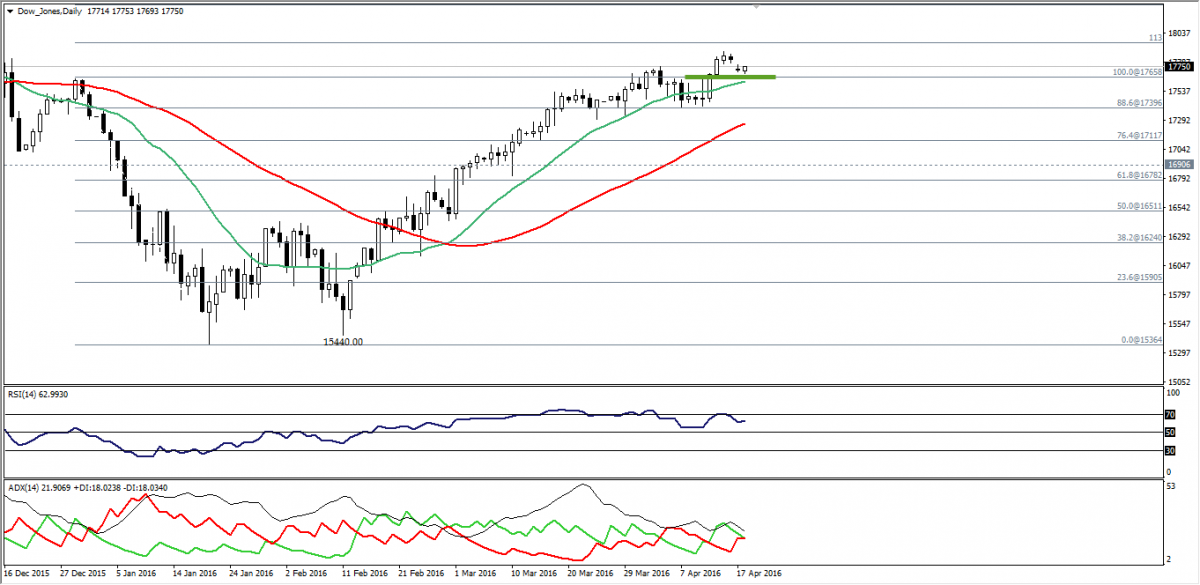

Dow Futures has opened the week on a downside gap that took the index near 100% Fibonacci once again, where it met SMA20.

RSI 14 shows signs of technical hesitation despite moving above the value of 50.00, while ADX couldn’t affirm a bearish overlap.

Actually, risk versus reward ratio is inappropriate now, and we are forced to stand aside until we make sure that 100% Fibonacci at 17660.00 is strong enough to prevent the index from falling down.

Support: 17730.00-17680.00-17630.00

Resistance: 17800.00-17860.00-17925.00

Direction: Neutral

S&P 500 Futures has also been trading above SMA20 after being resisted as well in the 100% Fibonacci regions, as seen on the provided daily chart.

There is no clear signal on other technical indicators, and that is why we will be neutral to see whether 2074.00 will be taken out or not.

On the downside, 2043.00 should be the protection for any upside attempts.

Support: 2060.00-2055.00-2043.00

Resistance: 2074.00- 2083.00-2095.00

Direction: Neutral