Election poll pushes NZD higher

- The kiwi dollar spiked higher yesterday, following the release of an opinion poll regarding New Zealand’s upcoming General election on the 23rd of September. The poll showed the incumbent National Party being very safely ahead, something that may have come as a surprise considering that most polls suggest an extremely tight race between the National and Labour parties.

- If the outcome is indeed very close, as the majority of opinion polls suggest, then one of these two main parties may have to form a coalition with the populist New Zealand First party, which advocates anti-immigration and protectionist policies. In our view, any potential coalition that includes NZ First could weigh notably on NZD, considering that protectionist policies would likely hurt the nation’s trade-focused economy.

- So far, the NZD has surged on polls showing the National Party being safely ahead, and declined on polls showing Labour gaining popularity. We believe this may have occurred mainly because a Labour victory could imply a Labour-NZ First coalition that renegotiates trade deals such as the Trans-Pacific Partnership (TPP), something Labour stated is likely to do. Any future polls that show the National Party being safely ahead could support NZD further, on speculation that the status-quo will be maintained. On the other hand, signs that Labour could win and perhaps even form a coalition with NZ First, could raise the likelihood for protectionist policies and thereby, weigh on the currency.

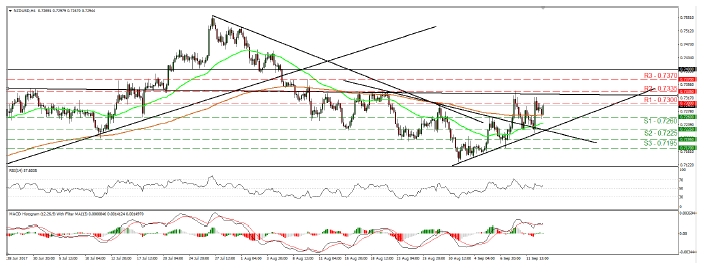

- NZD/USD surged during the European morning Tuesday, after it hit support at 0.7225 (S2), near the prior downside resistance line drawn from the peak of the 21st of August. In our view, the pair shows signs of a short-term trend reversal, from a downtrend to an uptrend. However, we would like to see a clear break above the 0.7335 (R2) resistance before we get confident on more bullish extensions. Such a move could initially aim for the 0.7370 (R3) barrier, where another break is possible to pave the way for the key territory of 0.7400.

UK inflation accelerates; focus turns to wage data

- Yesterday, both the headline and the core UK CPI rates for August rose by more than anticipated, enhancing speculation for a near-term BoE rate hike and pushing sterling even higher. The probability for a hike by year-end now rests at 50% according to the UK OIS. In our view, this development places even more emphasis on the labor market data for July we get today. The consensus is for the unemployment rate to have held steady at 4.4%, while average weekly earnings (both including and excluding bonuses) are anticipated to have accelerated.

- Coming on top of firming inflation, a potential acceleration in wages could heighten further expectations for a more hawkish tone by the BoE when it meets tomorrow, and perhaps raise the odds for more than 2 MPC members voting for a hike. Something like that could bring the pound under renewed buying pressure.

- GBP/USD surged yesterday after data showed that UK inflation accelerated. The pair rebounded from near 1.3160 (S3) and subsequently, it broke above the resistance (now turned into support) barrier of 1.3270 (S1), marked by the peak of the 3rd of August. On the 4-hour chart, we still see a short-term uptrend and thus, we believe that the break above 1.3270 (S1) may have opened the way for our next hurdle of 1.3360 (R1).

- As for the bigger picture, the rate continues to trade above the medium-term upside support line taken from back at the low of the 7th of October. Actually, the latest recovery started after the rate rebounded from that line. This is another point enhancing our view that the rate could continue trading north for a while, perhaps until it tests the long-term downside resistance line, drawn from the peaks of July 2014.

As for the rest of today’s highlights:

- Besides the UK employment data, there are lots of second-tier indicators on the calendar today. Germany’s final CPI for August, Eurozone’s industrial production for July, and the US PPI figures for August are all coming out.

- We have only one speaker on the agenda: EU Commission President Jean-Claude Junker. He will speak before the EU Parliament and he is expected to lay out the EU’s priorities for the upcoming year. With the theme of potential EU reforms currently in the spotlight after the French elections and ahead of the German ones, Junker’s comments could raise some eyebrows, should he address the subject.

- Support: 0.7260 (S1), 0.7225 (S2), 0.7195 (S3)

- Resistance: 0.7300 (R1), 0.7335 (R2), 0.7370 (R3)

GBP/USD

- Support: 1.3270 (S1),1.3225 (S2), 1.3160 (S3)

- Resistance: 1.3360 (R1), 1.3450 (R2), 1.3500 (R3)