After its repeated warnings about an interest rate hike this year, the Federal Reserve now finds itself with one last chance to save face. If, as we expect, the Fed hikes in December, the U.S. dollar should strengthen because an increase in the fed funds rate is not fully priced in by markets. One thing that could force the Fed to remain in pause mode, however, is an unexpected shock that creates financial market stress. The upcoming elections provide potential for such an event unfolding. If the days following Brexit are any guide, the U.S. dollar could do well even under such a scenario, supported by safe haven flows.

The European Central Bank and Bank of Japan both seem unable to stimulate their respective stagnant economies. Absent further debasement policies, the euro and yen may not depreciate all that much from here.

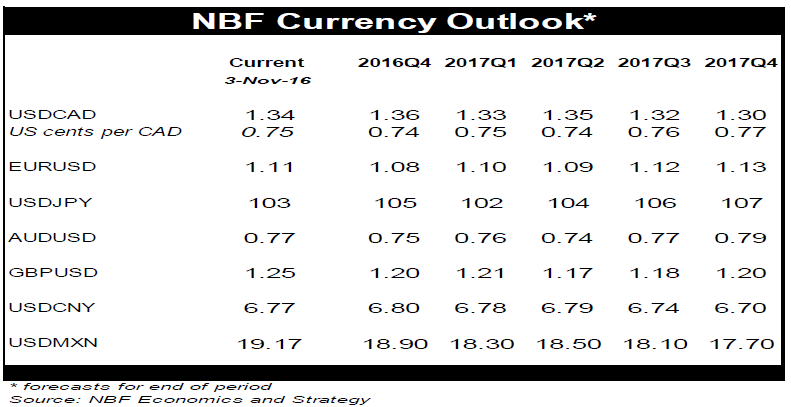

The Canadian dollar lost ground against the USD for a fourth consecutive month, despite higher oil prices in October. Already under pressure from a surging greenback ─ courtesy of rising odds of Fed rate hikes before year-end ─, the Canadian currency also has to contend with the Bank of Canada’s increasingly dovish rhetoric. Those headwinds should keep the loonie grounded over the near to medium term. We continue to expect USDCAD to trade in the 1.30-1.40 range over the next 12 months.

To read the entire report Please click on the pdf File Below