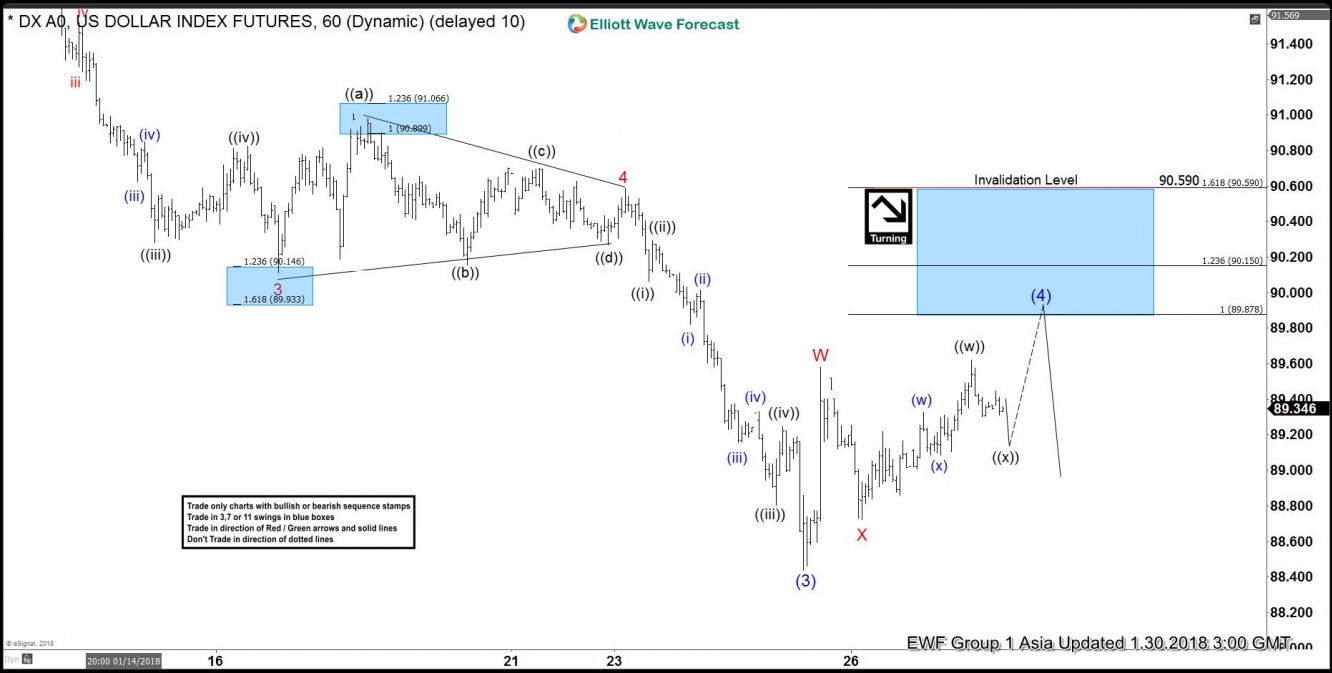

US Dollar Index Short Term Elliott Wave view suggests that decline to 88.44 ended Intermediate wave (3). Up from there, Intermediate wave (4) bounce is unfolding as a double three Elliott Wave structure where Minor wave W ended at 89.58 and Minor wave X ended at 88.723. Minor wave Y is in progress with Minute wave ((w)) ended at 89.619 and while Minute wave ((x)) pullback stays above 88.723, Index should extend higher in Minute wave ((y)) of Y towards 89.88 – 90.59 area. The rally should also complete Intermediate wave (4) and Index should then resume the decline lower or at least pullback in 3 waves. We don’t like buying the proposed bounce and expect sellers to appear in the above area for at least a 3 waves pullback.

DXY 1 Hour Elliott Wave Chart