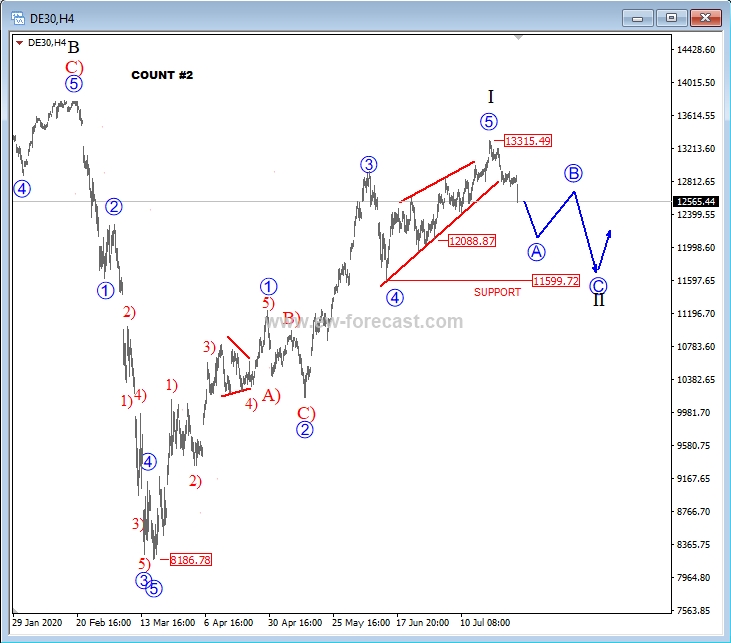

German DAX has made a very strong recovery from March lows, however, this recovery can now be slowing down based on two interpretations we are observing. The first one shows a potential flat correction in the making for wave II, where we are looking for a five-wave fall into wave C even back towards 1600 level. Then we have another wave count, count #2, that shows a potential top formation in wave 5 of I. This is also a bearish interpretation for the near future, as deeper, thee-wave A, B, C set-back could show up.

At the same time, let us also mention that market is turning down from above 13300 with minor five legs, breaking below the trend line connected from June lows, so traders should be careful and be aware of a risk-off.

From a long to mid-term perspective we think that there will be opportunities on the long side on the stock market, but best is to wait on lower, better prices.

German DAX, 4h

German DAX, 4H (count #2)