Red Hat Inc. (NYSE:RHT) is set to report FQ1 2015 earnings after the market closes on Wednesday, June 18th. Red Hat is a multinational open-source software company which sells enterprise products. Red Hat is most well known for its Red Hat Enterprise Linux operating system. In March Red Hat managed to beat the Wall Street consensus, but the company announced a weaker than expected outlook for the remainder of calendar 2014 and shares dropped by 6% throughout the following day of trading. This quarter Wall Street is expecting Red Hat to increase its FQ1 earnings by 1c per share compared to last year while sales grow by 14% on a year over year basis. Here’s what investors are expecting from Red Hat on Wednesday.

The information below is derived from data submitted to the Estimize.com platform by a set of Buy Side and Independent analyst contributors.

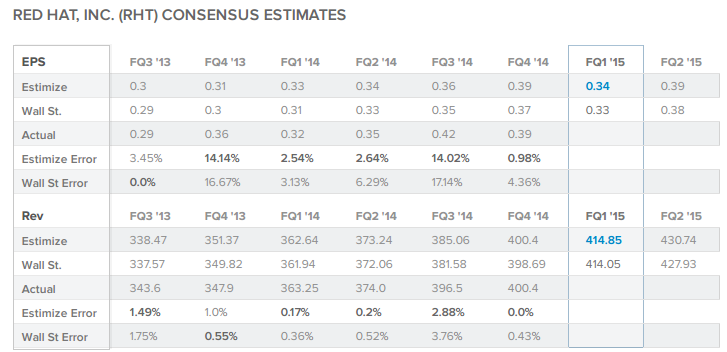

The current Wall Street consensus expectation is for Red Hat to report 33c EPS and $414.05M revenue while the current Estimize.com consensus from 12 Buy Side and Independent contributing analysts is 34c EPS and $414.85M in revenue. This quarter the buy-side as represented by the Estimize.com community is expecting Red Hat to beat the Wall Street consensus by a thin margin.

Over the previous 6 quarters the consensus from Estimize.com has been more accurate than Wall Street in forecasting Red Hat’s EPS and revenue 5 times each. By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors Estimize has created a data set that is more accurate than Wall Street up to 69.5% of the time.

More importantly it does a better job of representing the market’s actual expectations. It has been confirmed by Deutsche Bank Quant. Research and an independent academic study from Rice University that stock prices tend to react with a more strongly associated degree to the expectation benchmark from Estimize than from the Wall Street consensus.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. Here we are seeing a smaller than usual differential between the two groups’ expectations.

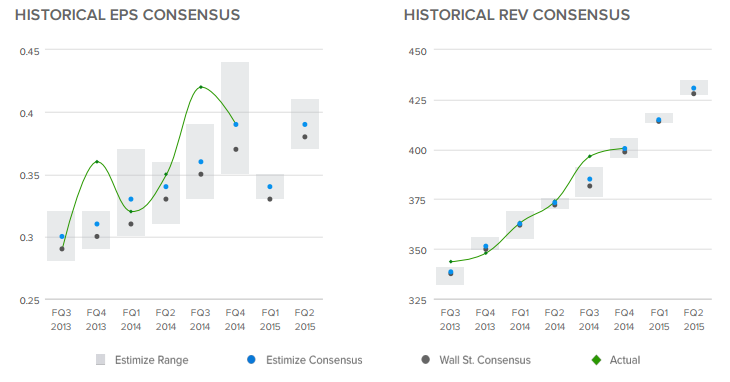

The distribution of earnings estimates published by analysts on the Estimize.com platform range from 33c to 35c per share and from $413.00M to $418.09M in revenues. This quarter we’re seeing a narrow range of estimates on Red Hat’s earnings.

The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A narrow range of estimates signals more agreement in the market, which could mean less volatility post earnings.

