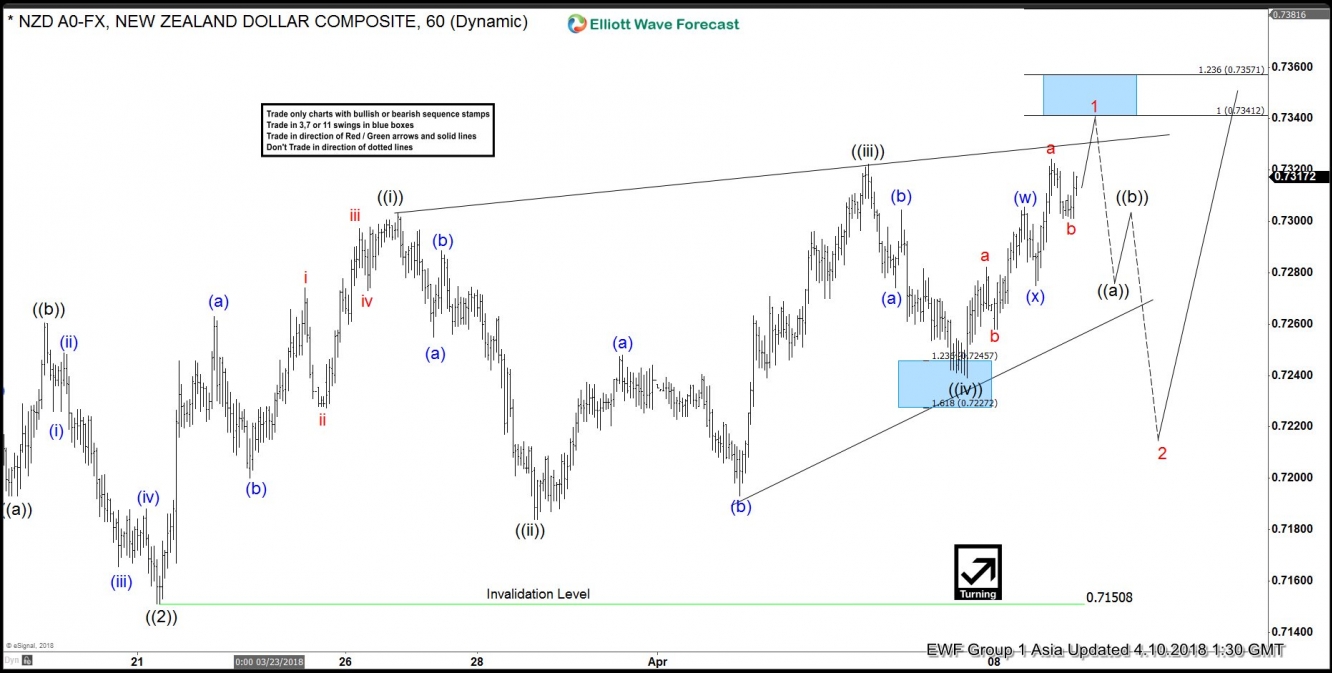

NZDUSD short term Elliott Wave view suggests that the decline to 0.715 low on March 21 ended Primary wave ((2)). Primary Wave ((3)) is in progress as a 5 waves where wave 1 of ((3)) is unfolding as a 5 waves diagonal Elliott Wave structure. A 5 waves diagonal is different than 5 waves impulse in that the subdivision of wave 1, 3, and 5 in diagonal is in 3 waves, instead of 5 waves in impulse. Up from 0.715 low, Minute wave ((i)) ended at 0.7303, Minute wave ((ii)) ended at 0.7184, Minute wave ((iii)) ended at 0.7322, and Minute wave ((iv)) ended at 0.7239.

In the case of NZD/USD, we can see the internal of Minute wave ((i)), ((iii)), and ((v)) have subdivision of 3 waves. For example, the internal of Minute wave ((i)) unfolded as a 3 waves corrective Elliott Wave structure called zigzag where Minute wave (a) ended at 0.7263, Minute wave (b) ended at 0.72, and Minute wave (c) of ((i)) ended at 0.7303. The internal of Minute wave ((iii)) also unfolded as 3 waves corrective Elliott Wave structure called a Flat. Up from 0.7303, Minute wave (a) ended at 0.7248, Minute wave (b) ended at 0.7193, and Minute wave (c) of ((iii)) ended at 0.7322. Finally, internal of Minute wave ((v)) also unfolded in 3 waves where Minute wave (w) ended at 0.7305, Minute wave (x) ended at 0.7275, and Minute wave (y) of ((v)) is in progress to 0.734 – 0.735.

Once pair reaches 0.734 – 0.7357, it should complete Minor wave 1 diagonal and end cycle from 3.21.2018 low (0.715). Pair should then pullback in Minor wave 2 in 3, 7, or 11 swing to correct cycle from 3.21.2018 low before the rally resumes. We don’t like selling the pair and expect Minor wave 2 decline in the pair to find buyers in 3, 7, or 11 swing as far as pivot at 0.715 stays intact.

NZD/USD Elliott Wave 1 Hour Chart