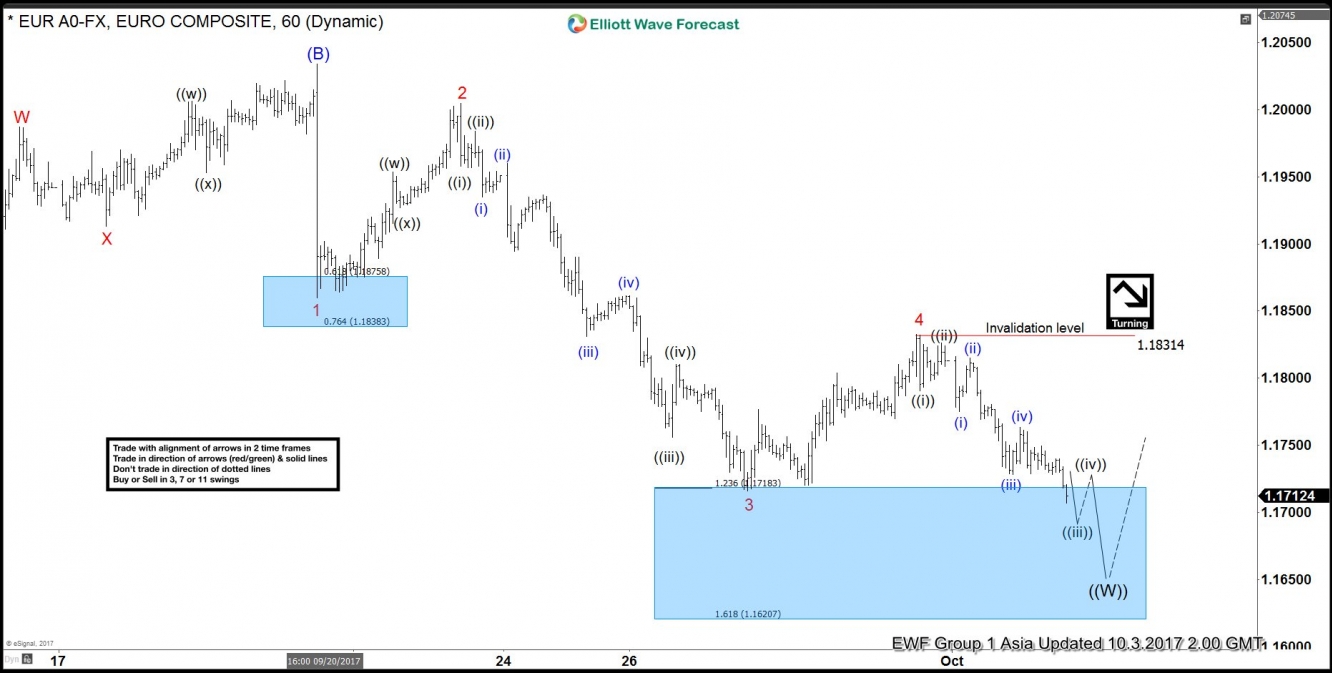

EUR/USD Short Term Elliott Wave view suggests that the decline from 9/8 peak is unfolding as an expanded Flat Elliott Wave structure. Down from 9/8 high (1.2094), Intermediate wave (A) ended at 1.1837 and Intermediate wave (B) ended at 1.2034. Intermediate wave (C) is in progress as 5 waves. Minor wave 1 of (C) ended at 1.186, and bounce to 1.2 ended Minor wave 2 of (C). Down from there, Minor wave 3 of (C) ended at 1.1716, and bounce to 1.1832 ended Minor wave 4 of (C). Minor wave 5 of (C) remains in progress and can reach as low as 1.16207. This area will also complete Primary wave ((W)) and end cycle from 9/8 peak. Afterwards, pair should bounce within Primary wave ((X)) to correct cycle from 9/8 peak in 3, 7, or 11 swing before turning lower again.

Alternatively, if pair extends below 1.16207, then the entire move lower from 9/8 high could be labelled as 5 waves impulse. In this case, the current decline will only end Intermediate wave (3). Then pair should bounce in Intermediate wave (4) before the decline resumes again.

EUR/USD 1 Hour Elliott Wave Chart