Despite Musk speaking out against Trump before the election, potential fans were shocked by the sudden support of Tesla’s CEO of the new US Secretary.

Elon Musk could face difficulties after reports claimed that he seemed to support an administration that completely opposed clean energy, considering he has been a solid advocate of energy conservation, reduction of carbon emission and the American’s dependency on fossil fuels.

With Musk’s determination to pursue a clean energy with his electric-car company Tesla Motors Inc (NASDAQ:TSLA). and solar-power firm SolarCity Corp, he has won a legion of fans, in which most of them opposes President Donald Trump.

Many of Musk’s fans were shocked after he publicly endorsed Rex Tillerson, Trump’s nominee for Secretary of State, despite publicly speaking out against the President’s candidacy.

It seemed that Musk has certainly changed his tune after he said “Trump is probably not the right guy” before the election.

Tesla’s Next Earnings Release Going Near-Term

All eyes are on Tesla Motors Inc.’s next earnings release scheduled on February 8, 2017 for the period ending on December 31, 2016. Sell-side analysts are expecting the electric carmaker company to post a quarterly earnings per share (EPS) of $-1.09.

Meanwhile, the company posted an EPS of $-1.29 for the same quarter prior year, while it recently posted an EPS of $0.14. Analysts are expecting the company to post a consensus estimate of $-1.14 prior to the last earnings report.

Tesla Motors, Inc. VP John Douglas Field sold around 1,000 shares of the company’s stock in a transaction made on January 10th, with an average price of $228.61, totaling to $228,610.00.

After the transaction, the vice president currently owns about 15,433 shares of the company’s stock, valuing at $3,528,138.13. The sale was disclosed in a form 4 filing with the Securities and Exchange Commission (SEC).

Shares of Tesla Motors, Inc. traded at 229.59 on Friday’s session. The stock’s 50-day moving average price stood at $201.12, while its 200-day moving average price hit $207.26. It has a 52-week low of $141.05 and a 52-week high of $269.34, with a market cap of $34.41 billion.

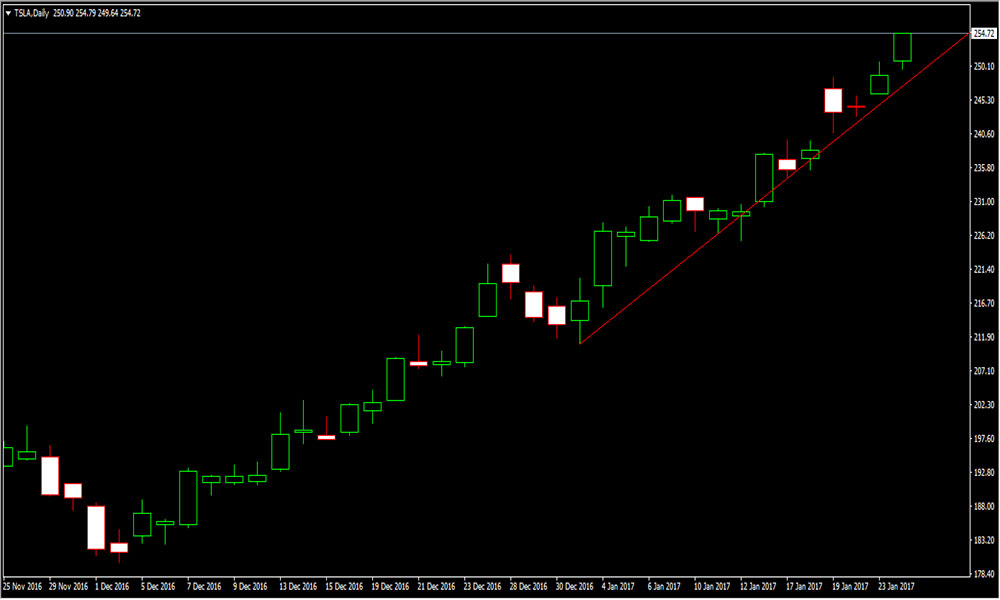

The chart below illustrates the stock price movement before the electric carmaker’s next earnings results.

A confirmation trend is currently testing support 234.18, in which the stock stood slightly away from its support level. Additionally, the RSI break through above 70 level, which could give a signal for the stock to decline as it hit the overbought level and valued at 84.2956.

Conclusion

Given that investors and analysts are likely to watch Tesla Motors, Inc.’s next earnings release, it is expected that shares could decline as the RSI has already reached the overbought level or consolidate.

In essence, Musk could face difficulties with potential investors after he showed support for the new US secretary of state. It could also lead to such arguments and assess Musk’s leadership over the company’s stability.

So far, investors are recommended to close current positions as the market is anticipated to become volatile during the earnings release.