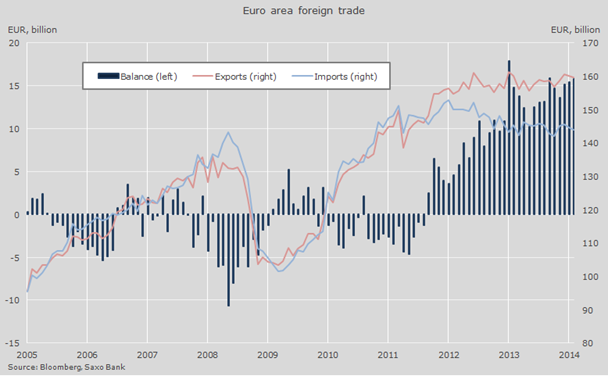

The euro area's trade with foreign nations declined in April as imports fell 0.5 percent month-on-month (m/m) and exports dropped 0.2 percent. However, the somewhat larger decline in imports relative to exports was enough to send the trade surplus higher to EUR 15.8 billion in April from an upwardly revised 15.4bn in March. Following that revision, the first quarter's trade surplus averages 15.4bn per month.

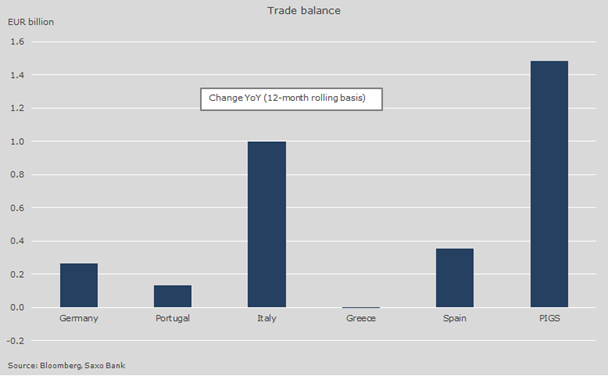

Germany has long been adding plenty to the overall euro area trade surplus, and this was also true in April when the German trade balance read 13.9bn, up from 13bn in March due to imports plummeting 4.9 percent m/m. France also recorded a larger surplus in April of 1.5bn with exports up 1.9 percent month-on-month, while imports dropped 3.3 percent. Germany is not the sole cause of the turnaround in foreign trade in the euro area in recent years, however, as the peripherals have also done their fair share. Italy in particular has gone from a structural deficit in 2005-2011 to a surplus of 1.88bn in the twelve months through April*; and an improvement of 11.7 percent on April 2013. Portugal has seen its deficit* narrow to 74 million from 208 million a year ago while Spain's deficit has shrunk to 2.2bn from 2.6bn in that time span and Greece's deficit is unchanged (but much improved compared to 2006-2010).

Looking ahead, domestic demand is expected to improve in the euro area as austerity measures fade and the effect of structural reforms (which varying greatly in size and scope across southern Europe) become more pronounced. This will aid not just demand for domestic produce, but also for imports and hence keep a lid on further improvements to the trade surplus. I expect the euro area economy to expand by 1 percent (with upside potential) this year following a decline of 0.4 percent last year.