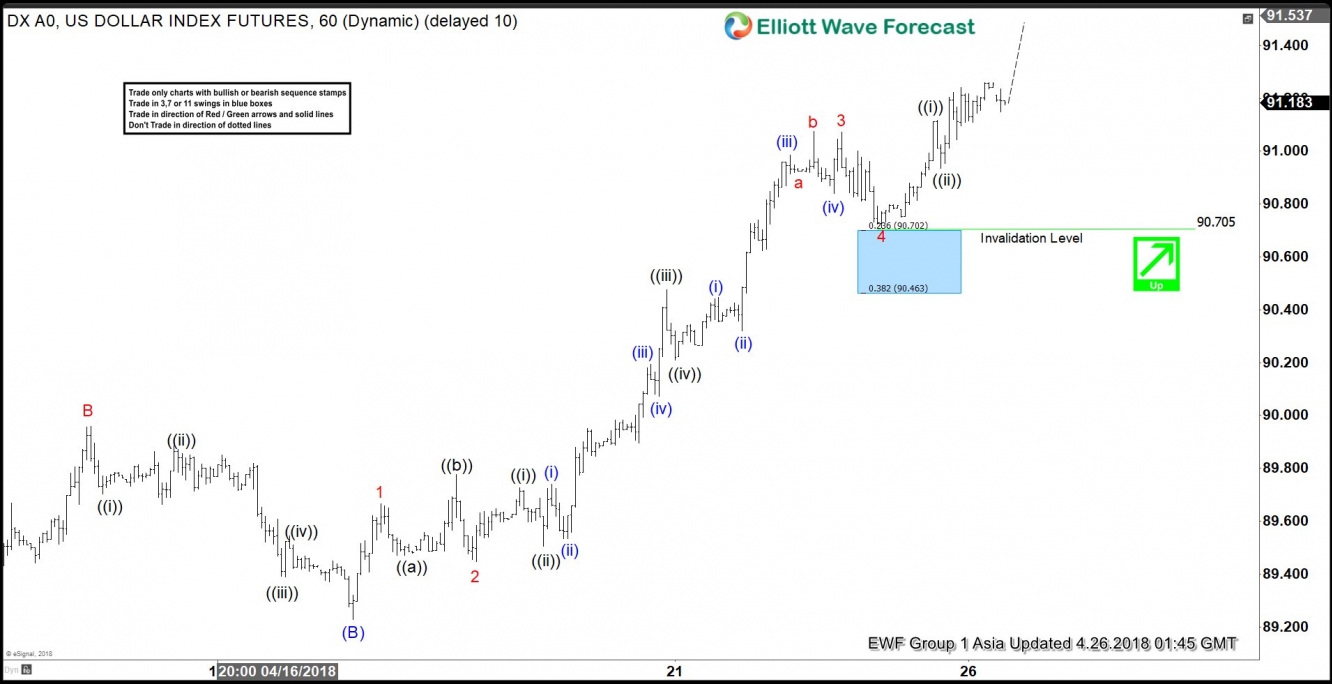

USDXElliott Wave view in short-term cycle suggests that the decline to 89.22 low on 4.17.2018 ended as a Zigzag correction in Intermediate wave (B). Above from there, the rally is unfolding as 5 waves Impulse Elliottwave structure looking to extend higher 1 more leg in Minor wave 5 at least before ending the 5 waves structure. Above from 89.22 low, Minor wave 1 ended at 89.66, Minor wave 2 ended at 89.45 low, and Minor wave 3 ended at 91.07. The internal of Minor wave 3 also unfolded as an impulsive sequence where Minute wave ((i)) ended at 89.72. Minute wave ((ii)) ended at 89.51, Minute wave ((iii)) ended at 90.47 high, Minute wave ((iv)) ended at 90.21 low, and Minute wave ((v)) of 3 ended at 91.07.

Down from there, Minor wave 4 pullback ended at 90.70 low. The Index then started Minor wave 5 of (C) higher with the completion of Minute wave ((i)) at 91.11 and Minute wave ((ii)) at 90.94. The index has reached the minimum number of swings to call the cycle from 4.17 low ended, but while trading above 90.70 low, index has scope to see some more upside towards 91.61-92.24 area before ending the 5 waves rally from 4.17 low. Afterward, the index should react lower in minimum 3 swings at least. We don’t like buying it.

USDX 1 Hour Elliott Wave Chart