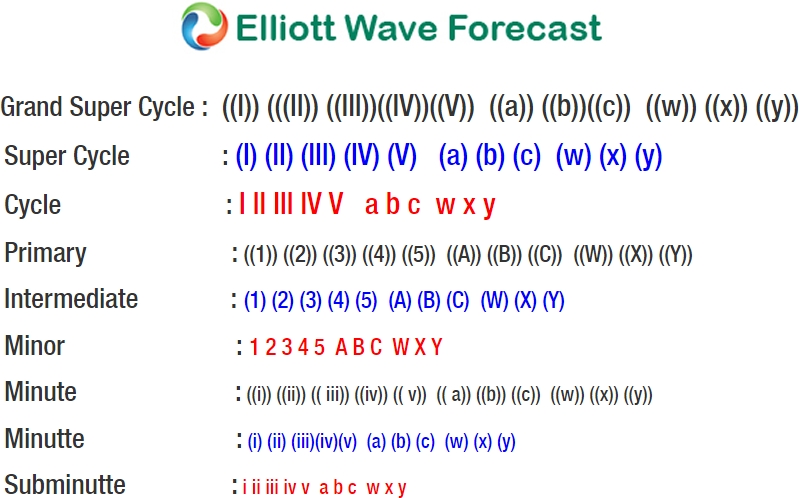

USD/JPY Short-term Elliott Wave view suggests that the rally to 110.48 high ended Intermediate wave (4) bounce on February 02.2018 peak. Below from there, the decline is unfolding as an Ending Diagonal Structure within Intermediate wave (5) lower. Where Minor wave 1 ended at 108.44 low as Zigzag structure, Minor wave 2 bounce ended at 109.77 in a Double three correction. Currently, Minor wave 3 remain in progress in a Double three correction, where internals of each leg is unfolding as Elliott Wave Zigzag pattern.

Where Minutte wave ((w)) ended at 108.03 low, Minute wave ((x)) ended at 108.87. Below from there Minute ((y)) of wave 3 remains in progress as zigzag structure. When Minutte wave (a) ended in 5 waves at 107.39 low and Minutte wave (b) ended at 107.89. Near-term cycle from 2/08 high (109.77) is mature already in Minor wave 3 lower after reaching blue box area (as shown on Chart). And pair can now start the Minor wave 4 bounce anytime soon in 3, 7 or 11 swings. However within the shorter-term cycles pair could extend lower towards 106.39-105.47 100%-161.8% Fibonacci extension area of (a)-(b) within ((y)) of 3 lower before a bounce in Minor wave 4 takes place. We don’t like buying the pair and as far as a pivot from 2/08 high 109.77 holds the wave 4 bounce should get rejected in 3, 7 or 11 swings for further downside extension in Minor 5 of (5) lower.

USD/JPY 1 Hour Elliott Wave Chart