The euro has been declining against its Japanese counterpart for years. Most recently, it fell to 114.43 on May 6th. However, a recovery has been in progress for the past three weeks. Earlier today, EURJPY reached a high of 118.96, up over 450 pips from the bottom.

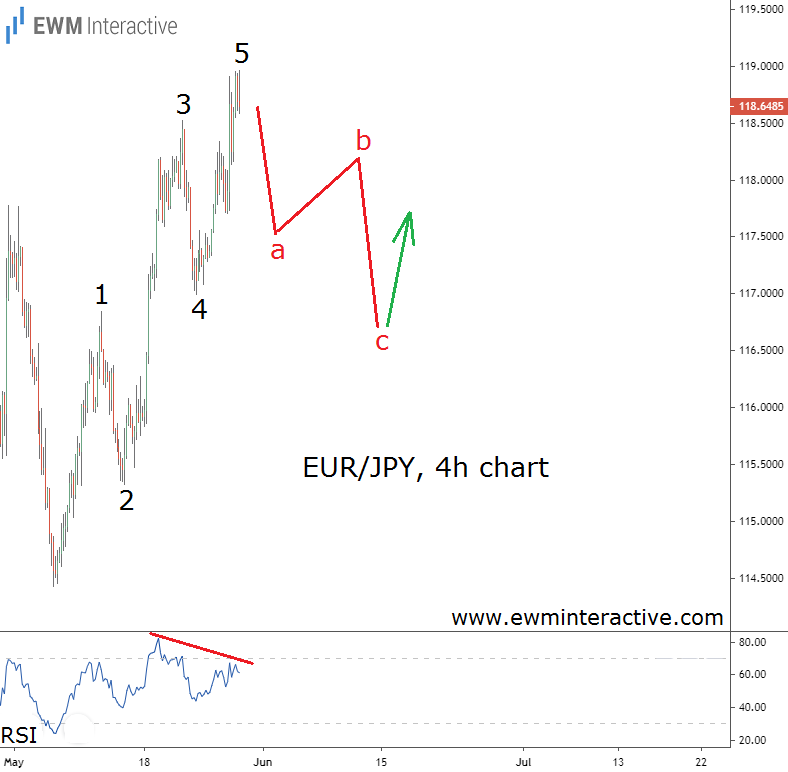

Can the rally continue and is the current level of ~118.60 appropriate for more bulls to join? These are the question we hope to answer with the help of the Elliott Wave principle. The chart below allows us to examine the structure of the recent rally.

As visible, EURJPY’s surge looks like a textbook five-wave impulse pattern, labeled 1-2-3-4-5. Wave 4 came very close to the top of wave 1, but stayed above it nonetheless, not violating the rules. According to the theory, a three-wave correction follows every impulse.

So, if this count is correct, we can expect a decline to roughly the support area of wave 4. This means EURJPY can drop to 117.00 or slightly lower before the bulls return. Another reason not to go long right away is the bearish RSI divergence between waves 3 and 5. Much better buying opportunities should present themselves near the lows of wave ‘c’ of the anticipated correction.