Market Brief

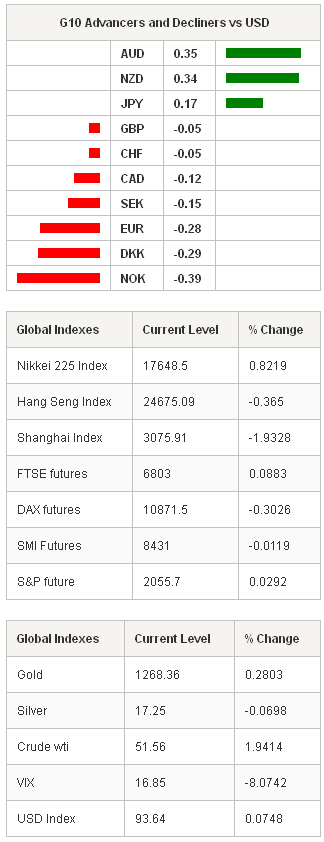

The overnight FX trading remained mostly ranged, stocks traded water except Shanghai’s Composite down to 3,052.939 on news that Hong Kong estimates Shanghai’s trading link quota would be filled by the end of the first quarter (Rts). USD/CNY gap-opened as PBoC’s Lei said this week’s RRR cut is not the beginning of a strong monetary stimulus. Given the macroeconomic conditions however, traders see further room for additional PBoC cuts to keep liquidity stable as growth concerns persist. Option bids trail above 6.20 before the closing bell.

USD/JPY and JPY crosses were mixed in Tokyo. USD/JPY sees resistance at 9-day Ichimoku conversion line (117.66), more offers are seen at 118.30/119.28 (baseline / cloud top). Option bets turn supportive above 119.40. On the downside, bids trail up from 117.00/25.

EUR/USD and EUR/JPY remain offered below their 21-dma (1.1495 / 135.38 respectively) as traders look to sell EUR-crosses on uncertainties regarding the Greek situation. The EUR/USD technicals are positive, yet decent option barriers are placed at 1.15+, if cleared should open the way to 1.1660/79 (Fibonacci 38.2% on December-January sell-off / Jan 21st high). The US jobs data should be determinant in direction before the week close, while EU-Greece tensions is the major downside risk to the short-term bullish push on both pairs.

The US labor data is the key event of the day. The January nonfarm payrolls are expected at 230K (vs. 252K last), the unemployment rate has likely steadied at 5.6% with slight improvement in average earnings. We have seen on latest data that the household spending has hard time picking up. This means that the weakness in the core PCE is partially due to low spending, and not only due to lower oil prices. Strong NFP reading today should keep Fed hawks hoping for the first Fed rate hike to happen by 2H, 2015; the sovereign curve steepens with 10-year yields back above 1.80%.

The high-beta currencies continue recovering. USD/CAD retreats below 1.2500 as oil markets recover. AUD/USD tests 0.7850 (post-RBA double top), while NZD/USD prepares to step in short-term consolidation zone for a daily close above 0.7451 (MACD pivot). The USD appetite in the afternoon will be important as the Fed is seen diverging from the expansive monetary policies in Canada, Australia and New Zealand.

Else, USD/BRL spiked to 2.7620 (fresh 10-year high) as the Petrobras corruption scandal keeps flows away from Brazil besides the broadly limited EM appetite pre-US jobs. USD/ZAR tests January-February down-trending base (11.25) with decent option barriers at 11.40 supportive of deeper short-term ZAR correction should the US prints no-surprise data.

Besides the US jobs, traders watch German and Spanish December Industrial Production m/m & y/y, French December Trade & Budget Balance ytd, Swiss January Foreign Currency Reserves, Swiss December Retail Sales y/y, Swedish January Budget Balance and Average House Prices, Norway December Industrial and Manufacturing Production m/m & y/y, UK December Trade Balance, US January Nonfarm Payrolls, Unemployment and Participation rate, Average Earnings m/m & y/y, Canadian January Unemployment and Participation rate and Employment Change and US December Consumer Credit.

