Ellomay Capital Ltd (NYSE:ELLO) is a renewable power and energy infrastructure company currently undertaking significant new development projects. 9M17 results showed significant EBITDA growth (+23% y-o-y), mostly reflecting an increase in solar production thanks to the normalisation in weather conditions. We expect 2018 to be a key year for project delivery as our revised forecasts point to very strong profit growth (EBITDA up 80% y-o-y), mainly driven by the commissioning of two new biogas projects in the Netherlands and full contribution from the solar PV acquisition in Israel. We see project delivery as the main catalyst for the stock.

2017 to show strong operating profit pick-up…

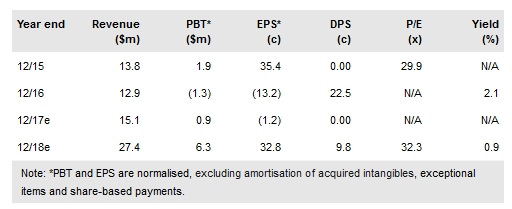

Ellomay's latest results (9M17) showed significant growth in EBITDA (+23% y-o-y), mainly reflecting the normalisation in solar PV production in Italy and Spain following unfavourable weather conditions in 2016. At the bottom line, the net loss of $3.6m was mainly the result of a one-off negative impact from revaluation of derivatives and exchange rate differences. Overall, after updating our FX assumptions (reflecting a recent move in the US$ vs €), 9M17 results and updated expectations re timing of growth projects, we forecast $10m FY17 EBITDA (company definition; +33% y-o-y) and a net loss of $3.3m. At the same time, we raise our 2017-20 EBITDA estimates by c 4-16%.

To read the entire report Please click on the pdf File Below: