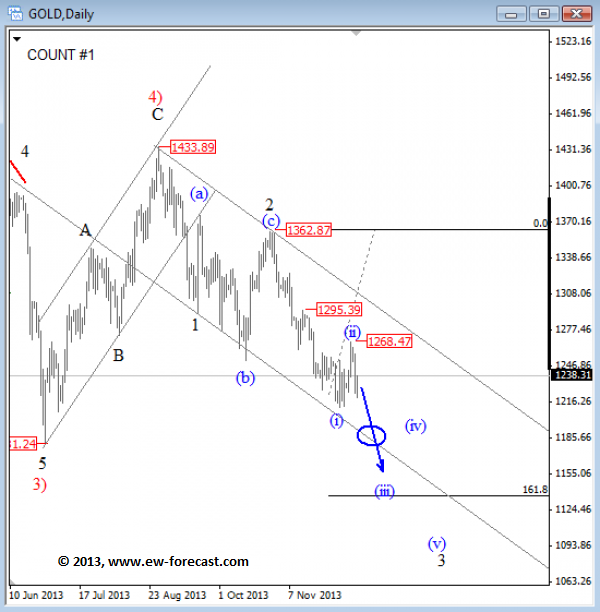

Gold reversed sharply to the downside at the start of September, through the rising trend line of a corrective channel. As we know that's an important signal for a change in trend, which means that bearish price action is now back in play which is accelerating for the last couple of weeks from 1362 so we think that market is moving down in wave 3 that could reach 1130 region in the next few weeks. From a short-term perspective a break of 1210 opens door for 1180. On the other hand, if 1268 is broken then bearish reversal could be seen from second resistance placed at 1295.

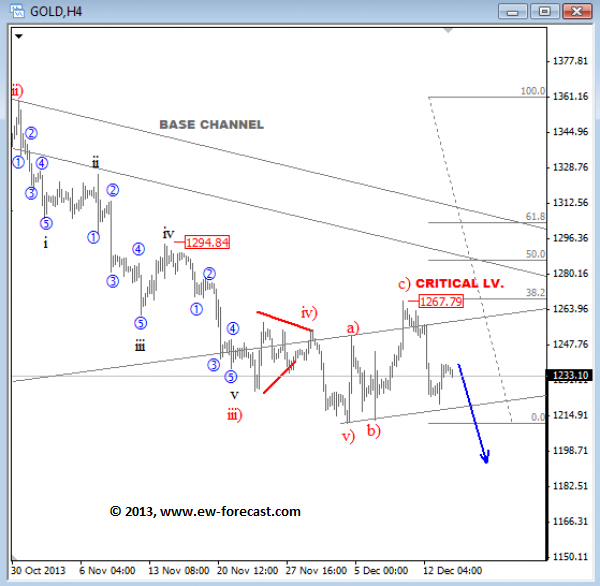

On 4h Chart Gold has made recovery only in three legs, labeled as a)-b)-c). We know that three wave move is structure of a corrective price action that now appears complete after recent sharp fall from 1267. Decline has unfolded impulsively so we believe that is part of a larger downtrend, heading through 1201 and possibly back to 1180.