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| GE Dec Industrial Production SA MoM | 0.40% | -0.10% | EUR / 07:00 |

| GE Dec Industrial Production WDA YoY | -0.30% | -0.50% | EUR / 07:00 |

| FR Dec Budget Balance YTD | - | -90.8B | EUR / 07:45 |

| FR Dec Trade Balance | -3300M | -3236M | EUR / 07:45 |

| SZ Jan Foreign Currency Reserves | - | 495.1B | CHF / 08:00 |

| SP Dec Industrial Output NSA YoY | - | -0.10% | EUR / 08:00 |

| SP Dec Industrial Output SA YoY | 0.30% | 0.00% | EUR / 08:00 |

| SZ Dec Retail Sales Real YoY | - | -1.20% | CHF / 08:15 |

| SW Jan Budget Balance | - | -100.7B | SEK / 08:30 |

| SW Jan Average House Prices | - | 2.397M | SEK / 08:30 |

| NO Dec Industrial Production MoM | - | -1.90% | NOK / 09:00 |

| NO Dec Industrial Production WDA YoY | - | 4.20% | NOK / 09:00 |

| NO Dec Ind Prod Manufacturing MoM | -0.30% | -0.40% | NOK / 09:00 |

| NO Dec Ind Prod Manufacturing WDA YoY | - | 4.00% | NOK / 09:00 |

| UK Dec Visible Trade Balance GBP/Mn | -£9100 | -£8848 | GBP / 09:30 |

| UK Dec Trade Balance Non EU GBP/Mn | -£3000 | -£2649 | GBP / 09:30 |

| UK Dec Trade Balance | -£1700 | -£1406 | GBP / 09:30 |

| IT Bank of Italy Report on Balance-Sheet Aggregates | - | - | EUR / 10:00 |

| CA Dec Building Permits MoM | 5.00% | -13.80% | CAD / 13:30 |

| US Jan Change in Nonfarm Payrolls | 230K | 252K | USD / 13:30 |

| CA Jan Unemployment Rate | 6.70% | 6.60% | CAD / 13:30 |

| US Jan Two-Month Payroll Net Revision | - | - | USD / 13:30 |

| CA Jan Net Change in Employment | 5.0K | -4.3K | CAD / 13:30 |

| US Jan Change in Private Payrolls | 228K | 240K | USD / 13:30 |

| CA Jan Full Time Employment Change | - | 53.5 | CAD / 13:30 |

| US Jan Change in Manufact. Payrolls | 12K | 17K | USD / 13:30 |

| CA Jan Part Time Employment Change | - | -57.7 | CAD / 13:30 |

| US Jan Unemployment Rate | 5.60% | 5.60% | USD / 13:30 |

| CA Jan Participation Rate | 65.7 | 65.9 | CAD / 13:30 |

| US Jan Average Hourly Earnings MoM | 0.30% | -0.20% | USD / 13:30 |

| US Jan Average Hourly Earnings YoY | 1.90% | 1.70% | USD / 13:30 |

| US Jan Average Weekly Hours All Employees | 34.6 | 34.6 | USD / 13:30 |

| US Jan Underemployment Rate | - | 11.20% | USD / 13:30 |

| US Jan Change in Household Employment | - | 111 | USD / 13:30 |

| US Jan Labor Force Participation Rate | - | 62.70% | USD / 13:30 |

| US Dec Consumer Credit | $15.000B | $14.081B | USD / 20:00 |

Currency Tech

EUR/USD

R 2: 1.1660

R 1: 1.1530

CURRENT: 1.1448

S 1: 1.1364

S 2: 1.1224

GBP/USD

R 2: 1.5486

R 1: 1.5381

CURRENT: 1.5320

S 1: 1.5251

S 2: 1.5140

USD/JPY

R 2: 119.32

R 1: 117.66

CURRENT: 117.31

S 1: 116.66

S 2: 115.86

USD/CHF

R 2: 0.9500

R 1: 0.9347

CURRENT: 0.9233

S 1: 0.9170

S 2: 0.8936