Bitcoin was trading above $7400 on Wednesday morning, following a recovery from as low as $5880. Crypto investors hoped the rally will continue, but they could not predict that just a few hours later Goldman Sachs will say it is abandoning its plans to establish a cryptocurrency trading desk, citing the ambiguous regulatory environment as a reason for its decision.

Just like a rabbit hearing a strange noise from the bushes, Bitcoin traders rushed to sell now and ask questions later. As a result, the price of the largest virtual currency plunged sharply to $6253 earlier today, losing over 15% or roughly $1150 per coin in less than 24 hours.

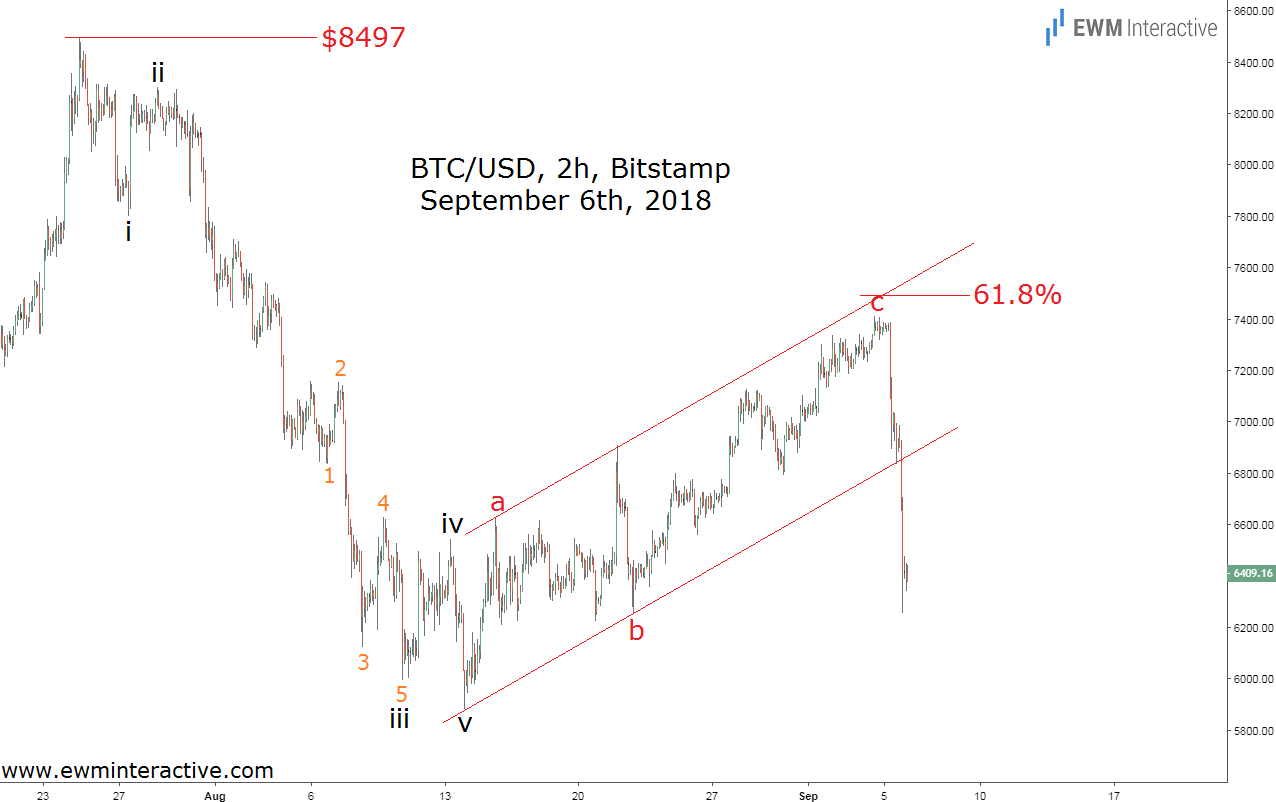

While hardly anyone could have predicted that Goldman will scrap its plans for a crypto trading desk, the following selloff was not such a huge surprise to Elliott Wave analysts, whose attention is always focused on the price charts and not on what some institution says or does. The chart below was sent to our clients on Wednesday morning, while Bitcoin was still near $7370.

Instead of waiting for some kind of news to move the markets, Elliott Wave practitioners look for recognizable patterns to help them stay ahead of the next major price swing. The chart above revealed an impulsive decline from $8497 to $5880, labeled i-ii-iii-iv-v, followed by a three-wave a-b-c recovery up to $7412. According to the theory, once this 5-3 wave cycle was complete, the trend was supposed to resume in the direction of the five-wave sequence. In addition, the price was approaching the resistance cluster formed by the upper line of the corrective channel and the 61.8% Fibonacci level, giving us another reason to expect a bearish reversal soon. What happened next was startling only to those unaware of the Elliott Wave pattern.

BTC/USD started crashing almost immediately so wave “c” could not even make it to the 61.8% level. Goldman’s decision to abandon its crpytocurrency trading desk triggered a selloff, which was supposed to happen anyway, because the Elliott Wave stage was already set for it.

It is important to make a difference between a reason and a catalyst. Here, Goldman Sachs (NYSE:GS) provided the catalyst, but the real reason for the plunge was the bearish Elliott Wave setup. Being aware of this difference saves traders the trouble to worry about catalysts. If the wave count is correct, a catalyst should eventually confirm it, even though you can never know what that catalyst will be exactly.