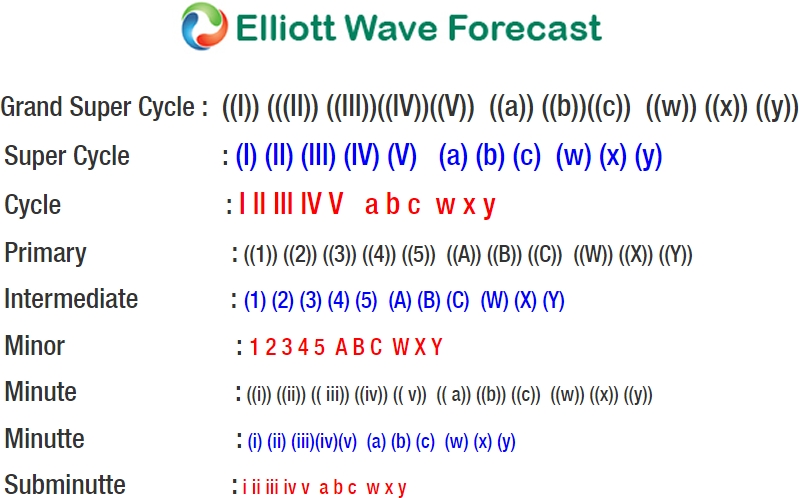

Short Term Elliott wave View suggests USD/JPY is correcting cycle from 2/2 peak (110.5) as an Expanded Flat Elliott Wave Structure. Flat is a corrective Elliott Wave structure with ABC label, and it has a subdivision of 3-3-5. In the case of USDJPY, Minor wave A ended at 197.9 on Feb 21 and Minor wave B ended at 105.23 on March 2.

Up from 105.23, Minor wave C rally is currently in progress as a diagonal 5 waves Elliott Wave structure. Minute wave ((i)) of C ended at 106.46, Minute wave ((ii)) of C ended at 105.43, Minute wave ((iii)) of C ended at 107.05, and Minute wave ((iv)) of C is expected to complete at 105.81 – 106.24 area. Near term, while pullbacks stay above 105.43, expect pair to extend higher towards 107.29 – 107.68 to end Minute wave ((v)) of C. The last push higher in Minute ((v)) of C should also complete Minor wave X and end correction to the cycle from 2/2 peak. Afterwards, pair should resume the decline or at least pullback in 3 waves to correct the 5 waves diagonal rally from 105.23 low.

USD/JPY 1 Hour Elliott Wave Chart