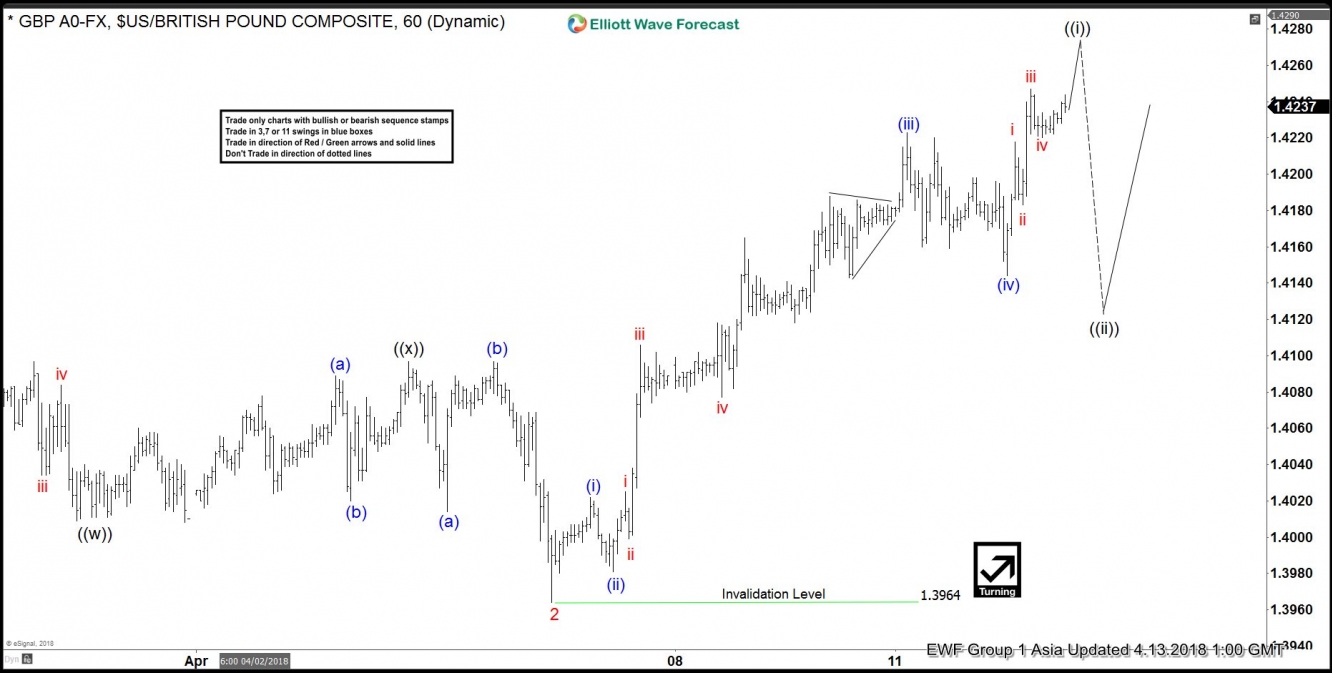

GBP/USD Short Term Elliott Wave view suggests that the rally from 3.1.2018 low (1.371) is unfolding as a 5 waves impulse Elliott Wave Structure. Up from 3.1.2018 low, Minor wave 1 ended at 1.4245 and Minor wave 2 ended at 1.3964. Pair has since broken above Minor wave 1 at 1.4245, suggesting that the sequence from 3.1.2018 low is bullish and the next leg higher in Minor wave 3 has started. Minor wave 3 is in progress with internal subdivision as 5 waves impulse of lower degree. Up from 1.3964, Minutte wave (i) ended at 1.4022, Minutte wave (ii) ended at 1.3981, Minutte wave (iii) ended at 1.422, and Minutte wave (iv) ended at 1.4144.

Pair has scope to do another minor leg higher to complete Minutte wave (v). This next leg higher should also complete Minute wave ((i)) of a higher degree. Afterwards, it should pullback in Minute wave ((ii)) in 3, 7, or 11 swing to correct cycle from 4/5 low before the rally resumes. We don’t like selling the proposed pullback and expect pair to find support in the pullback in 3, 7, or 11 swing as far as pivot at 4/5/2018 low at 1.3964 stays intact.

GBP/USD Elliott Wave 1 Hour Chart