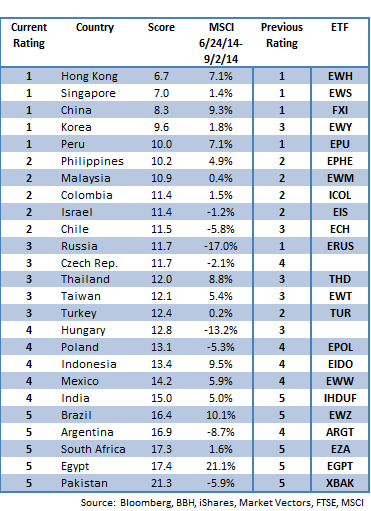

Our equity allocation model is meant to assist global equity investors in assessing relative sovereign risk and optimal asset allocation across countries in the EM universe. The countries covered include 20 of the 21 countries in the MSCI EM Index as well as 3 (Israel, Hong Kong, and Singapore) from the MSCI DM Index and 2 (Argentina and Pakistan) from the MSCI Frontier Markets Index.

A country's score reflects its relative attractiveness for equity investors – the likelihood that its equity market will outperform the rest of our EM universe over the next three months. A country’s score is determined as a weighted composite of 15 economic and political indicators that are each ranked against the other 24 in our model EM universe. Categories are industrial production growth, real interest rates, export growth, expected P/E ratio, real bank lending, current account, real money growth, GDP growth, investment, per capita GDP, inflation, retail sales, index of economic freedom, FDI, and ease of doing business.

A country that is typically ranked first in many of the categories will end up with a low composite score (the lower the better). Exchange rate fluctuations can have significant effects on the dollar return to foreign investors, and so we have chosen several variables that tend to highlight exchange rate risk. Others were chosen as leading indicators of economic growth.

MODEL PERFORMANCE SUMMARY

From 6/24/14 (our last quarterly model update) through today, the MSCI EM Index rose 3.5% while the MSCI DM Index rose 0.5%. Looking at regional EM performances, MSCI Asia rose 4.8% during this period, MSCI Latin America rose 6.9%, and MSCI EMEA fell -4.4%.

Looking at regional DM performance, MSCI US rose 2.8% during this period, MSCI Europe fell -6.7%, and MSCI Japan fell -1.4%.

Within our model universe of 25 EM countries, those five that were at the top of our rankings with a 1 rating (VERY OVERWEIGHT equity position) rose an average 5.3% during this period. Those with a 2 rating (SLIGHTLY OVERWEIGHT) fell an average -0.3%, while those with a 3 rating (NEUTRAL) fell an average -0.9%. This compares to an average gain of 0.4% during the same period for those with a 4 rating (UNDERWEIGHT) and an average gain of 3.5% for those with a 5 rating (VERY UNDERWEIGHT).

Thus, our equity model had fairly good results so far this quarter in identifying equity outperformers, and had a moderate success in identifying the underperformers. We do note that very strong performances for 4-rated Indonesia (up 9.5%) and 5-rated Egypt (up 21.1%) and Brazil (up 9.9%) helped skew the results up a bit on the bottom end. Without them, the 4- and 5-rated category returns would have averaged -1.9% and -4.4%, respectively.

Over the long run, our model has shown a consistent ability to pick winners and losers, and we believe that will be the case for the rest of 2014 and into 2015. We continue to think that investors will continue to differentiate within EM, favoring those countries with stronger fundamentals. This environment should make a fundamentally-based allocation model such as ours much more accurate in picking winner and losers.

FOREIGN EQUITY FLOWS IN 2014

According to the latest report by the IIF, portfolio investments in emerging markets slowed sharply in August after reaching a 2-year high in June. EM received $9 bln of inflows in August, down from an average of $38 bln per month in the May-July period. The drop primarily reflected a reversal of portfolio flows to EMEA, as well as a decline in (but still positive) flows to EM Asia and Latin America. This recent drop was also more pronounced in EM debt inflows, while EM equity inflows held up relatively better.

According to EM data from Bloomberg, the taiwan Taiwanese stock market has received the most investment from foreign accounts this year through September 2, with $13.25 bln of inflows. Next up is India with $13.0 bln of inflows (through September 1). The next favorite destinations (measured in absolute numbers) for foreign investors this year is South Korea ($8.8 bln through September 2), Brazil ($7.9 bln through August 28), and Indonesia ($4.8 bln through September 2), respectively. Mexico registered $6.5 bln of inflows through June 30 and is likely to be amongst the top destinations when Q3 inflows are included. Thailand is the only major EM country registering outflows this year at -$672 mln through September 2. Please note, however, that the sample of countries for which data is available and uniform by Bloomberg is very limited.

EM EQUITY OUTLOOK

We remain cautiously optimistic on EM for the remainder of this year. In light of recent EM outperformance over DM, we think that portfolio adjustments in 2013 that favored DM at the expense of EM have ended. Japan and Europe are struggling to grow, and this has weighed on their equity markets. We believe that the two indices should remain highly correlated in Q4 2014 and into 2015, and no longer diverging, but with EM continuing to outperform. EM equities have typically been a turbo-charged version of DM, and we seem to have moved back to this historical trend.

We continue to think that the biggest risk to EM ahead is that the Fed rate hike cycle will start earlier than the H2 2015 consensus. However, our base case remains that nothing will be done before mid-2015. Of course, we acknowledge ongoing negative headline risk from Ukraine/Russia, Iraq/Syria, and other hot spots, but EM has rebounded quickly from such events so far this year.

Under these assumptions, we still believe it will be very important for investors to continue focusing on the fundamentals. We continue to believe that countries with weak fundamentals and poor growth outlooks will suffer more this year. As such, we favor Asia and, to a lesser extent, Latin America, while EMEA should continue to underperform. Our 5-rated grouping for Q3 2014 consists of Brazil, Argentina, South Africa, Egypt, and Pakistan. Conversely, our 1-rated grouping for Q3 2014 consists of Hong Kong, Singapore, China, Korea, and Peru. Our next model update for Q4 2014 will come out at the beginning of October.

(from my colleagues Dr. Win Thin and Ilan Solot)