The U.S. dollar fell against several of the majors as risk appetite improved subsequent to the first day of testimony by the Federal Reserve’s Chairwoman, Janet Yellen, during which she spoke to lawmakers in a positive tone about the U.S. economy. Mrs. Yellen suggested that the speed of economic recovery will determine how fast the central bank trims stimulus. Investors nonetheless shied away from haven currencies, thereby bolstering risk assets. The greenback also weakened as the Fed Chairperson intimated that turmoil in the emerging markets won’t pose a problem to the U.S. economy, a factor that gave investors some relief. Meanwhile, a hike in gold prices raised speculation that demand may decline. Gold Futures traded mixed, staying close to a recently reached three-month high then retreating as market traders gauged the future for U.S. monetary policy. Contracts for April delivery settled at $1,289.50 a troy ounce on the Comex during New York’s morning hours, after surging to $1,294.40 on Tuesday.

The euro slumped for a second consecutive day versus the greenback as Benoit Coeure, a board member from the european Central Bank, suggested that policy makers may consider implementing a negative deposit rate. Mr. Coeure added that the central bank isn’t worried about the low rate of inflation and that he hopes it will inch higher towards 2 percent. The euro also traded lower against the British pound and the yen as economic reports revealed that Factory Production went down by more than analysts had anticipated. The British pound sustained another day of gains versus the greenback as the Bank of England issued its report on Inflation, which pointed to the strength of the U.K.’s economic recovery. Policy makers offered forward guidance, stating that they won’t increase the interest rate until solid evidence of progress for unemployment, wages and production is seen. Such progress is not expected until 2015.

The yen slipped versus the greenback as demand for safety ebbed in the currency exchange. Optimism reigned in the markets, especially as the U.S. announce that Republican lawmakers approved an increase for the debt ceiling, signaling that the Federal government will have enough funds to meet its responsibilities, thereby averting another shutdown. The yen remained under pressure as the Tertiary Industry index posted a decline.

Lastly, the South Pacific currencies benefitted from strong fundamentals from China, which reduced concerns that the Chinese economy has cooled off. The Australian and New Zealand dollars reached a one-month high against the greenback.

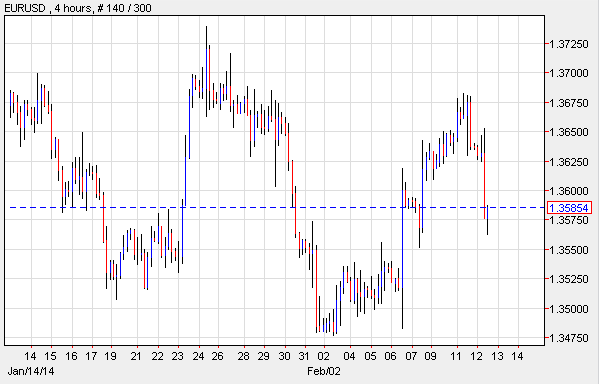

EUR/USD: EU Industrial Output Dips

The EUR/USD slipped as the european Statistics Office indicated that Industrial Output fell 0.7 percent in the last month of 2013 after posting a modified 1.6 percent hike the prior month. Economists were expecting a decline of 0.3 percent, and have forecast that upcoming releases could reveal an expansion for the region’s economy of 0.2 percent in the final quarter of 2013. Meanwhile, despite the surge in risk appetite in the Forex exchange, the EUR/USD remained under pressure on the likelihood the central bank may opt for imposing a negative deposit rate, even as Executive Board member Benoit Coeure stated that it wouldn’t be by much.

EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="474" height="242">

EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="474" height="242">

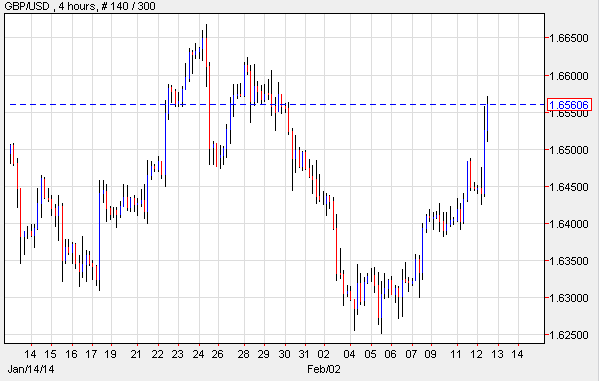

GBP/USD: Mr. Carney Boosts Pound

The GBP/USD surged after the Bank of England released the Inflation Report. The hike took place as the report indicated that policy makers raised their economic expansion outlook and hinted at the possibility of raising interest rates in the year to come. However, Mr. Mark Carney, the bank’s governor, tried to eradicate the idea of a higher benchmark interest rate from speculators’ minds while saying that the economy has improved remarkably, but certain factors like employment, wages and spending still have to recover. In the report, policy makers indicated that the production gap could post between 1 and 1.5 percent of the Gross Domestic Product. Furthermore, officials predicted that GDP for the fourth quarter of 2013 will probably be modified to show a jump to 0.9 percent; and they bolstered their growth estimates for 2014 from 2.8 to 3.4 percent.

GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="474" height="242">

GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="474" height="242">

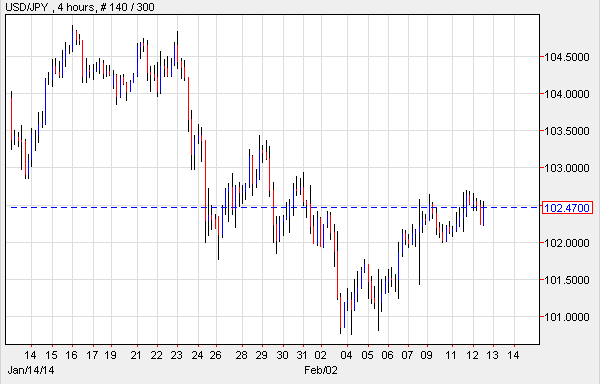

USD/JPY: Tertiary Industry Index Comes In Low

The USD/JPY dropped subsequent to testimony by Federal Reserve Chairperson Yellen, and as domestic data out of Japan revealed that the Tertiary Industry index, which measures activity, plunged more than estimated in December. According to reports, the industry activity index dipped from 0.8 to an adjusted seasonal -0.4 percent. The USD/JPY fell as Fed Chairperson Yellen indicated that she plans to follow in the footsteps of former Chairman, Ben Bernanke, and adhere to his policies, meaning that the central bank would continue slowly tapering the monthly asset purchases.

USD/JPY Hourly Chart" title="USD/JPY Hourly Chart" width="474" height="242">

USD/JPY Hourly Chart" title="USD/JPY Hourly Chart" width="474" height="242">

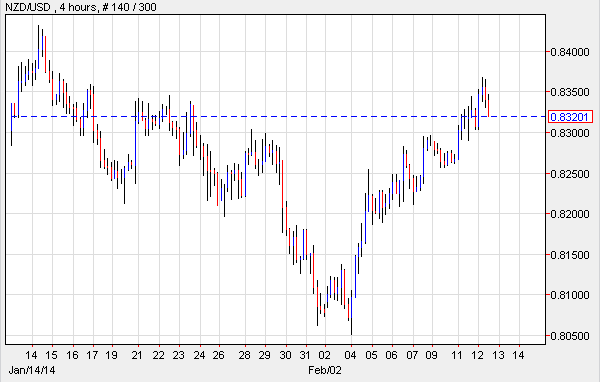

NZD/USD: China Boosts Tasmanian Currency

The NZD/USD hit a four-week high as China published solid macroeconomic fundamentals confirming that exports rose 10.6 percent from the previous year, while imports went up 10 percent. Furthermore, the release showed that the annual trade of goods surpassed $4 trillion for the first time last year, when China rated above the U.S. as a major trading nation. However, economists say that it may be too soon to rejoice since recent metrics have disappointed. The Purchasing Manager’s Index which measures the level of manufacturing plunged to the lowest in five months, denoting that factories have slowed down. And the HSBC British bank reported that the Chinese Manufacturing sector contracted last month for the first time in a half a year. The NZD/USD also benefitted by a jump in American stocks and as Mrs. Janet Yellen suggested that the Employment sector still needs to recover

NZD/USD Hourly Chart" title="NZD/USD Hourly Chart" width="474" height="242">

NZD/USD Hourly Chart" title="NZD/USD Hourly Chart" width="474" height="242">

Daily Outlook: Today’s economic calendar reveals that in the euro region, the ECB will issue the Monthly Report; and Germany will offer data on CPI. Switzerland will post PPI. The U.S. will publish Initial and Continuing Jobless Claims, Core Retail Sales, and Retail Sales; furthermore, Janet Yellen will continue her testimony before Congress. Lastly, China will release metrics on CPI and PPI.