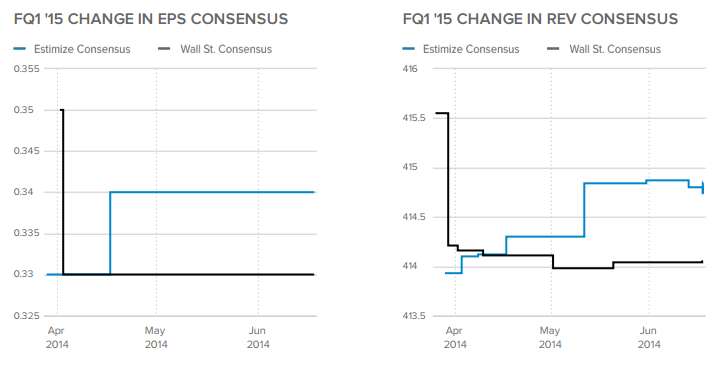

Over the past 3 months Wall Street decreased its EPS consensus from 35c to 33c while the Estimize consensus increased from 33c to 34c. Meanwhile the Wall Street revenue forecast fell from $415.55M to $414.05M while the Estimize sales consensus rose from $413.93M to $414.85M. Timeliness is correlated with accuracy and the directionality of analyst revisions going into an earnings report are often a leading indicator. Here we see relatively flat revisions from both groups.

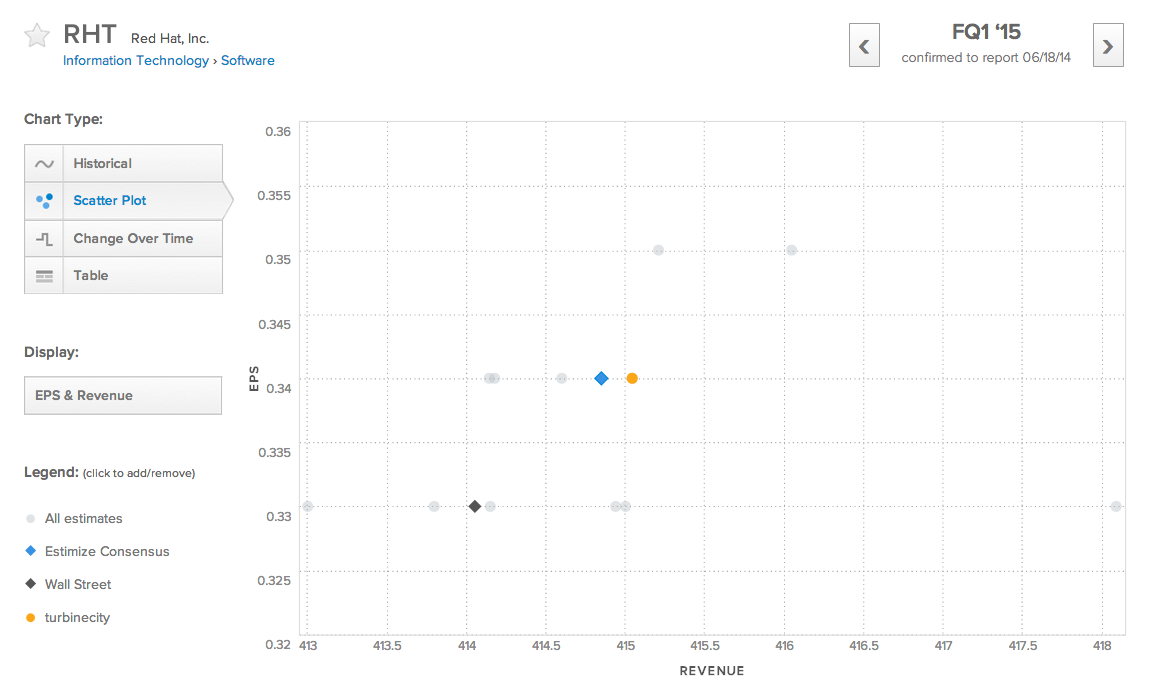

The analyst with the highest estimate confidence rating this quarter is turbinecity who projects 34c EPS and $415.04M in revenue. turbinecity was our Winter 2014 season winner and is ranked 2nd overall among over 4,500 contributing analysts. This season turbinecity has been more accurate than Wall Street in forecasting EPS and revenue 60% and 51% of the time respectively throughout a massive 1,154 estimates.

Estimate confidence ratings are calculated through algorithms developed by deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case turbinecity is expecting Red Hat to report in-line with the Estimize earnings consensus while beating the sales forecast by a small margin.

Contributing analysts on the Estimize.com platform are expecting Red Hat to edge past the Wall Street consensus by 1c per share on earnings and less than $1 million in sales. This quarter Wall Street and the Estimize community have very similar expectations for Red hat, Wednesday afternoon we will see if the open source software company can match them.

Get access to estimates for Red Hat published by your Buy Side and Independent analyst peers and follow the rest of earnings season by heading over to Estimize.com. Register for free to create your own estimates and see how you stack up to Wall Street.