Forex News and Events

GBP higher as nationalism fervours spread

In the wake of the election of Donald Trump as 45th president of the United States, the pound sterling was the sole currency within the G10 complex to extend gains versus the US dollar. It seems that the pound sterling is taking advantage of the broader EUR weakness that is stemming from the increasing political risk as we head into 2017. Indeed, the UK’s decision to leave the European Union has raised questions regarding the future of the union, especially since the escalation of nationalist fervour and rise of populism across members. In fact, the heightening political risk remains the more probable cause of the recent EUR weakness. Indeed, the next 13 months will be a veritable minefield for the European Union with several major risk events on the programme, including the Italian referendum, the Spanish general election, both general and presidential election in France, the Dutch national election and the German federal election. The market is therefore anticipating a darker outlook for the euro zone, especially now that inflation expectations have risen across the Atlantic.

Therefore, the fact that the UK is trying to distance itself from the EU is having a positive impact on the GBP, at least in the short-term. In the longer term it will be a different story as it will depend on the terms of the new relationship between UK and the EU. GBP/USD however moved below the 1.25 threshold this morning on renewed dollar strength. After falling more than 5% amid the US election EUR/GBP recovered this morning and bounced back 1% to 0.8690.

Ruble stops its 8-day decline

The ruble has finally halted its decline after eight days passing from 63.5 to 66 ruble for a single dollar note. Also, despite being short-lived, the Russian stock markets did enjoy a surge on the back of the US presidential election result.

In fact Trump’s election may already have altered the status of the ruble and this effect is likely to make it a seriously attractive option for investors. Indeed, the carry trade generated by the ruble is significant for a currency which is not correlated to US rates. Market fear towards Trump’s actions may indeed confirm the attractiveness to the Russian currency.

We believe that Russia will keep its key rate at 10% on 16th December, especially as fundamentals are not very optimistic. Oil prices are getting closer to $40, retail sales continue to collapse (-3.6% y/y) and industrial production looks concerning.

There are now high hopes that once inaugurated, Trump will ease trade sanctions against Russia. The election result is definitely good news for the Eastern economy as the currency has weakened and should support exports. The next question on everyone’s lips is whether Europe will follow suit and thaw its own policies towards its Soviet neighbour.

The Risk Today

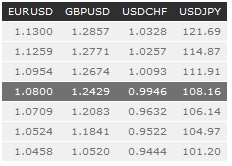

EUR/USD is now consolidating above 1.08 the decline over the last few days. Hourly support lies at 1.0709 (14/11/2016 low) while hourly resistance is given at 1.0954 (10/11/2016 high). Expected to see further continued decline. In the longer term, the death cross indicates a further bearish bias despite the pair has increased since last December. Key resistance holds at 1.1714 (24/08/2015 high). Strong support is given at 1.0458 (16/03/2015 low).

GBP/USD is riding lower within medium-term uptrend channel. Hourly support is given at 1.2354 (09/11/2016 low). Resistance stands far away at 1.2674 (11/11/2016 high). The technical structure suggest further bouncing. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY 's buying pressures are still important. Hourly resistance lies at 108.55 (28/10/2016 high) has been broken. Key support can be found at 100.09 (27/09/2016). Expected to see further upside moves. We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF has broken resistance at 0.9999 (25/10/2016 high) before bouncing back. Hourly support is given at 0.9832 (11/11/2016 low). Expected to see further upside moves towards parity. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.

Resistance and Support: