The two market-leading weight loss/obesity drugs (GLP-1), Zepabound (Eli Lilly (NYSE:LLY)) and Wegovy (Novo Nordisk (NYSE:NVO)), just completed a clinical side-by-side trial. After 72 weeks of testing on 750 obese or overweight adults with at least one medical problem, Eli Lilly came out ahead by a substantial margin. Per Eli Lilly:

Zepabound provided a 47% greater relative weight loss compared to Wegovy® (semaglutide). On average, Zepbound led to a superior weight loss of 20.2% compared to 13.7% with Wegovy.

The head-to-head test results are a big win for Lilly. The size of the global GLP-1 market is expected to grow significantly over the coming years. Accordingly, the GLP-1 that people think is the most effective will benefit the most. Current sales of all GLP-1 drugs are estimated at approximately $50 billion.

Future estimates vary widely. UBS, for instance, forecasts the market will eclipse $125 billion by 2029. MarketsandMarkets thinks it could reach $471 billion by 2032, or a compounded growth rate of 33.2%. More competition is coming but Eli Lilly has a clear leg up on the competition. As shown below, the market has been betting on Lilly (LLY) for quite a while. Over the last five years, it has risen about twice as much as Novo Nordisk (NVO-ADR).

Disclaimer: We own Eli Lilly (LLY) in our equity models.

What To Watch Today

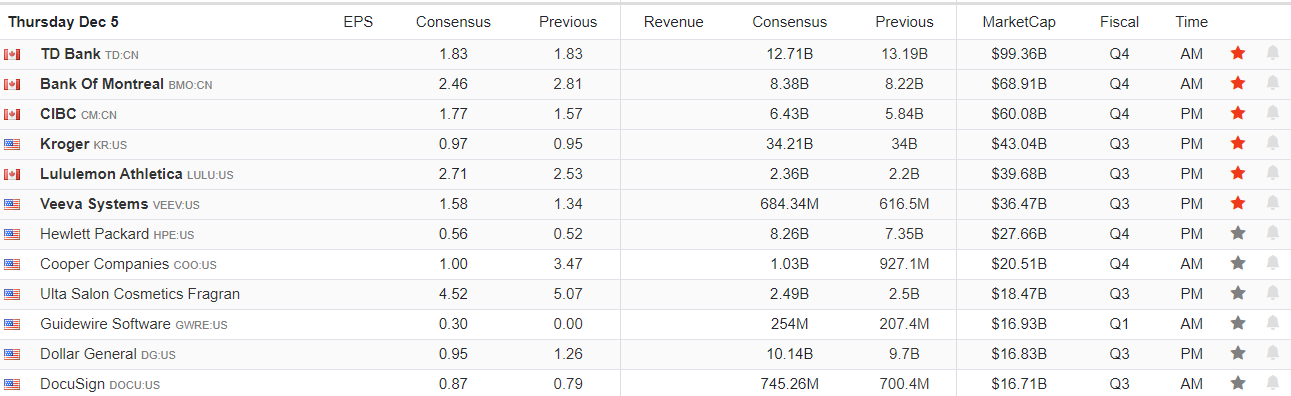

Earnings

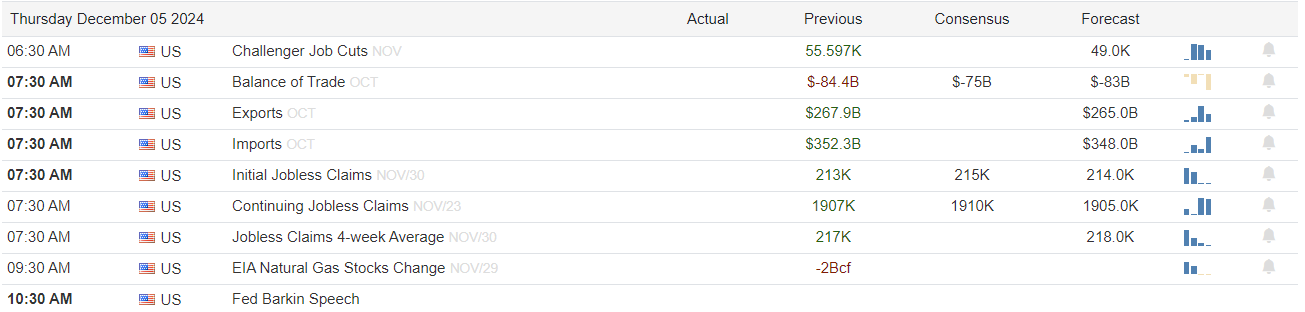

Economy

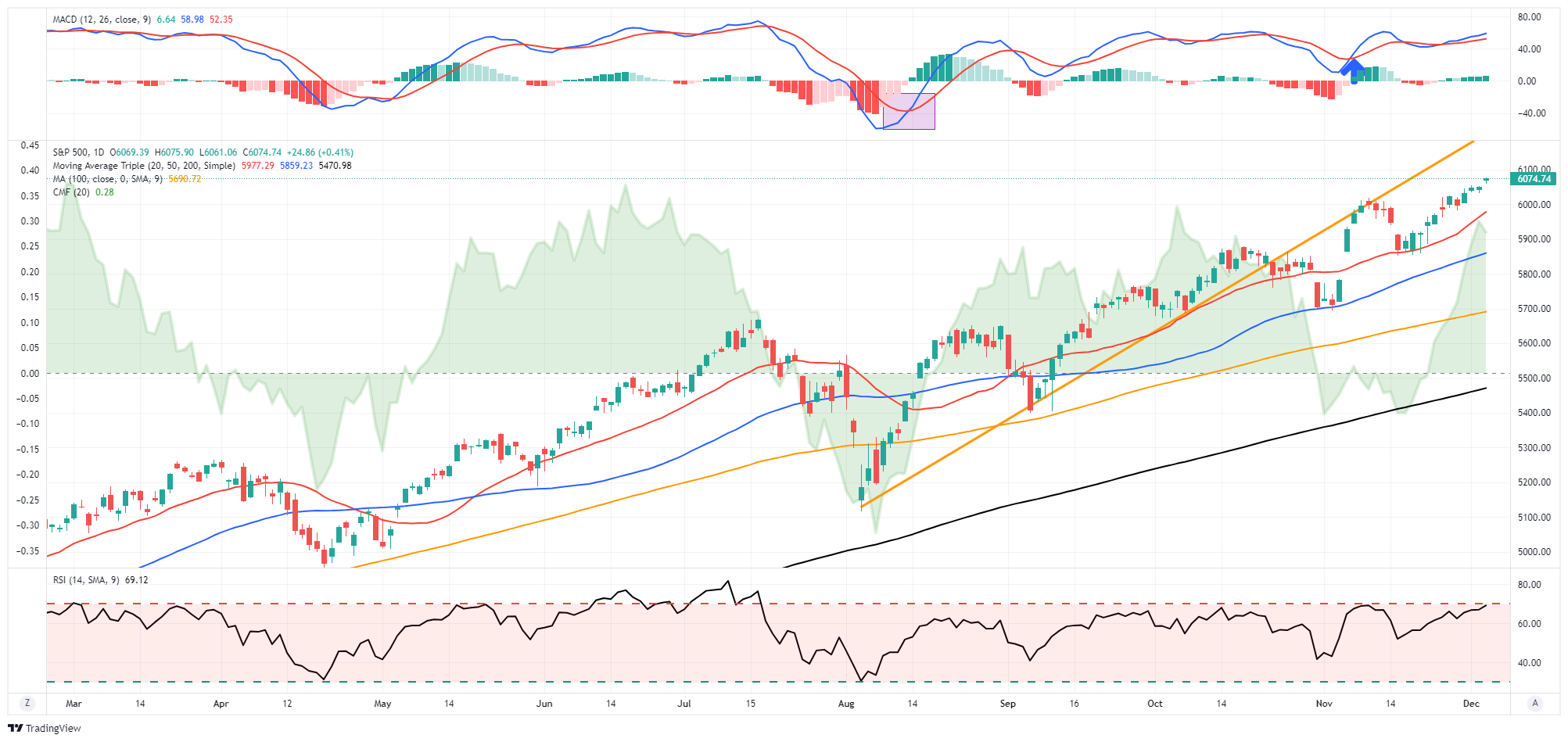

Market Trading Update

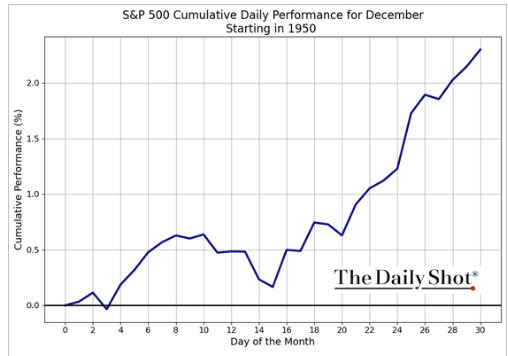

As discussed yesterday, the market remains on a very bullish trajectory. However, it is becoming short-term overbought at a point in the monthly cycle that is normally weaker.

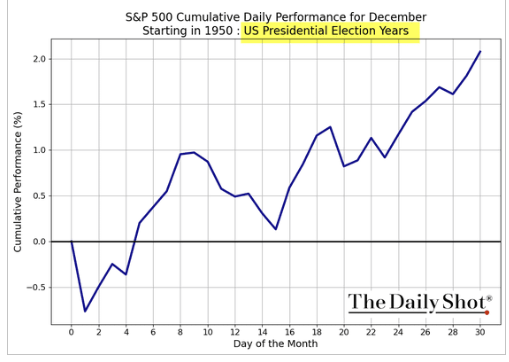

As shown, in both the average monthly cycle and the average Presidential election year, the market tends to weaken mid-month as mutual funds make their annual distributions.

With the short-term overbought conditions, a pullback to the 20-DMA is likely due. However, it is not out of the question the market could test the 50-DMA. Such weakness does not last long and usually subsides by mid-month as portfolio managers begin to window-dress for year-end reporting. It is also worth noting that allocation-based portfolio managers will need to significantly rebalance given the outperformance of stocks and underperformance of bonds. Such could be one catalyst for a deeper correction to the 50-DMA. Such rebalancing could also boost bond performance.

As always, we have no idea what will occur. We are just making assumptions based on history and market tendencies. We suggest continuing to monitor your levels of risk relative to your goals and adjust accordingly. With the market up strongly this year, it is always worth locking in some gains today against those future goals. The market has a long history of taking away those gains when investors least expect it.

Trade accordingly.

ADP Slumps Yet Musalem Favors Patience

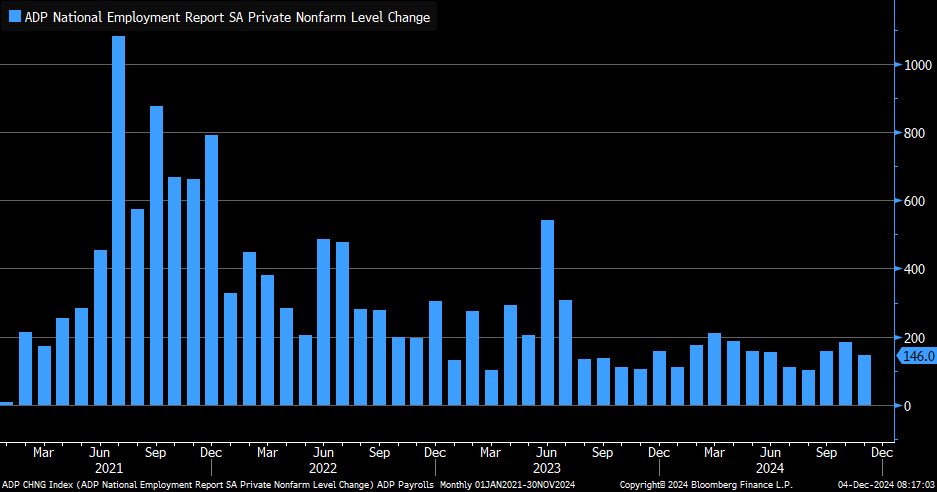

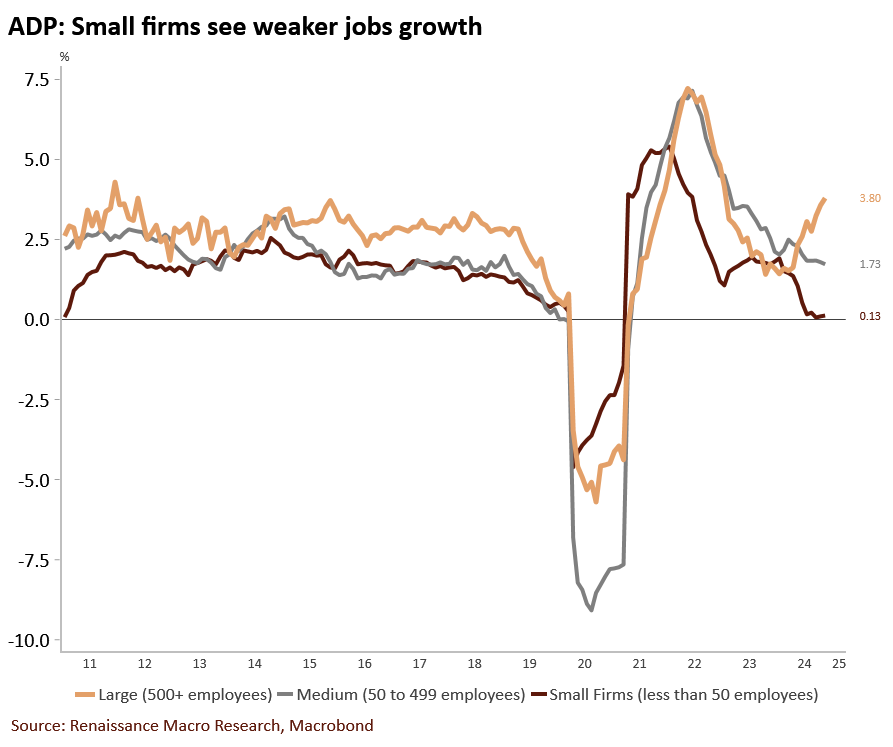

ADP was slightly weaker than expected at 146k versus estimates of 165k. However, last month’s figure was revised lower by 49k jobs. The graph below shows that ADP employment has varied but been consistent between 125k and 200k. The BLS data has been much more volatile.

Furthermore, the BLS data has been revised to a much larger extent than ADP. The second graph below shows that small and medium-sized businesses continue to see weakening trends. To wit, small business payrolls fell by 17k, the fourth decline in the last five months. This is likely a function of higher interest rates having a much more significant impact on smaller companies.

Despite the weaker ADP data, St. Louis Fed President Alberto Musalem said he favors a “patient” approach to monetary easing. It appears his thoughts are based on inflation running higher than 2% and less so on the labor markets. While he does see more rate cuts, he thinks a pause at the December meeting may be reasonable. Currently, the Fed Funds futures market is pricing in a 75% chance the Fed cuts rates at the December 18th meeting.

