Electronic Arts Inc. (NASDAQ:EA) is set to report first-quarter fiscal 2018 results on Jul 27. In the previous quarter, the company posted a negative earnings surprise of 4.92%. On an average, EA has delivered a positive earnings surprise of 25.04% in the last four quarters.

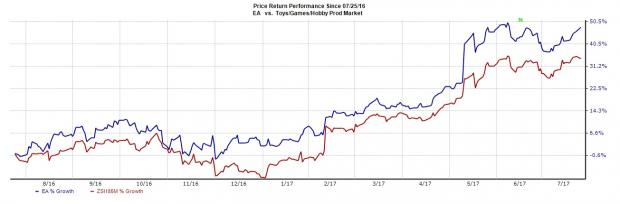

In the last one year, EA has posted a return of 47.9% compared with the industry’sgain of 34.4%.

Let’s see how things are shaping up for this quarter.

Factors at Play

We believe that EA’s popular franchises like Star Wars and Battlefield; EA Sports titles like FIFA and NFL; and strength in digital business, especially mobile, are key growth catalysts..

Management expects the “live services components” of the franchises to emerge as a big growth driver.Ongoing cost-optimization initiatives are also expected to cushion the company’s top-line performance in the to-be-reported quarter.

For the upcoming results, the company expects GAAP revenues of $1.425 billion. Net revenues will increase 10% year over year to $750 million driven by titles like Battlefield 1, Ultimate Team and Mass Effect Andromeda. Change in deferred revenues will be a negative $675 million. The company projects earnings per share of $1.93.

However, the hit-driven nature of the video game industry and stiff competition from other game makers such as Activision Blizzard Inc. (NASDAQ:ATVI) and Glu Mobile Inc. (NASDAQ:GLUU) remain major concerns.

Earnings Whispers

Our proven model does not conclusively show that EA will beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: EA has an Earnings ESP of -7.14%. This is because the Most Accurate estimate stands at 13 cents whereas the Zacks Consensus Estimate is pegged higher at 14 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: EA currently carries a Zacks Rank #3. Although a Zacks Rank #1, 2 or 3 increases the predictive power of ESP, the company’s negative ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stock to Consider

Here is one stock that, as per our model, has the right combination of elements to post an earnings beat this quarter.

Cypress Semiconductor Corp (NASDAQ:CY) has an Earnings ESP of +11.11% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.See these stocks now>>

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Electronic Arts Inc. (EA): Free Stock Analysis Report

Glu Mobile Inc. (GLUU): Free Stock Analysis Report

Original post

Zacks Investment Research