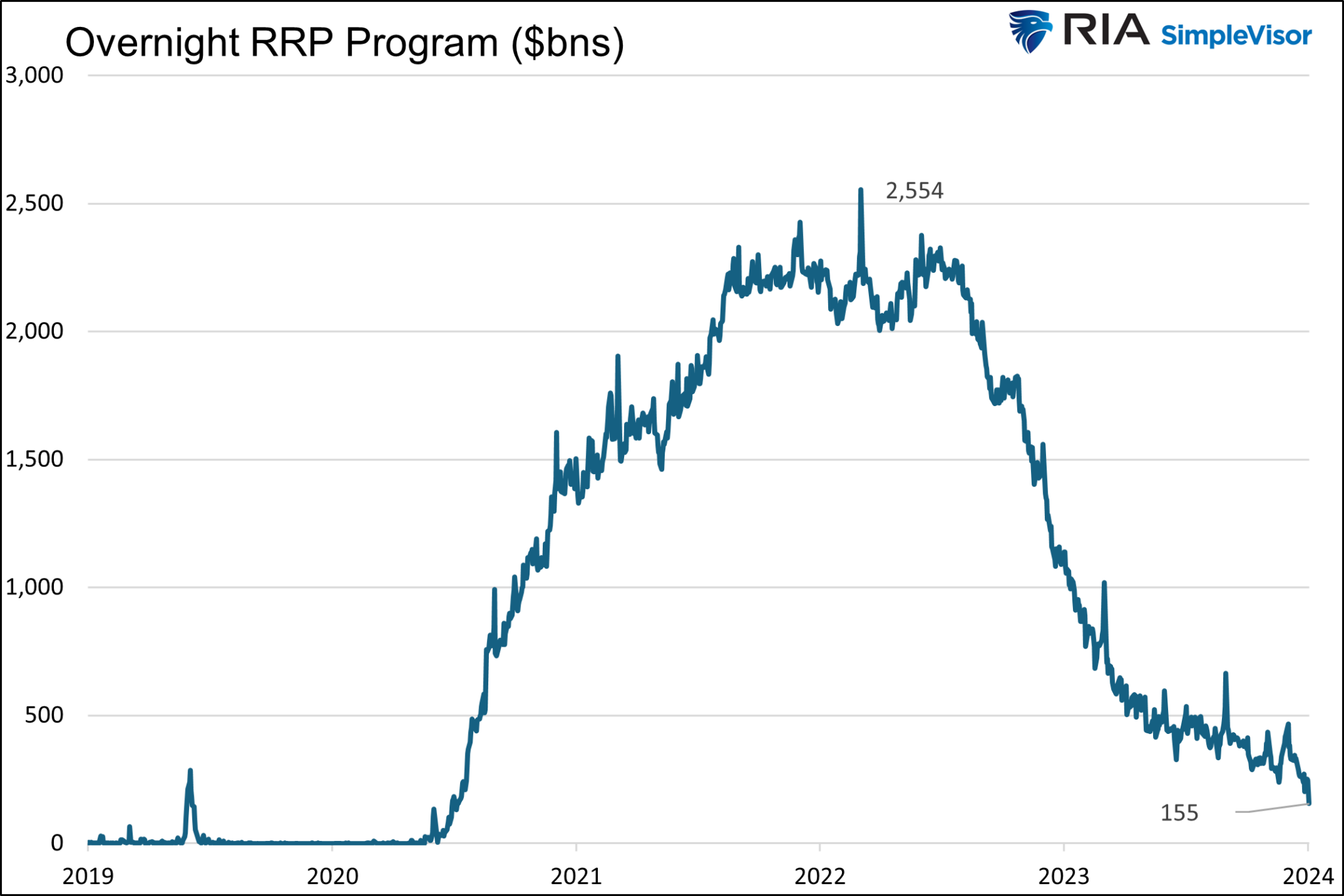

2019 Redux: Is Another Liquidity Crisis Near?

Might another market liquidity event be on the horizon? While there is generally good liquidity in the financial system, there are some nascent signs that problems could arise. A liquidity shortfall can have meaningful market impacts since asset prices rely heavily on liquidity. Liquidity problems lasting more than a few days typically require the Fed to inject liquidity into the financial system to stabilize it.

Investors and traders, aware of the liquidity situation, are often rewarded handsomely for frontrunning the inevitable Fed response. Therefore, let’s review the current liquidity status in the financial system and harken back to 2019 to appreciate the potential timing for a liquidity shortage and, equally importantly, consider how the Fed may react to such a problem.

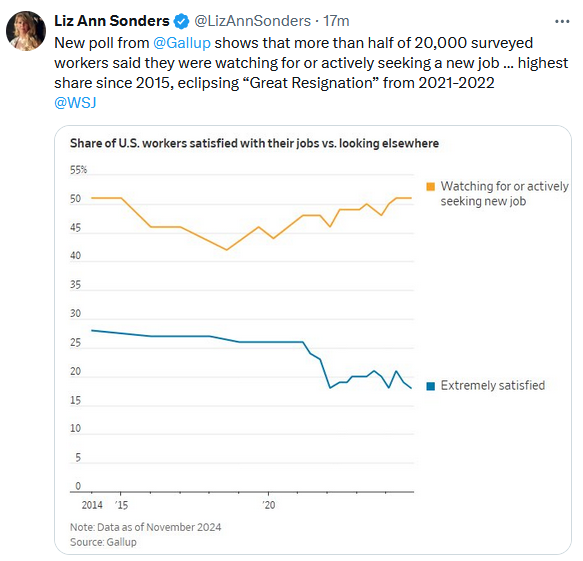

Tweet of the Day